A new study released today by Wunderman Thompson Commerce found Amazon’s race to dominate eCommerce could be facing challenges, as younger consumers report less satisfaction with the retail giant than older generations.

WTC’s latest international report, surveying over 15,000 consumers, looks at consumers expectations when it comes to retail, their thoughts on amazon and what they would like to see more from brands and retailers in terms of innovation. The study also found where consumers turn to when they start looking for and purchase products, with Amazon not always being their top choice. The findings can also tie into this week’s CBI figures, which revealed retail sales slid in June at their fastest pace since 2009, emphasising the desperate need for retailers and brands to find new ways to reach consumers.

Here are some key findings from the report:

• 16 to 24-year olds are less likely than older shoppers to believe the Amazon provides the best experience when it comes to access to brands, easy returns and customer service

• Almost one in five (18%) Gen Z consumers said they were swayed by brand ethics when making a purchase decision, a factor which would see them choose another retailer over Amazon

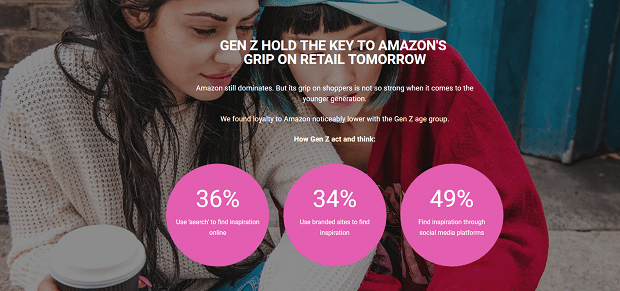

• Over half (51%) of consumers said they turn to Google and other search engines for inspiration or ideas for products to buy, while 33% said the same for brand websites and 32% for social media

• 56% of consumers go directly to Amazon to start their search of what to buy online

• Consumers still crave an in-store experience; almost half (46%) say they prefer to shop with a brand that has a physical store, which rises to 49% among Gen Z shoppers

• When buying clothing and fashion, 26% of consumers shop on retailer sites like Selfridges, compared to 17% on Amazon

The Future Shopper report takes an in-depth look at the current commerce landscape through the lens of the modern shopping journey and found that while Amazon attracts more than a third of all online retail spend internationally (36%), 16 to 24-year olds are less likely than older shoppers to believe the marketplace provides the best experience when it comes to access to brands, easy returns and customer service. Almost one in five (18%) Gen Z consumers also said they were swayed by brand ethics when making a purchase decision, a factor which would see them choose another retailer over Amazon.

For brands and retailers, the study revealed a key challenge in the online shopping journey. While consumers are relatively platform-agnostic when it comes to finding inspiration for purchases, this behaviour changes when they search for products. Over half (51%) of consumers said they turn to Google and other search engines for inspiration or ideas for products to buy, while 33% said the same for brand websites and 32% for social media. However, when it comes to actively searching for individual products to buy online, 56% of consumers go directly to Amazon to start their search.

Although the statistics reflect Amazon’s increasing dominance, there were certain factors that shoppers said would influence their decision to shop elsewhere. For consumers to choose other retailers and brands over Amazon, they look for the following key attributes:

• Cheaper pricing (61%)

• More attractive loyalty programmes (26%)

• More convenient delivery options (23%)

• A better, more specialised product range (18%)

Consumers are also still craving an in-store experience; almost half (46%) say they prefer to shop with a brand that has a physical store, which rises to 49% among Gen Z shoppers.

Neil Stewart, Global CEO, Wunderman Thompson Commerce said: “Brands and retailers continue to grapple with the challenge of how to exist alongside Amazon. While the retail giant may be a competitor, it is also a platform that can give brands and retailers enormous scope to reach millions of consumers globally. The most important thing is that they find a way to partner with Amazon but still own the relationship with the customer; now and into the future.”

The Future Shopper report also found that, when purchasing products, there is only a handful of product categories in which Amazon is not the number one purchase destination. These include:

• When buying clothing and fashion, 26% of consumers shop on retailer sites like Selfridges, compared to 17% on Amazon

• When buying health and beauty products, 24% of shoppers prefer to go to retailer sites, compared to 21% who shop on Amazon

• For luxury items such as high-end clothing, watches and jewellery, 21% prefer to buy from the website of the brand directly

• In other categories including entertainment, technology and home and garden products, Amazon is the preferred way to buy items

Stewart continued: “Amazon Prime is the world’s most advanced loyalty program and has completely changed what ‘good’ looks like for consumers. Expectations are set incredibly high by the speed, ease and convenience of the Prime service but, rather than relying solely on replicating this model, brands and retailers need to find the areas where Amazon falls down in the eyes of consumers. Focus on “What Amazon Cannot Do” (WACD) and this is where your company can compete. The future of retail is up for grabs for the companies that can tap into what customers will want from their shopping experience in five, 10 and 15 years’ time.”

Other notable findings from the study:

• Amazon Prime members are twice as likely to start their searches on Amazon versus non Prime members

• Only 36% of Gen Z shoppers turn to search engines for inspiration

• 96% of shoppers say pricing is the most important factor in purchasing decisions

• 47% of consumers are excited about the prospect of a cashless world

Over 15,000 consumers who shop online across the US, UK, France, Germany, Spain, Czech Republic, Belgium and the Netherlands were surveyed for this report.

David Nicholls, Chief Technology Officer for Retail and Hospitality at Fujitsu UK, said: “These latest findings on spending habits of Generation Z is positive reading for retailers that are worried about Amazon’s dominance over the industry. The verdict that many young people are seeking alternatives to Amazon is particularly positive for the high street, given that the threat of online is the cause for much of the decline in sales in-store. Ultimately, the report proves that retailers still have the opportunity to draw the next generation of shoppers back to the high street, as they still crave an in-store experience.

“To attract the next generation of shoppers, retailers must look to create an experience that will make customers become brand advocates. The report shows that consumers crave a digitally innovative experience, underlining that technology has a role in re-inventing the in-store experience, building excitement and engagement, and creating a memorable and relevant relationship between the customer and the retailer. Store employees are a key differentiator for high street retailers and can connect with customers in a more personalised and empathetic way; creating shopping experiences that can surprise and delight customers with fantastic customer service.

“Those high street retailers who are best equipped to benefit from the changing trends of Generation Z understand that when store employees are engaged, passionate and motivated at work, they can significantly improve the customer experience. By giving those on the shop floor a voice and supporting them with the technology and systems to make informed decisions, retailers can free up more time for colleagues to engage with their customers and create retail experiences that will continue to attract this next generation of shoppers to the high street.”

Commenting on the report, Angel Maldonado, Founder at empathy.co looks at if consumers are to remain loyal, they must innovate by providing memorable experiences, the ones that evoke emotions and feelings.

“It’s clear that Amazon has captured shoppers’ attention; so much so that they are pulling in more than a third (38%) of online retail spend,” Maldonado said. “The eCommerce giant has drastically changed expectations in retail with its next-day Prime delivery, Fresh grocery service and Alexa-controlled devices; all three designed to keep the shopper locked into the brand. Other retailers can learn from Amazon’s tenacity to provide the now instantaneous, convenient service that is expected from online shopping.

“However, retailers cannot afford to stop innovating – they need to challenge Amazon and tap into their target audience. The research shows that customers will remain loyal to those that can provide a memorable experience online. It’s time for the retail industry to create more tailored customer interactions, ones that evoke emotions and feelings. This is something that technology is capable of triggering and it needs to be done in a way that ensures shoppers feel like individuals, not numbers on a graph. It’s time to make online shopping relatable, personal and irresistible.”