Since the redesign of the platform in late 2017, users have been leaving in favor of Instagram and other competitors.

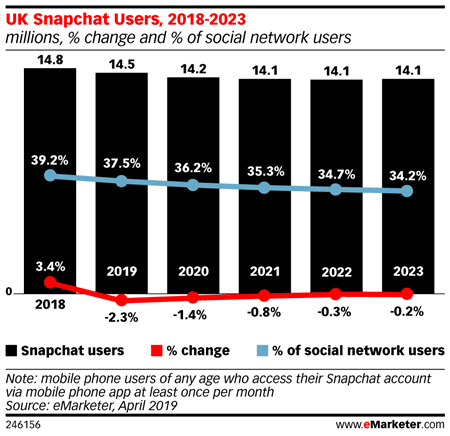

This year, 14.5 million people in the UK will use Snapchat, down 2.3% from last year. Usage will continue to decline through 2023, when it will drop to 14.1 million. eMarketer has cut its forecast substantially since Q3 2018, when it forecast 17.0 million users for 2019.

“Many of Snapchat’s users didn’t like the way Stories and chats were mixed together in a confusing presentation, a change that went into effect in late 2017 but continued to roll out throughout 2018,” said eMarketer forecasting analyst Showmik Podder. “The backlash was so severe that Snapchat was forced to scale back some of the changes just a few months later.”

Despite the dissatisfaction among some users with the redesign, Snapchat continued to add users in 2018 as it reworked and tweaked the app design. In fact, it grew strongly in early 2018, but user growth waned near the end of the year as Snapchat faced increased competition from other apps.

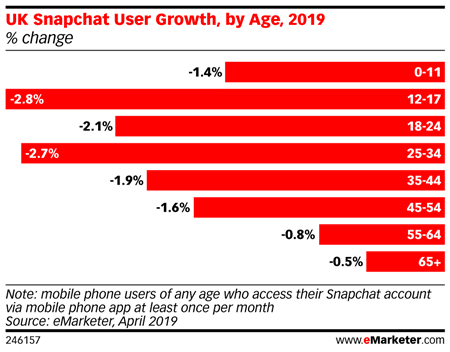

Importantly, we expect that Snapchat will lose users in every age group in 2019. Two key demographics for social networks will see the highest numbers of departures: users ages 12 to 17 (down 2.8%) and those 25 to 34 (down 2.7%).

“While it’s too early to tell whether Snapchat’s ad revenues will suffer as a result of the redesign, a declining number of younger users could make advertisers less inclined to spend on the platform if that same audience can be reached elsewhere,” Podder said.

Rival Instagram will pick up many of those leaving Snapchat. Its user base will grow 8.0% in 2019, reaching 21.0 million. While Instagram’s growth will slow to single digits this year, it will remain positive through 2023, when its user base will reach 23.3 million.

“Many of the same features that have made Snapchat popular have been adopted by Instagram,” Podder said. “This raises the question of whether former Snapchat users will ever return to the app.”

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.