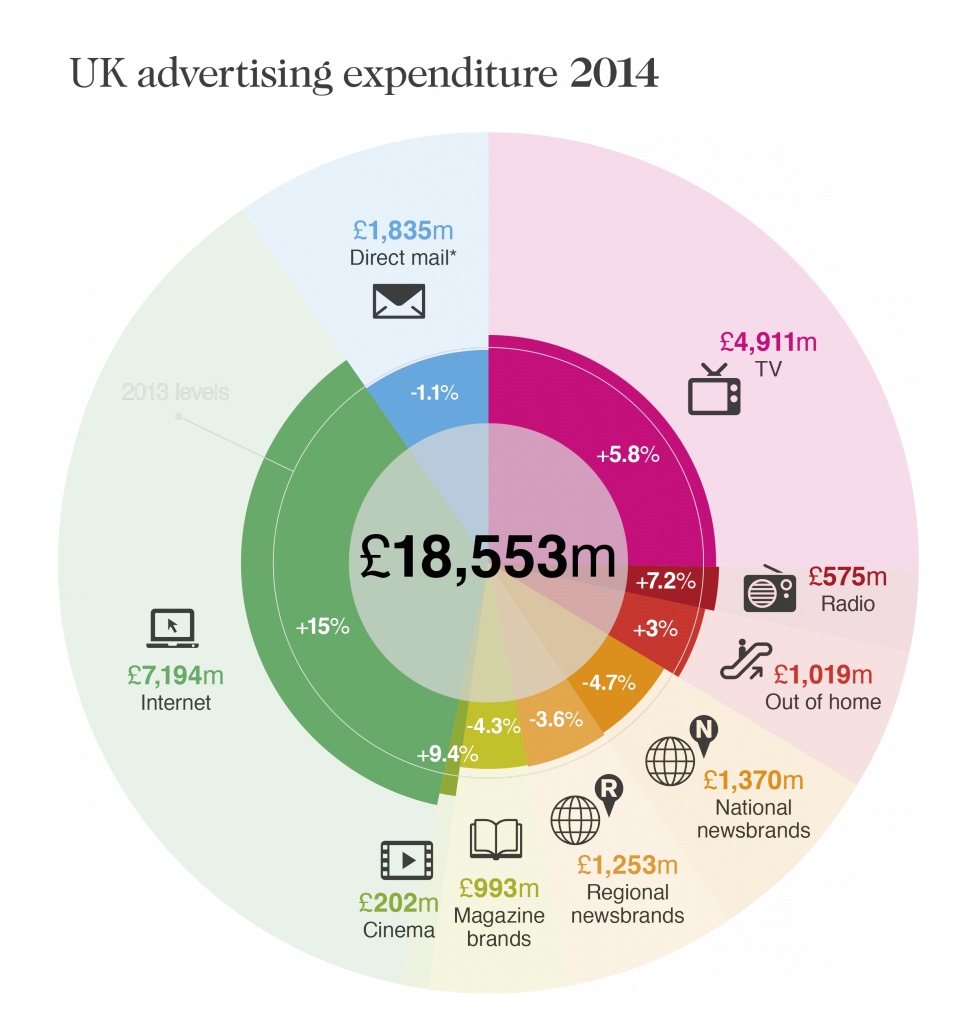

Digital ad spend grew 5.8% increase in 2014, with digital now accounting for most investment, according to new research.

The data, from the Advertising Association and Warc, indicates that UK advertising grew at its highest rate since 2010 last year, increasing 5.8% to £18.6bn.

This strong growth is forecast to continue, with adspend predicted to break the £20bn barrier in 2016.

Internet advertising (+15.0%) and mobile (+58.9%) continue to grow strongly but digital advertising through traditional channels also took-off in 2014.

Broadcast video-on-demand (+15.1%), digital national (+16.4%) and regional (+24.7%) newsbrands were stand-out performers but the upward trend is also reflected in magazines and outdoor.

Tim Lefroy, Chief Executive at the Advertising Association said: “It’s time to stop thinking of digital as something that lives on the internet. In cinemas, outdoor, news, television and elsewhere, advertising is seizing the opportunity of new technology. That trend is transforming our media, driving growth and keeping UK advertising ahead of the global competition.”

Separate data recently released by the AA predicts that 70,000 new advertising-related jobs will be created over the next five years – double the rate of the UK average, bringing the total number of people working across the sector to over 434,000 by 2019.

The Advertising Association/Warc Expenditure Report is the definitive measure of advertising activity in the UK. It is the only source that uses advertising expenditure gathered from across the entire media landscape, rather than relying solely on estimated or modelled data. With total market and individual media data available quarterly from 1982, it is the most reliable picture of the industry and is widely used by advertisers, agencies, media owners and analysts.

Ian Twinn, Director of Public Affairs at the representative body for advertisers ISBA welcomes the report: “The new figures for ad spend are great news for business and consumers, this is at its highest rate since 2010, highlighting advertising as an economic powerhouse for the exchequer. The strengthening economy is reflected in growing spend on advertising across all media from traditional TV spots, regional news brands to digital and the fast growing mobile advertising which break the £20bn barrier by 2020.”

“When business spends money on advertising it means consumers are buying and job opportunities are growing.”

At-a-glance media summary

• TV Spot advertising, benefiting from the football World Cup, increased 5.4% year on year to reach £4,463m in 2014. The growth rate will slow to 4.4% this year, however this is up on our January forecast by 0.3pp. With adspend penned to rise a further 4.6% in 2016, TV spot is set for its strongest consecutive growth in over a decade.

• Radio adspend (excluding branded content) recorded annual growth of 10.9% in 2014, its best performance since 2000. After an exceptional second quarter of growth (17.7%), adspend maintained double-digit growth in the second half of last year (10.3%). We expect radio to register an annual rise of 4.9% (a +0.9pp revision from January) in 2015, slowing to 3.9% next year.

• Out of home adspend rose 3.0% in 2014 to surpass the £1bn mark for the first time. Within the total, adspend on digital OOH rose strongly at 27.3% last year and now comprises around a quarter of the total. We have upwardly revised our forecast for 2015 growth to 4.1% (0.8pp), with further growth of 4.5% expected in 2016.

• National newsbrands recorded total adspend of £1,370m in 2014, a year-on-year drop of 4.7%. The rapid rise of digital ad revenues (+16.4% to £214m) could not offset the decline in print (down 7.7% to £1,156m). However, we expect the overall decrease in spend to slow in 2015 (-1.8%) and flatten in 2016 (-0.2%), driven by an average growth rate of 14.5% in digital adspend over the forecast period.

• Regional newsbrands witnessed a drop in total adspend of 3.6% last year to £1,253m, however this was half the rate of decline recorded in 2013 (-7.3%). Print revenues fell by 7.0% to £1,079m, although digital revenues rose by a solid 24.7% to reach £174m. We expect total ad revenue to continue to decline at a similar rate this year (-3.7%), slowing to a 2.4% fall in 2016.

• Magazine brands adspend fell 4.3% in 2014 to £993m, the first time the total has been below the £1bn mark since 1986. Within this, print dropped by 7.6% to £727m while digital revenues rose by 5.9% to £266m. Growth in digital adspend is predicted to cushion the decline in print over the forecast period, however, with the fall in total ad revenue slowing to 3.3% this year and only 0.7% in 2016.

• Cinema adspend, according to data from Nielsen, registered a year-on-year rise of 9.4% in 2014, reaching a value of £202m (its second-highest total). Looking ahead, we anticipate overall adspend growth of 4.8% this year – to £212m – followed by 2.2% growth next year, when spend should top its 2012 peak.

• Internet (including mobile) adspend – using the IAB definition, incorporating revenues from newsbrands, magazine brands, broadcaster VOD and radio stations – rose by an estimated 15.0% in 2014. Mobile was a strong driver of this growth and now accounts for just over 22% of spend on £1,623m (up from a 10% share in 2012). Further, we expect mobile to comprise just over a third of internet adspend by the end of the forecast period. Total internet advertising will rise in the region of 11.5-12.0% until 2016.

• Direct mail advertising revenue reached £1,835m in 2014, a year on year decline of 1.1%, accor