There will be four distinct business models that will define retail over the next decade, built around sharing, replenishment, personalisation and services, according to new research.

The report. From Accenture, surveyed +25,000 consumers across 33 countries and found that retailers could unlock £2.2 trillion in value over the next decade by accelerating digital transformation.

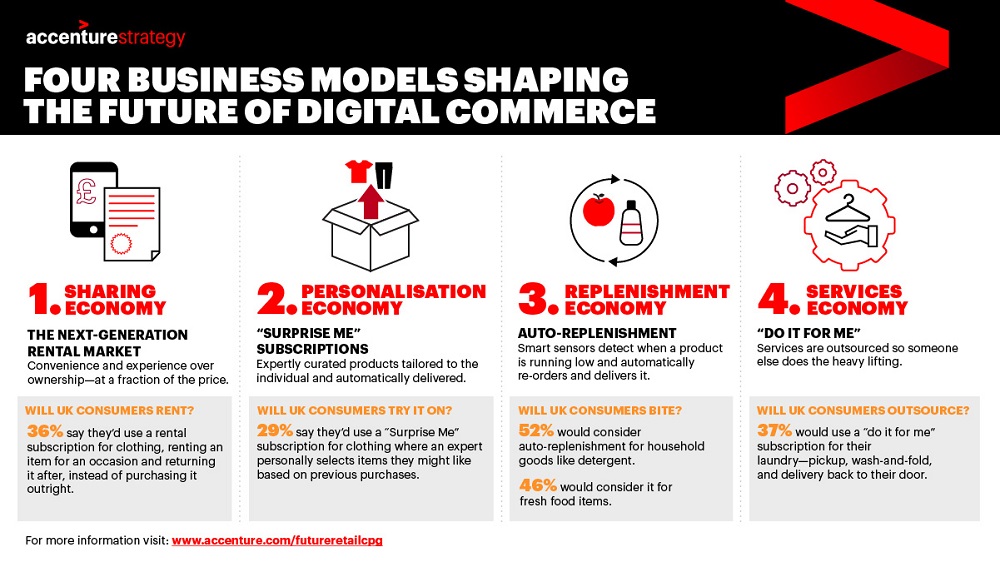

The four new business models are identified as the sharing economy, the personalisation economy, the replenishment economy and the services economy.

The report outlines the increasing consumer appetite for new purchasing experiences, despite general UK trust issues.

For example, it reveals:

– Nearly a third (29%) of UK consumers would use a ‘surprise me’ delivery subscription for fashion, such as The Chapar, where an expert personally selects items that are tailored to the customer’s particular style

– Over a third (37%) say they’d use a ‘do it for me’ service for laundry such as laundrapp

– Over a third (36%) of UK consumers said they would rent a fashion item for an occasion rather than owning it, a service which Chic By Choice offers

Accenture Strategy’s ‘Painting the Digital Future of Retail and Consumer Goods Companies’ report, based on analysis for the World Economic Forum, quantified the impact of digital transformation on consumer industries over the next decade. The study identified current consumer appetite for new purchasing experiences, the business models that have the highest potential to unlock new value, and how organisations and policymakers can prepare themselves.

“The next decade will be a golden age for consumers, with technological innovation creating a variety of shopping experiences that will give consumers the simplicity, convenience or excitement they crave,” said Chris Donnelly, senior managing director, global retail lead, Accenture Strategy. “Out of the £2.2 trillion in value the report identified, consumers have the most to gain – just over £1.5 trillion – through cost and time savings. The success of retailers and consumer goods companies to unlock value will be dependent on their ability to gain a deep understanding of consumers, embrace disruptive technologies and adopt innovative business models.”

Consumer appetite for new purchasing experiences

Today, 39 percent of UK consumers would allow companies to collect their personal data via intelligent devices in return for a better experience or financial reward. Another 37 percent would subscribe to a service that constantly looks for the best pricing deals on their behalf, and actively recommends which company to switch to, and when.

Nearly a quarter (24 percent) of UK consumers would use sensor-based digital services that pre-emptively address their needs without human intervention. Another 21 percent would subscribe to brands that analyse their shopping history to select products especially for them, and orders them automatically.

“The retail and consumer goods industries will change more in the next 10 years than they have over the past 40,” said Oliver Wright, managing director, global consumer goods lead, Accenture Strategy. “As expectations around cost, choice, convenience and experience continue to increase, consumers will challenge the industry to evolve and innovate which will drive huge growth in digital commerce.”

Industry transformation

To reach the next frontier of digital commerce, retailers and consumer goods companies need to explore the following transformative business models which are already being welcomed by UK consumers:

- Sharing economy (the next-generation rental market) – Convenience and experience over ownership, at a fraction of the price. Thirty-six percent of UK consumers said they would use a rental subscription for clothing, renting an item for an occasion and returning it after, instead of purchasing it outright.

- Personalisation economy (‘surprise me’ subscriptions) – Expertly curated products tailored to the individual and automatically delivered. Twenty-nine percent of consumers said they would use this subscription for clothing, where an expert personally selects items they might like based on previous purchases.

- Replenishment economy (auto-replenishment) – Smart sensors detect when a product is running low and automatically re-orders and delivers it. Fifty-two percent of consumers would use auto-replenishment for household goods like detergent. Another 46 percent would consider it for fresh food items.

- Services economy (‘do it for me’) – Services are outsourced so someone else does the heavy lifting. Thirty-seven percent of consumers would use this service for their laundry – pick-up, wash-and-fold, and delivered back to their door.

Societal implications

As a by-product of industry transformation, there is potential disruption for people and society which companies, policymakers and regulators need to actively address to:

- Minimise impact on local communities – With an increasing number of retail stores downsizing or closing due to the rise of digital commerce, local communities need to respond by businesses and government establishing economic development strategies and partnering with communities to repurpose physical space as hubs for experiences, leisure and lifestyle activities.

- Reskill the workforce – Emerging technologies will drive a range of efficiencies which will significantly change the nature of the industry’s workforce. Business leaders and policymakers must focus on accelerating reskilling people, creating partnerships with educational institutions, and influencing public policy to meet the needs of the future workforce.

- Ensure sustainability – Meeting consumer demand for rapid delivery needs to be achieved in parallel to minimising environmental impact. Shifting to electric vehicles and exploring load-sharing can help while also enhancing delivery efficiency. Furthermore, innovation in packaging design and supporting recycling infrastructure is also critical, helping to build a more circular economy.

“To thrive in the next decade, organisations must aggressively pursue innovation and be willing to disrupt themselves. The winners will be those organisations that prioritise adopting a partnership mindset to offer customers new value, innovatively meet consumer demand for new services, and implement advanced data sciences to derive deeper customer insight to enable better decision-making,” said Donnelly.

To find out more information about the report, please visit www.accenture.com/futureretailcpg. Join the conversation at @AccentureStrat #Retailers #CPG.

About the research

Accenture Strategy created a value-at-stake methodology for the World Economic Forum to quantify the impact of digital transformation on the retail and consumer goods industries, and consumers, in digitally developed economies over the next decade. Consumer insights were taken from Accenture Strategy’s latest Global Consumer Pulse Research which surveyed 25,426 consumers across 33 countries during July and August 2016, including 1,811 UK consumers.

Source: www.accenture.com.