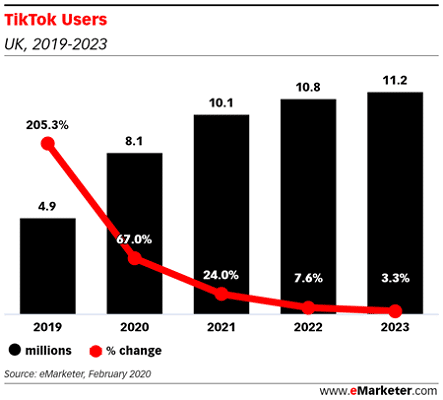

The data, from eMarketer, indicates that since launching in the UK in 2017, China-based TikTok has exploded in popularity. But after more than doubling its UK user base last year, growth for the Chinese-owned app will slow in the coming years, as competition heats up and concerns grow among marketers.

This year, TikTok’s UK user base will grow 67.0% to 8.12 million people. By 2021, it will surpass 10 million. This follows 205.3% growth in 2019, as the dynamic, short-form video platform drew in a huge number of users, especially children and teens. Growth will slow to single-digits in 2022, as the app becomes heavily saturated among core younger users.

“TikTok had a breakout year in 2019, and it is incredibly popular among teens at this point,” said eMarketer principal analyst Debra Aho Williamson. “Some are spending multiple hours per day on the app, which is a testament to the incredible stickiness of its scrolling video format. But it has yet to develop a strong following among older generations.”

This year, 20.2% of UK social network users, or more than 1 in 5, will use TikTok at least once a month. Despite having lower penetration than more established competitors, it’s one of the few social apps whose penetration is growing.

Competition may also hinder growth for TikTok in the coming years.

“This year, we expect new entrants like Firework and legacy players like Instagram and Facebook to take on TikTok,” said Williamson. “Instagram is a particularly large threat; it recently added new tools to its Boomerang looping-effect feature that mimic similar features on TikTok.”

And while many marketers are curious about the app, several issues could hold back adoption. Because it is Chinese-owned, TikTok faces questions about censorship and data privacy, as well as brand safety.

“Properties like TikTok are supporting and creating new forms of self-expression, and brands want to tap into that,” Williamson said. “It’s an experiment for many marketers. In many ways, TikTok is where Facebook was in the late 2000s, and where Snapchat was three or four years ago.”

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.