As China’s innovation-driven development continues to drive the growth and global strategy for many home-grown brand leaders, a report released today by WPP and Kantar Millward Brown, in collaboration with Google, reveals how Lenovo Group Ltd – a global leader in personal computer and mobile technology – continues to lead the rankings in this year’s BrandZ Top 50 Chinese Global Brand Builders Report.

The report takes an in-depth look at the Chinese brands that are making an impact with consumers in international markets and provides a rich seam of thought-provoking insights on how Chinese companies can successfully build their brands on a global scale.

The growth of the ranking from 2017’s 30 brands to this year’s 50 brands is in part due to the rapid pace at which Chinese businesses are pursuing global expansion. Many of China’s brands are championing President Xi Jinping’s 2013 ‘Silk Road Economic Belt’ initiative, answering China’s clarion call for a new era of globalisation in what has been called the biggest development push in history.

Chinese brands are at the forefront of innovation and its global brand-builders are helping to establish ‘Brand China’ as innovative, cutting-edge and pioneering. China’s insatiable appetite for new technology is fuelling the growth of many brand categories and powering innovation at an incredible pace.

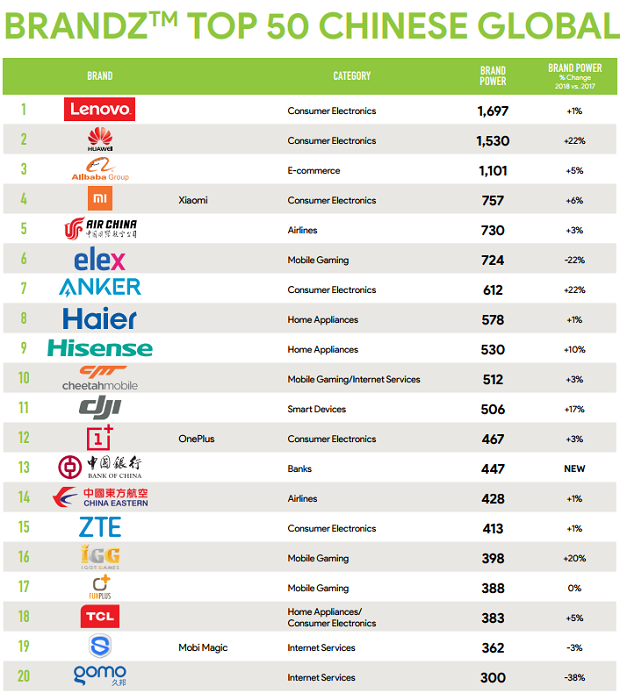

Consumer Electronics remains by far the best performing category, dominated by brands such as Lenovo, Huawei, Xiaomi and Anker.

In 2018, there are ten Consumer Electronics brands among what is now the Top 50, and they contribute 34% of the total Brand Power score. Collectively, Consumer Electronics, Mobile Gaming, and E-Commerce (including online fast fashion) account for 61% of all Brand Power in the Top 50. The remaining 39% of aggregate Brand Power comes from seven other categories.

David Roth, Chairman of BAV Group and CEO EMEA & Asia, The Store WPP commented: “The companies behind China’s brands are taking a more active role on the world stage. They are increasingly shaping the conversation at a category level, as well as helping to support economic growth in developing markets in many ways, not least by investing in infrastructure. China’s brands are not only changing the way that people around the world think about brands, they are also changing the way those people think about Brand China”.

Providing insight into the growing popularity of Chinese brands, Doreen Wang, Global Head of BrandZ, Kantar Millward Brown said: “Chinese brand builders aren’t just concerned with reaching a wider global audience, they are aiming to change customers’ perceptions too. Brands that succeed in China’s formidably competitive marketplace are not just out-gunning the competition in terms of innovation, they are deploying an equally powerful weapon – branding.”

Key highlights of the BrandZ Top 50 Chinese Global Brand Builders 2018 study include:

- Innovation is the number one factor attributed to the growth of Chinese brands and perception of innovation is highest among consumers aged 18 – 34 years (millennials).

- Digital media (43%) and in-store display (22%) are the most important media used to drive Chinese brand awareness among international consumers.

- UK demonstrates the most positive attitude towards Chinese brands, while views vary significantly between countries.

- Gap between international and China brands search volume narrows by 29% according to Google Search Index Data.

- China’s Global Brand Builders see themselves as having a higher calling, helping them play their part in building Brand China abroad.

- Chinese state-owned brands have demonstrated their widespread support for the ‘Belt and Road’ initiative. Banks, airlines and China’s heavy manufacturing industry are putting their full weight behind China’s ambitious foreign policy.

- In this year’s Top 50, there are four auto brands; the largest two state-owned oil & gas giants; three state-owned banks and payments networks; and five of China’s airlines.

China’s challenge

Doreen Wang explains that despite making significant headway, there remain challenges ahead for Chinese brands. She commented: “While negative perceptions of some Chinese brands may persist among older generations of consumers, there is a shift in attitude among younger generations. Younger consumers are turning to brands such as Lenovo, Alibaba and JD.com because they are united by their love of cool, affordable products and services, regardless of their country of origin.”

The report highlights three key focus areas to help improve Chinese brand awareness:

- Limited awareness in the way of a brand’s global acceptance – Regarded as the number one barrier that needs to be overcome if brands are to ‘go global’. Increasing brand awareness among the targeted segments will continue to be the top priority.

- Perception of trust still needs to be improved – While many younger consumers regard Chinese brands as innovative, there remains some uncertainty about quality. Many brands have an excellent reputation for producing quality products and need to communicate this better in order to change consumer perception.

- Lack of brand-building investment – Smaller brands are learning from those appearing in the Top 50 Brand Power rankings that a commitment to marketing investments is key to success, and that these decisions need to be driven by local-level understanding of both markets and consumer. Brands should sharpen their focus on the most effective media channels and deploy stronger, more impactful advertising campaigns.