A report from the World Federation of Advertisers (WFA) has indicated that global multinational companies have been looking to respond to concerns that they have lost control of media activity.

This extends to 35 companies with a total annual marketing spend of more than $30 billion globally.

This research by the WFA found global brands making or having plans to make major and extensive changes to their media governance practices. This was across a wide range of areas.

According to the report, more active management of media issues now involves brand safety, viewability and ad fraud as well as the transparency issues raised by the ANA’s reports from K2 and Ebiquity.

The survey was conducted in May this year and saw 73% % of respondents having global roles. The rest were in regional roles covering Europe, North America and APAC.

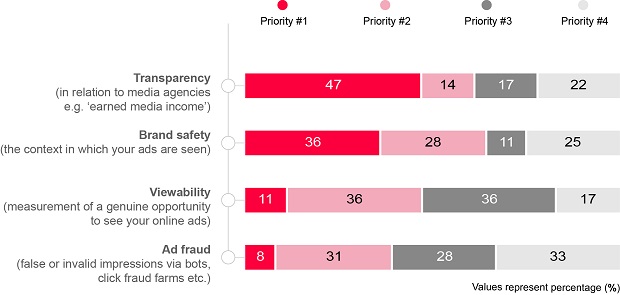

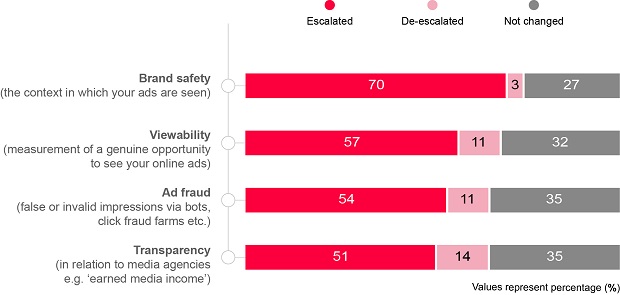

Overall, transparency remained top priority for 47% companies surveyed. Brand safety is also moving up in terms of priority, with 70% of companies adding that the issue has been escalated in the last 12 months.

On media transparency

- 29% have added specific media/financial audit right clauses to contracts and 9% plan to do so. (53% of respondents were already doing this.)

- 26% have added contractual clauses for return of media income and a further 15% plan to do so. (53% of respondents were already doing this.)

- 26% have added contractual clauses for the return of incentives and a further 21% plan to do so. (47% of respondents were already doing this.)

- 35% have improved media knowledge via internal training and eduction and 21% plan to do this. (38% of respondents were already doing this.)

- 32% have added data ownership clauses to contracts and 24% plan to do this. (38% of respondents were already doing this.)

- 26% have conducted forensic/financial/contract compliance audits of their agencies and a further 21% plan to do this. (35% of respondents were already doing this.)

- 24% have taken greater contractual control of programmatic via a hybrid model and a further 41% plan to do so. (21% of respondents were already doing this.)

- 41% have conducted a programmatic review and a further 35% plan to do this. (15% of respondents were already doing this.)

On viewability

- 57% percent have started implementing viewer tracking via a third-party vendor and a further 9% plan to. (31% of respondents were already doing this.)

- 40% now only invest in inventory which meets the minimum industry standards laid out by MRC/JICWEBs and a further 26% plan to. (23% of respondents were already doing this.)

- 20% have devised their own viewability criteria and a further 40% plan to. (17% of respondents were already doing this.)

On brand safety

- 49% have adopted site whitelists or blacklists where advertising should or should not appear and a further 6% have plans to do so. (46% of respondents were already doing this.)

- 54% have worked with third-party verification companies to monitor the environment in which their ads appear and a further 20% also plan to do this. (20% were already doing this.) 37% have limited investment in networks that do not allow the use of third-party verification and 34% plan to do so. (17% were already doing this.)

- 54% have suspended investment in ad networks where they feel there is unnecessary risk and 14% plan to do so. (20% were already doing this.)

On ad fraud

- 54% are now working with third-party verification/counter ad fraud partners and 11% plan to do so. (34% of respondents were already doing this.)

- 29% have stopped or reduced run of exchange buys i.e. not buying blind and 20% plan to do so. (26% of respondents were already doing this.)

- 26% have put in place contractual stipulations assigning liability for misallocation of spend on fraudulent inventory and 51% plan to do so. (14% were already doing this).

The survey took place in May 2017 and 73% per cent of respondents had global roles, with the balance in regional roles covering Europe, North America and APAC.

WFA head of marketing services Robert Dreblow says: “The WFA has long championed the need for clear and transparent relationships between brands and their agency partners. Last year’s ANA report was a catalyst for a new wave of action by brands not just in the US but around the world, addressing many of the media issues that our members have highlighted including brand safety and ad fraud.

“These actions, coupled with an increasing number of WFA members sharing that they have witnessed improved transparency, are positive signs that we can create an improved media landscape for brands, agency partners and media owners.”

Read more here<