The analysis was carried out by Results International, leading global M&A and fundraising advisors to the marketing, technology and healthcare sectors.

Despite Publicis’ acquisition of Epsilon being one of largest deals completed in the sector to date, M&A volumes for the holding groups have been low.

Only Dentsu made the list of top acquirers, completing six deals, which is far removed from the 17 acquisitions it made in the same period last year.

Private Equity firms are starting to dominate M&A and the pace of acquisition is increasing. In Q2 just under half of deals completed were by PE players and five of the seven most acquisitive businesses in H1 were PE.

Key findings:

- 745 deals completed in total in H1 across marketing services, martech and adtech

- PE firm Insight Venture Partners was the most acquisitive in H1 completing eight deals as part of its buy and build strategy

- Accenture was the only management consultancy to make the top acquirers list, completing six deals in total

- The consultancies are acquiring creative capabilities to complement, notably Accenture bought Droga5 and Shackleton, Deloitte acquired Pervorm and KPMG’s picked up the Love Agency.

There were 91 private equity deals in Q2, bringing the total number of PE-backed deals so far this year to 180, accounting for around a quarter of the 745 deals seen in total in H1 2019 across marketing services, martech and adtech.

It also found that of the seven most active buyers in 2019 so far, five were private equity firms. Insight Venture Partners was the most acquisitive in completing eight deals, all within the marketing and e-commerce technology sector as part of a buy and build strategy.

Just under half of the private equity deals in Q2 2019 were the result of ‘buy and build’ strategies, with buyers adding new capabilities to existing portfolio companies. For example, Horizon Capital made three acquisitions last quarter – LiFE, ResearchBods and Bonamy Finch – to form a new marketing agency called STRAT7, focused on customer acquisition and analytics.

The headline deal of the year to date has undoubtedly been Publicis Groupe’s acquisition of Epsilon, one of the largest deals completed in the marketing sector ever. Looking beyond value, only one holding agency made the top buyers list in H1: Dentsu, which made six acquisitions, far removed from the 17 deals it had completed this time last year.

As with Q1 2019, none of the other agency networks have made their way onto the top buyers list. WPP has only completed one deal this year, focussing more on operational synergies internally and the divestment of Kantar. Publicis and IPG have both made transformative acquisitions in the last 12 months and are now focusing on integration. Omnicom and Havas are traditionally more focused on organic growth. Although Havas did make two acquisitions in Q2 – Think Design and Battery Agency.

Accenture alongside Dentsu and Alpine Investors made six acquisitions this quarter, being the only management consultancy to make the top buyers list in H1 2019. These acquisitions included Droga5 and Shackleton in April and PXP/X in June. All three were in line with Accenture’s strategy of acquiring creative capabilities to complement its traditional consulting offering.

This approach has been mirrored in acquisitions made by other consulting firms this quarter, such as Deloitte’s acquisition of digital marketing agency Pervorm and KPMG’s acquisition of the Love Agency.

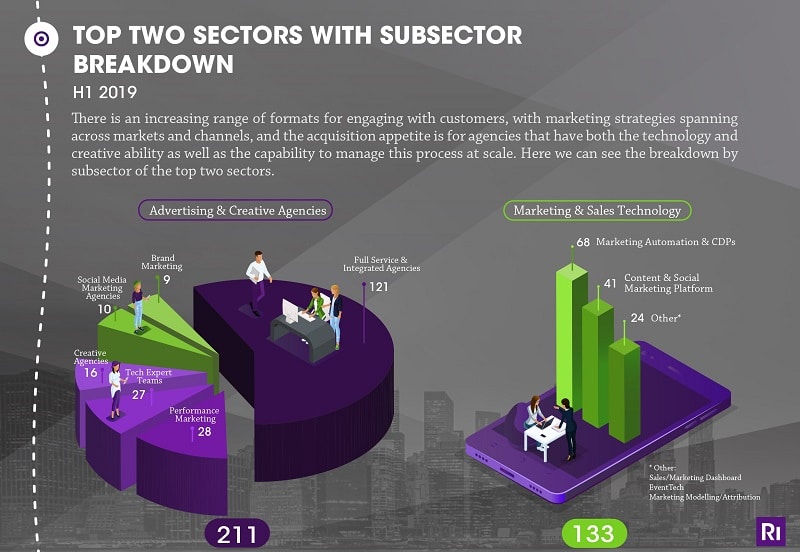

Advertising and creative was again the most active subsector in Q2 2019 with 115 deals, more than half (53%) of which involved either full-service agencies or UX/design/build providers. It illustrates that acquirers are keen to buy businesses that have an integrated offering with a full-funnel proposition and the ability to build and activate digital experiences at scale.

Marketing and sales technology was the second most active subsector with 57 deals in Q2, of which 22 were within marketing automation. There also continues to be a number of deals within the identity resolution and customer data platform (CDP) space, showing the importance of single customer view as a prerequisite to personalisation and omnichannel marketing.

The value of generating a single customer view is further illustrated by the rise of buyers that would traditionally not invest in the marketing technology space, but which have access to broad and diversified data sets: for example, the acquisition of cross device identity vendor Drawbridge by LinkedIn and Dun & Bradstreet’s purchase of the B2B CDP Lattice Engines.

North America was the most active target region with 169 deals in Q2 2019, a slight decrease from the 175 in Q1. Western Europe, excluding the UK, accounted for 21% of deals completed in H1 2019, while 12% of deals were UK ones.

Julie Langley, partner at Results International, comments: “Private equity has been a key driver in marketing industry M&A for some time now, as PE buyers are excited by the transformative change and subsequent growth of agencies that are leading change in the sector.

“The ‘buy and build’ approach PE takes has led to the creation of many new PE-backed agencies with exciting new capabilities focused on future / next generation marketing. They, along with new entrants including the likes of LinkedIn, Apple and Walmart, are keeping the market vibrant, as many of the traditional network buyers focus their attention internally. These acquirers are recognising that the ability to identify customers individually and provide them with targeted and personalised marketing is a key driver to increasing sales.

“Agencies that have the technology, creative ability, talent and capabilities to manage and deliver this personalised approach to marketing at scale are in high demand.”

Notes to Editors:

* Martech defined as sales & marketing technologies, ecommerce technologies, websites creation & optimization

** Adtech defined as search and advertising technologies

About Results International Group

Results International Group is the leading adviser to companies seeking to build and realise value in the global marketing, technology, communications and healthcare industries. Results was founded over 20 years ago in London to advise owners of agencies on creating, building and realising value in their business. The international business was started 14 years ago and over 250 UK and International M&A transactions have been managed by the firm and its partners.