Internet ad spend will overtake broadcast advertising in the US next year, according to a new report from Price Waterhouse Coopers.

The PWC Global Entertainment and Media Outlook report forecasts that entertainment and media spending will hit $720 billion by 2020, up from $603 billion in 2015.

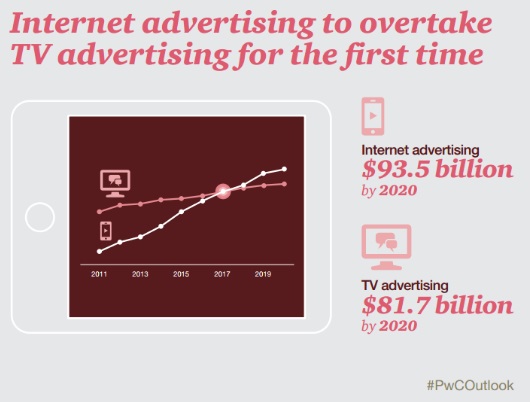

U.S. TV advertising revenue is expected to rise from $69.9 billion to $81.7 billion in 2020, at a compound annual growth rate (CAGR) of 3.2 percent. Internet advertising, meanwhile, brought in $59.6 billion in revenue last year, and that number is projected to rise to $93.5 billion by 2020 (9.4 percent CAGR). PwC forecasts that internet advertising will overtake broadcast TV advertising for the first time in 2017.

“We don’t see an abrupt switchover during the forecast period, but more of a continued evolution towards more multichannel viewing and more digitally enabled viewing,” said Christopher Vollmer, principal with Strategy&, PwC’s global strategy consulting firm.

The biggest advertising gains are expected in mobile advertising, which was responsible for 34.7 percent of total internet ad revenue in 2015 at $20.7 billion and is projected to rise to 49.4 percent by 2020.

Mobile video internet ad revenue will jump from $3.5 billion in 2015 to $13.3 billion in 2020 (a 30.3 percent CAGR). The coming rollout to 5G mobile networks—which will offer higher speeds, faster rendering and a higher-quality user experience—should accelerate the interest in mobile video, though some mobile advertising revenue could be hindered by ad-blocking technology.

“Our forecast reflects that [advertising] dollars will begin to catch up to where the eyeballs are,” Vollmer said. “There’s a lot more shifting of spend that can come out of areas that are maybe already allocated to digital, like money that’s targeted more at desktop inventory today that can be shifted over to mobile. There’s also money that can be shifted over from other budgets as well.”

The report forecasts a 4.4 percent growth in TV advertising this year thanks to the presidential election, which PwC projects will generate $3.3 billion for local stations, and the Summer Olympics. “The Olympics is pretty special in that it’s not just a sporting event, it’s also a cultural event,” Vollmer said. “There are so few of those today that they become very scarce and therefore they become even more premium given the amount of fragmentation there is in media today.”

Vollmer noted that because this year’s Olympics takes place in a prime-time friendly time zone, which will allow more live events, NBCUniversal is “being aggressive about marketing the Olympics as a real multiplatform brand and advertising opportunity, too.”

PwC forecasts that consumers are more likely to become cord shavers than cord cutters. “We assume that a lot of them will gravitate to cheaper bundles of content, a lot of which will be supplied by some of the same players that supply more expensive models of content today,” said Vollmer. “I think you’ll see them not signing up for the 80, 90 bucks a month. They’ll be signing up for things like what Sling is offering, what Hulu is rumored to be offering in about a year and these lower-priced packages.”

While advertisers shouldn’t make any major ad budget shifts for now, PwC said they will have to determine ways—via integrations or other methods—to reach consumers increasingly accustomed to watching content with no ads or limited interruptions on streaming services like Netflix, Hulu and Amazon. “Their share of time spent in ad-supported television is unlikely to increase,” said Vollmer.

PwC’s full Global Entertainment and Media Outlook report is available here.