ECI Media Management has today released a flash update to its 2020 Annual Media Inflation Report to record how media inflation has been affected by the coronavirus pandemic across 15 key markets.

Global inflation trends

Restrictions and reduced consumer activity have forced many brands to reduce their ad spend and almost all have revised their 2020 marketing activity. As a result, the increased amount of inventory available teamed with decreased advertising spend means media prices are dropping significantly, across all offline media. Despite increased readership, digital media are also being negatively impacted due to programmatic blacklists blocking keywords associated with coronavirus.

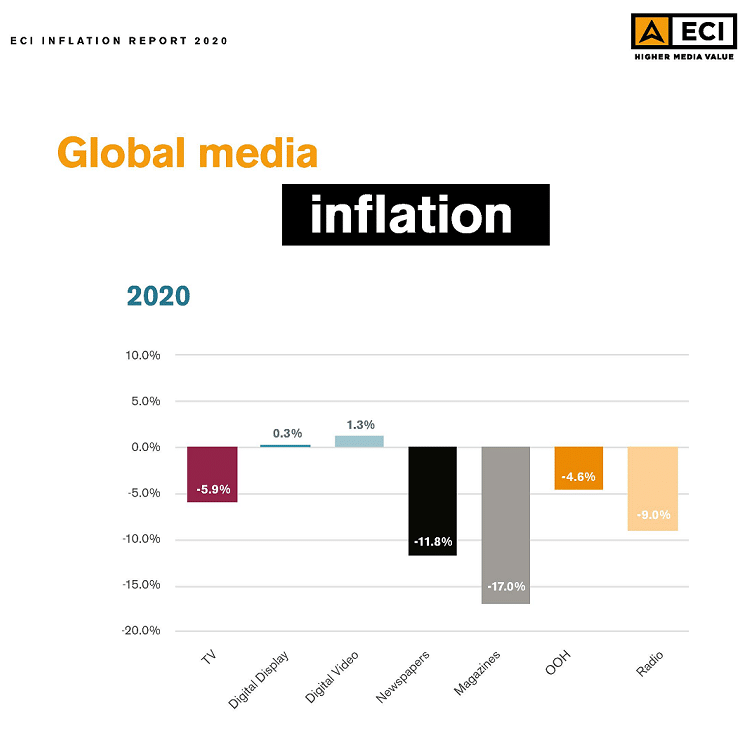

As the decade started, ECI forecast that global media inflation in 2020 would grow across the board, with TV inflation reaching 7.1% and Digital Video inflation increasing to 6.7%. All traditional media types are now predicted to deflate, with TV dropping to -5.9%, while Digital Display and Digital Video are the only media to see rising prices, with global inflation at 0.3% and 1.3% respectively.

High demand is leading to overall inflation for Digital, particularly in APAC, which is driving overall global digital inflation. However, Digital is deflationary in EMEA, with a number of key markets such as the UK, France and Spain seeing deflation due to huge increases in inventory combined with decreased demand. However, there is now an additional trend reducing the price drop on digital: the use of programmatic blacklists to block terms associated with coronavirus.

In the UK the TV market in particular is seeing extreme levels of deflation, with many clients deferring activity later in 2020, along with other offline media due to the decrease in demand. Unlike other global territories, digital in the UK is also expected to see deflation, thanks to high supply and demand.

ECI Media Management’s Global CEO, Fredrik Kinge, said: “The coronavirus, and the havoc it is wreaking on economies and our way of life, will have a profound and lasting effect on the entire industry. Restrictions and reduced consumer activity have forced many brands to reduce their ad spend, which has in turn affected media pricing and inflation. Consequently, the increased amount of inventory teamed with decreased demand means we are seeing media prices dropping rapidly, particularly for offline media.”

Kinge continues: “Economic uncertainty and a lack of growth will see brands continue to exercise caution over marketing spend and media inflation will inevitably respond. In the context of dropping media prices, we’ll continue to provide forensic analysis and actionable insights so advertisers can successfully navigate a media landscape that has transformed beyond all recognition and plan their media activity in a post-coronavirus world.”

ECI Media Management’s Annual Media Inflation Report forecasts media inflation for seven key media channels; TV, Digital Display, Digital Video, Newspapers, Magazines, OOH and Radio, at a global and regional level and across 61 countries. ECI Media Management’s experts draw data from the report from the company’s global network of offices, and cross-references it with industry sources.