There are still many uncertainties regarding how fast and far COVID-19 will spread worldwide, and health officials in most countries without severe outbreaks are simply urging consumers to be cautious.

In 2020, eMarketer expects total media ad spending worldwide will reach $691.7 billion, up by 7.0% from 2019. That’s a decrease from our previous forecast when it expected worldwide ad spending to rise by 7.4% to $712.02 billion this year.

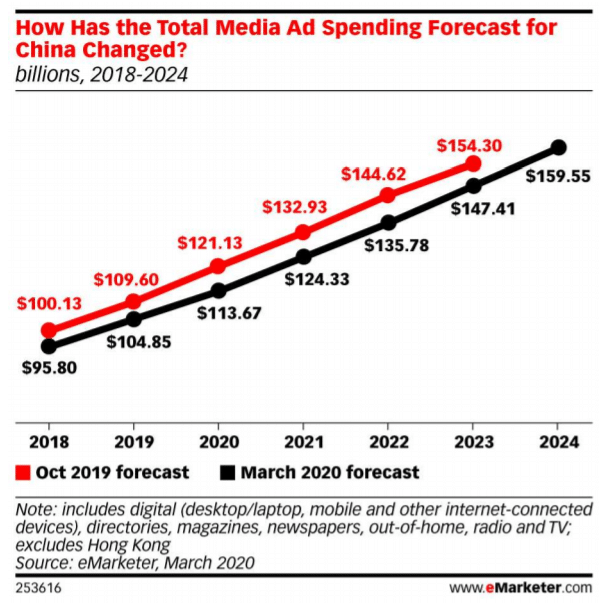

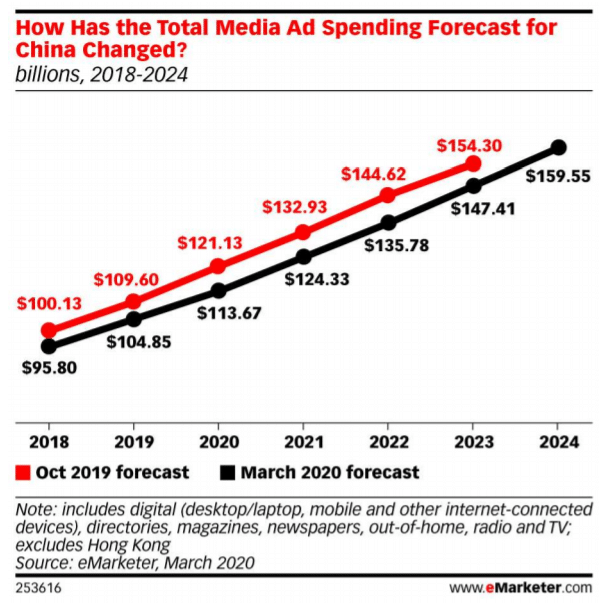

The downward revision is primarily due to one country: China, the epicenter of the COVID-19 outbreak. The first case was discovered there in late December 2019, so we have had more time to track the virus’s impact on the country’s ad market.

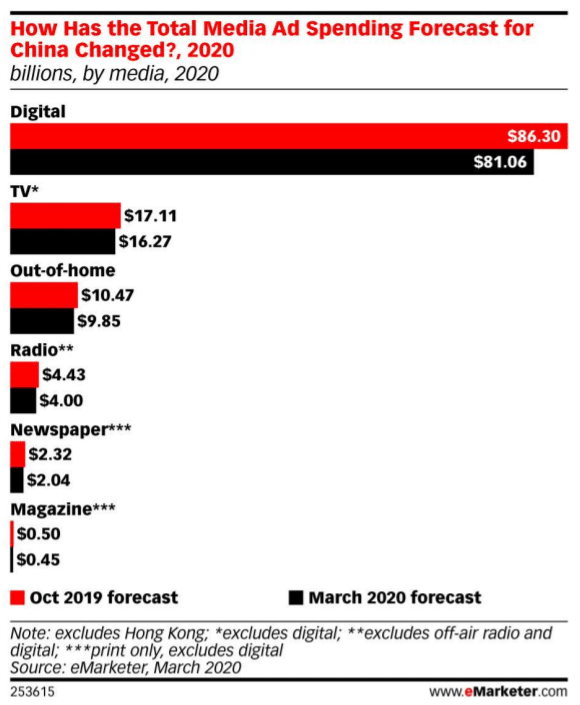

This year, it expects total media ad spending in China to reach $113.7 billion, down from the previous estimate of $121.13 billion. China is the world’s second-largest ad market after the US, so a reduction in China estimates would lower our global forecast.

The report has also downgraded China’s 2020 ad spending growth rate to 8.4% from 10.5% due to a reduction in spend across all media formats, including digital.

Out-of-home (OOH) ad spending could also feel a negative impact worldwide if the social distancing and isolation measures that have emerged in some cities expand to larger territories. Consumers in countries with significant numbers of reported COVID-19 cases are already actively avoiding large public places and gatherings, and that may eventually impact advertisers’ willingness to advertise there as well.

For now, however, eMarketer is not making any other major adjustments to our ad spending forecasts because of the COVID-19 outbreak. The forecasts are for the full year, and there is still a strong possibility that the virus could be contained in the coming months, allowing for a rebound in H2 2020. In most countries, the bulk of ad spending takes place in the latter part of the year for the holiday season.

One factor that could cause a re-evaluation of the outlook is if the 2020 Summer Olympics in Tokyo are postponed or cancelled. Even as organizers around the world have pulled the plug on many other major events, our forecast assumes that the Olympics will still take place in June, and it is expected that will provide a boost in ad spending in the US and worldwide.

A sustained economic contraction could also cause a revision later this year. While some major industries—such as travel and tourism—have already been hit hard, it’s too soon to tell how debilitating the impact will be on the global economy in the long-term.

It’s true that the recent stock market blows from the COVID-19 crisis could bring us closer to an economic slowdown, but it’s important to note that industry experts have been weighing the possibility of a recession for at least a year.

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.