Facebook is expanding into mobile payments by letting users exchange money through its Messenger app.

The move would mean that users would not need to open another app such as PayPal or Venmo to send them money- keeping users on Facebook’s site.

The service will carry zero transaction fees, making it free to exchange money with friends.

How it works

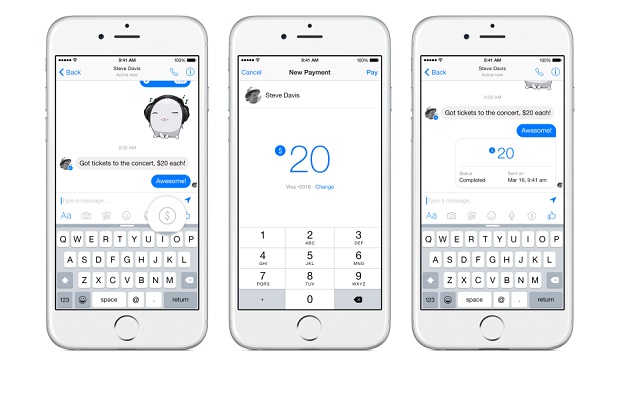

Users who want to take part can do so by linking a Visa or Mastercard debit card to their account. From there, users will be able to initiate payment from within a conversation by pressing a “$” icon. A new menu pops up, prompting you to type the dollar amount you’d like to send. Then, with the tap of the “Pay” button, the money is sent.

The money is transferred immediately, though like any bank deposit can take one to three business days to actually be available.

Facebook is also taking steps to ensure the transactions are secure by adding a PIN to be entered before completing the transaction. Owners of iOS devices can authenticate the transaction by using TouchID.

Facebook joins a list of apps that offer peer-to-peer payments. Snapchat partnered with Square to introduce Snapcash late last year.

Google Wallet exist primarily as means of completing transactions in stores but can be used for direct to user payments as well.

Facebook will begin rolling out the new feature in the United States over the coming months, with the payment option landing on Android, iOS, and desktop.

‘Joining up the dots’ of the consumer experience

Commenting on the move Joanna Parnell, Strategy Director at Unique Digital, said: “Facebook Messenger’s move in to mobile payments is a clear sign that that the ‘innovators’ have finally arrived in the payment sector and we’re certain to see a big shake up to old payment modes and business models. With recent innovations in contactless payment systems, the early success of Apple Pay in the US, Transferwise in Europe, and the reinvigoration of Google Wallet the stage is set for some fierce competition.

“The Facebook offering may be starting as a friend-to-friend payments tool, but with over 500 million monthly active users on Messenger, brands could eventually tap into the emotional side of the social media network that bonds friends together. Why can’t friends discuss trips, deals and events and make impulse decisions with brands benefiting from more common and in turn, more lucrative interactions?

“WeChat in China is already showing that convenience is king, with the platform providing a complete experience that lets you make swift payments, e-commerce purchases and even hail taxis. Once the payments platform proves successful, there is no telling how many dots Facebook can join up to provide a complete, convenient experience for users.

Security threats

TK Keanini, CTO at Lancope, discussed the potential security threats of the service, and why consumers need to take their Facebook account more seriously from now on.

“It has become a standard feature of social communities to have in-game or in-world commerce,” Keanini said. “Most online game communities offer this and from that perspective Facebook is late to the game.

“This payment system is exciting and useful to everyone, including criminals, so everyone must do their part to secure their accounts. Remember, when your account is compromised, it effects everyone. Some people treat Facebook as a play account and don’t take security seriously, approving friend requests from complete strangers, accepting game invites from anyone, these accounts be more of a problem now that you can send and receive payments.”

Tim Erlin, director of security and risk, Tripwire, added: “While Facebook may be late to the mobile payments game, they’re large enough that they can still dominate the space. It’s not hard to imagine how this feature might expand from peer-to-peer transfers to compete with the likes of Apple and Google for payments to more traditional vendors. The Facebook platform, including the mobile app, is already a big target for attackers, but adding a financial component to messenger puts it in a different category. There’s simply no doubt that cyber criminals will immediately begin looking for ways to use this new feature to get into your wallet.”