The research, from eMarketer, indicates that by 2022, nearly one-third of mobile phone users will use a payment app .

The world quickly adapted as the pandemic increased the demand for contactless payments. As a result, we saw a significant jump in mobile payment users in 2020.

The year-over-year growth was significant, increasing by 22.2%. Penetration among smartphone users increased as well—44.6% in 2020, up from 38.3% in 2019.

Going forward, eMarketer anticipates that mobile payment users worldwide will continue to grow but at a decreasing rate. This year, there will be 1.278 trillion mobile payment users worldwide, up 8.0% from 2020. Users worldwide are on track to reach 1.498 trillion by 2025, representing 48.2% of all smartphone users.

China

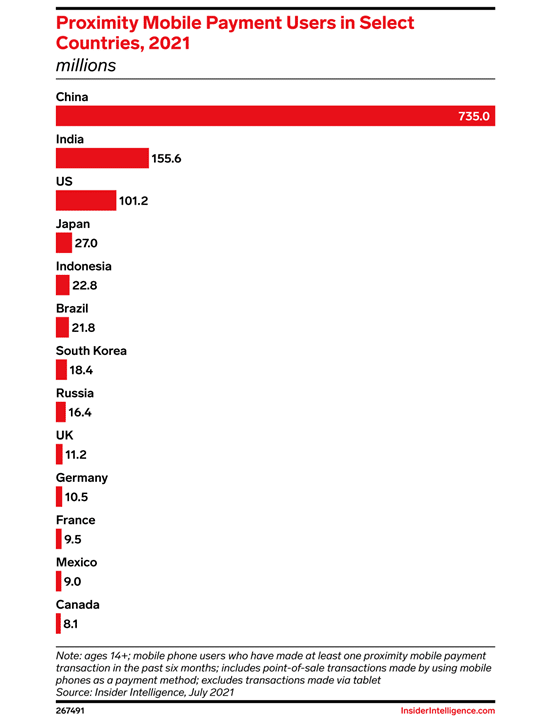

China is the unrivalled leader in mobile payment usage, accounting for 57.5% of users worldwide this year. The country will have 735.0 million users in 2021, up 5.1% over last year. After double-digit growth for several years, this is the first time that growth will slow to single digits, largely because the market is already so heavily saturated.

Already, 62.7% of the population in China uses a mobile payment platform at least once in a six-month period, the highest penetration among the countries we track. By 2025, penetration will surpass two-thirds.

UK

In 2020, mobile payment users in the UK grew even faster than the global pace, rising 25.0%. Last year, users in the UK surpassed 10 million for the first time, falling just shy of a quarter (22.7%) of all smartphone users in the UK.

“The pandemic dramatically accelerated the shift toward a more cashless society in the UK, as consumers relied less on cash for in-store transactions. One likely accelerator for mobile payment growth has been the increase in contactless payment limits to £45 ($57.71) last April during the early stages of the pandemic, and there are plans to increase that limit to £100 ($128.24) this year,” said Cindy Liu, eMarketer director, forecasting, at Insider Intelligence. “For the remainder of our forecast, growth in the UK will remain above the global rate. In 2021, we anticipate that there will be 11.2 million mobile payment users, up 9.9%. UK users are on track to reach 13.9 million people by 2025, representing 28.2% of all smartphone users.”

Canada

In 2020, mobile payment users in Canada experienced high growth, increasing by 19.7% and surpassing one-quarter (27.6%) of smartphone users.

“Contactless payment has been popular in Canada, even before the pandemic, thanks to well-established point-of-sale infrastructure, including widespread chip and PIN terminals—but most of it was done with contactless credit and debit cards,” said Paul Briggs, eMarketer principal analyst for Canada coverage at Insider Intelligence. “Growth in smart wearables adoption and more phones with NFC capabilities led to growth in mobile wallet usage among younger people in Canada. However, for mobile devices to take share away from card payments, they need to provide more incentives like rewards points, coupons, or store credit options.”

In 2021, eMarketer anticipates that there will be 8.1 million mobile payment users in Canada, up 8.3%. Users are on track to reach 9.4 million people by 2025, representing 31.8% of all smartphone users.

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.