In research by TabMo, undertaken the week before non-essential retail outlets were allowed to restart trading, 74% of respondents said they would go back to stores they frequently visited pre-lockdown as soon as the government said it is safe to do so.

This was reflected by the queues outside many high street shops when they re-opened on Monday 15 June, having been closed since 23 March this year.

Mobile advertising company TabMo commissioned Dynata, the leading data and insights company, to carry out the study, ‘TabMo’s Retail Spotlight: UK Shopping Habits Before, During and After the Coronavirus Lockdown’. Having established their shopping habits before and during lockdown, the survey asked consumers about their preferences for returning to shopping ‘In Real Life’ (IRL) when they could do so.

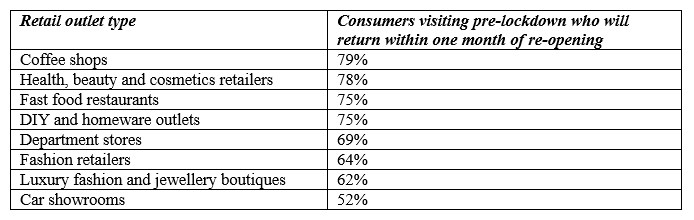

Coffee shops are likely to see the fastest return to near pre-pandemic footfall, closely followed by health, beauty and cosmetics retailers, fast food restaurants and DIY outlets:

The desire to shop in-store is illustrated by the supermarkets, which, as essential retailers, have been open throughout the crisis. TabMo’s research showed that 70% of people who shopped at them in-person before the pandemic continued to visit during lockdown. (25% undertook grocery shopping online, while 5% said they had not shopped at a supermarket).

Intent to return to pre-pandemic shopping habits was strong across all ages, with people over 55 providing similar responses to the younger age groups (18-34 year olds and 35-55 year olds).

TabMo commissioned the research to determine people’s appetite for shopping in-store to help retailers, brands and advertisers adjust their marketing communications as the UK begins to re-open for business, in recognition that this will potentially be in unfamiliar circumstances.

Although shoppers are keen to return to physical retail outlets, their behaviour is likely to change. While many survey respondents were unsure about their future shopping habits, 48% said they are more likely to browse online and purchase in-store, and 49% reported that they would shop locally (continuing their commitment to the outlets that have catered for them during lockdown). 48% thought purchasing in-store would be less enjoyable, indicating that shopping is likely to become less of a social activity.

With the high focus on buying rather than browsing, shopping becomes transactional rather than social and the ‘value’ of each customer in store increases. This is key insight for retailers in terms of the in-store experience, but also informs the advertising required to encourage people back to physical retail outlets.

Chris Childs, managing director for TabMo in the UK says: “Retailers, brands and advertisers need to prepare now as people think about heading back to the shops. As well as the offering itself, that means getting communications right – encouraging people to visit retail outlets in person while being sensitive to the high degrees of anxiety and uncertainty that still exist and recognising that, while lockdown has eased, the pandemic is far from over.”

Shanil Chande, head of agency sales, at TabMo says: “We are sailing in uncharted waters, but it seems that the UK’s love of shopping hasn’t waned during lockdown. However, consumer behaviour does seem set to change, at least in the short term. Advertising has a huge role to play in promoting what is possible when it comes to IRL retail while also enabling people to stay safe. Content, context and cross-channel promotion will be key, along with the smart use of data to ensure that messages reflect each shopper’s specific needs and can be quickly adapted in a rapidly-changing environment.”

The full report, TabMo’s Retail Spotlight: UK Shopping Habits Before, During and After the Coronavirus Lockdown, scheduled for publication in early July, will provide further breakdown and analysis of the data, offering insight into pre and post lockdown shopping habits, while also looking at splits by gender, retail category and location.

Dynata conducted the study on behalf of TabMo with a representative sample of adults aged 18 years or older across the UK through its proprietary online research panel. A total of 500 interviews were carried out between 5th and 11th June 2020.