Lenovo has been named as the most powerful Chinese global brand builder, followed by Huawei and Alibaba, according to new research.

The first “BrandZ™ Top 30 Chinese Global Brand Builders” ranking and report has been released by WPP and Kantar Millward Brown in collaboration with Google.

The 2017 ranking lists the Chinese brands that have most successfully established a presence in overseas markets. The report presents pioneering research gauging overseas consumers’ attitudes towards Chinese brands, which indicates that China has the world’s attention.

The circumstances are favourable for brands that move now to build strength in global markets by delivering and communicating quality and relevance, and the report provides insights and recommendations to help them conquer the challenges and seize the opportunities in their path.

To produce the ranking, Kantar Millward Brown calculated the Brand Power (the BrandZ™ measure of consumer predisposition to choose a particular brand) of Chinese brands outside of China across seven countries, supported by research conducted using Google Surveys in September 2016. The evaluation looks at 167 Chinese brands, the median Brand Power score of which is 85.

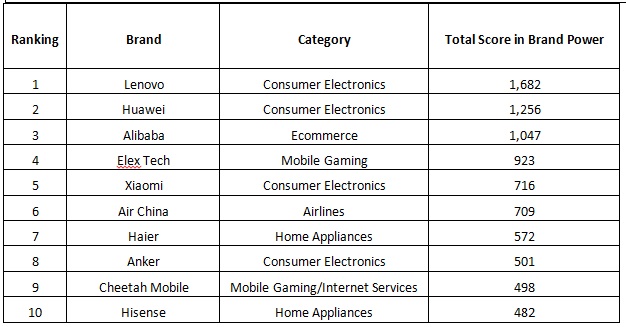

Lenovo, a global leader in personal computer and mobile technology, leads the charge as the most powerful Chinese export brand with a Brand Power score of 1,682. It is followed by the innovative international brands Huawei (1,256), in the consumer electronics category and the ecommerce marketplace giant Alibaba (1,047). Consumer electronics brands represent 40% of the ranking’s total Brand Power, and dominate the Top 5 – Lenovo (no. 1), Huawei (no. 2) and Xiaomi (no. 5) – an indication of the strength of Chinese consumer electronics brands overseas.

The study shows that internationally the notion of Brand China is shifting. While established brands (in categories like consumer electronics and airlines) currently have an edge over the emerging internet-driven brands (mobile gaming and e-commerce), with 57% of the total Brand Power in the ranking, digital brands are the real winner. Combined, consumer electronics and mobile gaming lead the ranking, both in terms of the number of brands in the ranking (17) and combined Brand Power (59%). This composition reflects the transformation of Brand China, which consumers abroad increasingly associate with innovative digital devices and services.

One challenge facing Chinese brands is that international consumers are generally less aware of, and less likely to consider purchasing, a Chinese brand than a local or globally recognised one. However, the research shows that awareness and consideration gaps vary, with consumers in France, Germany and Spain more aware of and likely to consider Chinese brands than consumers in Japan, Britain or America.

David Roth, CEO EMEA & Asia, The Store WPP commented: “The study shows that the movement of ideas and product leadership has expanded globally, with consumers increasingly looking to China as a potential source for the newest and most innovative products and brands. This is the opportune time for Chinese brands to expand abroad, despite the many obstacles and this is why in collaboration with Google we have produced the ground-breaking “BrandZ™ Top 30 Chinese Global Brand Builders 2017” report. By analysing consumer perceptions of Chinese and non-Chinese brands, we have been able to identify gaps in Chinese brand performance and provide recommendations for brand building strength.”

BrandZ™ Top 10 Chinese Global Brand Builders 2017

Key highlights of the BrandZ™ Top 30 Chinese Global Brand Builders 2017 study include:

• Negative perceptions of Chinese products are declining. Consumers recognise that product quality has improved, and they increasingly choose brands based on benefits and relevance rather than fame. As the number of Chinese brands going global rise, so will consumers’ receptivity – facilitating further expansion. Now is the time for Chinese brands to expand abroad.

• Technology brands are closing the ‘awareness gap’. Chinese brands are still less well known than global or local market brands, and consumers are less likely to buy them. Technology brands are changing this by showing they can improve consumers’ lives by applying digital technology and establishing ecosystems that combine e-commerce and mobile payment apps with other services. They must now leverage their success, while brands in other categories should learn from them – closing the ‘gap’ by telling powerful brand stories that clearly communicate their quality and relevance.

• There is great potential for internet-driven brands. Established brands enjoy high Brand Power but lack differentiation which is increasingly important in the digital age. In contrast, newer, internet-driven brands have had less time to meet consumer needs but are seen as distinctive due to their product and innovation.

• Chinese brands tend to operate faster than Western brands. While speed is definitely an advantage, a certain level of systemisation can simplify decisions and add useful knowledge.

Doreen Wang, Head of BrandZ, Kantar Millward Brown added: “The rules are changing for brands. Whereas established brands have shown slow growth internationally over time – sometimes growing through mergers and acquisitions – the newer internet-driven brands are typically growing organically. Brands today are able to use the internet to give them global reach, leveraging their brand equity as a global identity and passport. The expansion of a brand is now no longer defined by the limits of its category, but by the possibilities of technology. So there is no longer a need to wait to be a domestic giant before going global. Start your brand intending to go global, and anticipate the necessary business infrastructure.”

As global consumers increasingly look to China for the newest products and brands, Chinese brands need new powerful strategies to realise their full potential in developed markets. In order to provide insights and recommendations, BrandZ™ analytics capabilities have been used to analyse the perceptions of 270,000 global consumers towards more than 560 Chinese and non-Chinese brands across seven countries (US, UK, Germany, France, Australia, Spain and Japan) and nine product categories (Consumer Electronics, Home Appliances, Airlines, Ecommerce, Mobile Gaming, Internet Services, Smart Devices, Cars, Online Fast Fashion).

The Chinese brands that are able to champion these trends in the competitive, developed markets are likely to enjoy not only global commercial success but an additional return on their investments at home, with the endorsement from an international audience seen as a guarantee of quality.

The BrandZ™ Top 30 Chinese Global Brand Builders 2017 report, charts and video are available here.

The mobile app can be downloaded via www.brandz.com/mobile or search for BrandZ in the iTunes or Google Play app stores.

Background and methodology

Produced by WPP and Kantar Millward Brown in collaboration with Google, the BrandZ™ Top 30 Chinese Global Brand Builders report identifies and ranks Chinese brands based on the strength of their brand overseas. It also reveals challenges and opportunities, and provides vital insights and recommendations for Chinese brands going global. Brands across nine product categories are ranked based on their Brand Power Scores in seven developed markets, including France, Germany, Spain, the UK, the US, Australia, and Japan.

Brand Power is the BrandZ™ metric of brand equity, the consumer predisposition to choose a particular brand. Three ingredients comprise Brand Power: Meaningful (meeting functional and emotional needs in relevant ways); Different (being distinctive or trend setting); and Salient (coming easily to mind in a buying situation). Meaningful and Different scores of each brand were computed based on Google Survey answers. Each brand’s Salience was computed based on the survey answers and the brand’s indexed search volume.

Source:

www.wpp.com

www.millwardbrown.com