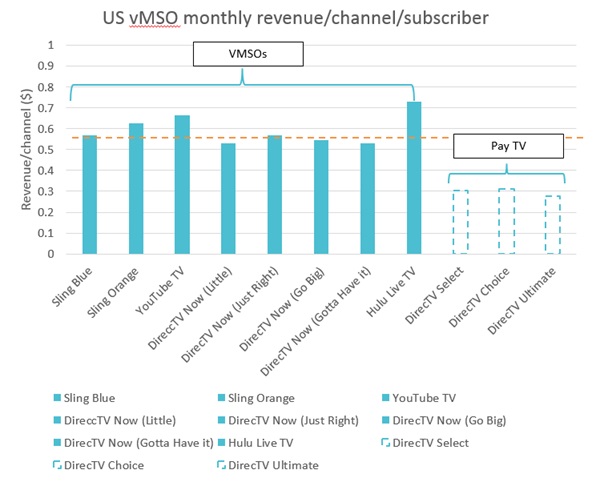

The study, from Ampere Analysis, shows that there’s more money to go around in the skinny pay TV bundle than in traditional US pay TV packages, making the switch to ‘virtual’ pay TV potentially lucrative for channels.

The change is due to the rise of “skinny bundles,” collections of television channels that are cheaper and less comprehensive than the hundred-plus networks that come jammed in traditional cable packages.

With pay TV operators in the US coming under increasing pressure from the cost of carriage fees, and the increasing availability of streaming pay TV offers and so-called ‘skinny bundles’, the channel distribution market has become far more complex in recent years. The conundrum for subscription channels is how to balance demands to join skinny bundles with support for their core business model.

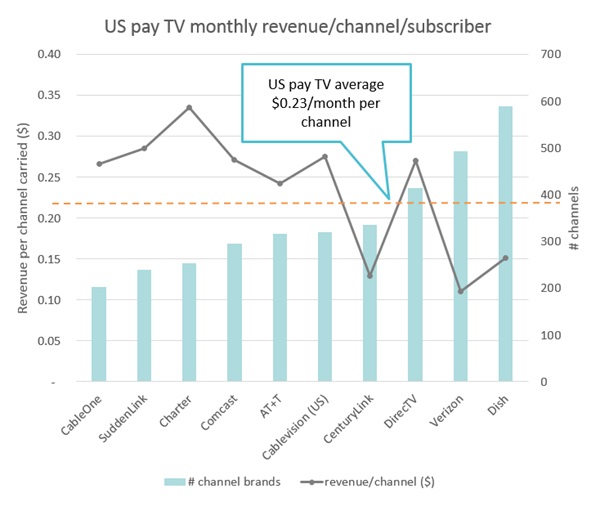

Traditional US pay TV operators make an average of $0.23 per subscriber a month in gross revenue for each channel carried, with revenues per channel consistently falling within a range of $0.15 to $0.30. By contrast, vMSOs (virtual Multiple Systems Operators) make a healthier $0.59 per channel in their streaming packages.

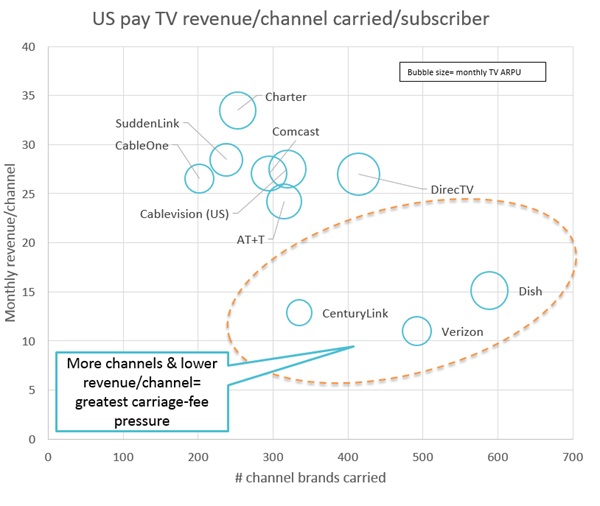

While carriage fees paid to channels vary greatly (from nothing to several dollars at the premium end), a comparison of operators’ ARPU (average revenue per user) to carriage load gives an indication of the pressure each US pay TV operator is under, as well as the flexibility they have in paying channels for inclusion in the new vMSO packages.

Under pressure

Measuring revenue per channel carried, the US operators that look to be under most pressure from carriage fees are DISH, Verizon, DirecTV and Century Link. These operators have a high number of channels and commensurate lower revenue per channel based on their current customer ARPU levels. In contrast, those operators with the highest income per channel and which look to be in a relatively strong position are cable operators Comcast, Charter, Suddenlink and CableOne.

More to go around in the virtual world

While the national average revenue per channel per customer for traditional pay TV sits at $0.23 a month, vMSOs (virtual Multiple Systems Operators) make a healthier $0.59 per channel per month on average. The sting in the tale for operators is that all channels offered in streaming packages are strong brands with relatively high carriage fees. But the higher relative income combined with the pay TV operators’ considerably lower Subscriber Acquisition Costs (SAC) for streaming pay TV customers leaves channels in a strong position to negotiate carriage fees for streaming packages.

A point of contention has been the carriage fees charged to include US national networks in streaming packages. These reportedly run to several dollars per channel, resulting in the highly variable carriage of the major networks in vMSO packages. Sling TV currently offers two networks only in its higher package; DirecTV offers three in its base package, and YouTube and Hulu offer all four major networks as standard. Yet, even removing the cost of carrying US national networks, the remainning revenue per channel for vMSO packages still stands at $0.48, more than double the average for traditional pay TV.

Guy Bisson, Research Director at Ampere Analysis, says: “US pay TV operators have needed to balance carriage fees and revenue for a long time. However, with the increasing migration of pay TV subscribers to OTT services, that balancing act is only set to become more precarious. Despite the fees they are charged to include US networks in their streaming packages, vMSOs have made a better job of reconciling the carriage fees versus revenues per channel equation. Taking out the fees associated with the networks, they are still left with revenues of, on average, $0.48 per channel – almost double that of traditional pay TV operators. For channels, the shift to streaming and rise of vMSOs looks like a potentially strong plus – providing they have strong enough brands to make the cut.”