Ad blocking continues to be a controversial subject, but only half of US users are aware of filtering software, according to a new report.

This special report in collaboration with Adblock Plus, The State of Mobile Ad-blocking in 2017, takes a deep-dive into the attitudes of U.S. consumers towards ad-blocking and online advertising to find out what’s behind this growing trend.

Key findings

• Only half of device users in the United States are even aware that they can block ads on their mobiles.

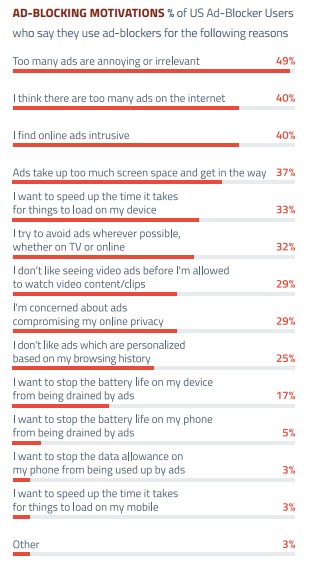

• Ad-frustration is the primary driver behind ad-blocking in the U.S.

• One fifth of smartphone owners say they don’t mind seeing ads on their mobiles once they’re respectful.

Report highlights

• Despite mobiles being one of the most commonly owned devices in the US, they lag significantly behind PCs and laptops as a device used for ad-blocking – only 22% of current ad-blocker users are blocking ads on their smartphones (meaning only 15% of US internet device owners block ads on mobile).

• Only half of internet device owners in the USA are even aware that they can block ads on their mobile. And if we look only at those who have not blocked ads on a mobile, more than 6 in 10 state that they did not know that it was possible to do so.

• Ad-frustration is the primary driver behind current adblocking uptake in the US. Ad-blocker users are most likely to state that ads are intrusive, they are irrelevant, or that there are simply too many of them.

• There is plenty of evidence indicating an underlying demand for mobile ad-blocking tools, and as such there is likely to be a substantial addressable market should awareness of these tools increase. For example, 1 in 3 smartphone owners say that they see too many ads when browsing the mobile internet and a large section of this group are currently unaware of mobile ad-blocking.

• The need to download an additional browser in order to be able to block ads (particularly on Android devices) is slowing mobile ad-blocking adoption. Only 14% of smartphone owners in the USA say that they use an additional browser. • Brand familiarity (or lack thereof) stands out as another potential barrier to mobile ad-blocking uptake. Smartphone owners say they are most likely to choose their mobile browser because they knew the brand, and over 3 in 4 of those who are aware of the existence of mobile ad-blocking are unable to name an app or a browser which allows users to block ads on mobile.

• There remains little willingness or recognition on the part of many consumers to accept that ads – even if they are respectful – are at the core of free content online. 1 in 2 smartphone owners in the USA state that they would prefer to block all ads on their mobile device. However, it is still one fifth of smartphone owners who say they don’t mind seeing ads on their mobile if they are respectful, while a similar number say they are willing to donate money to support websites.

Download the free report here (registration required)