The IPA agency trade body’s Q2 Bellwether report which measures marketers’ expectations, found that total marketing budgets are contracting at the quickest pace since data collection began over 20 years ago.

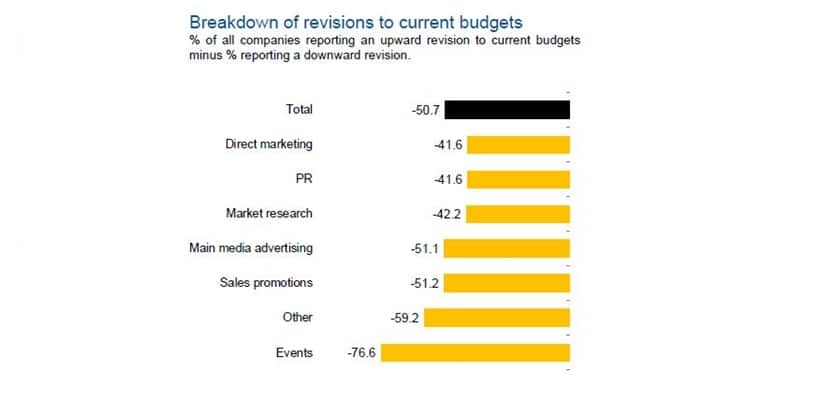

Almost 64% of panel members registered a decrease in spending compared to the first quarter, while only 13% posted an increase. The net balance of firms that cut marketing budgets fell to -50.7% in Q2, down from -6.1% in the first quarter.

IHS Markit, which authored the Bellwether Report, is expecting a 11.3% reduction in adspend during 2020.

However, this figure is heavily dependent on most sectors in the UK economy remaining open for the rest of the year – something that could be scuppered by a second wave of infections leading to further lockdowns.

Worse than the global financial crisis

The decline is worse than the final quarter of 2008, when the UK was in the grip of the global financial crisis. Then, the net balance of companies cutting marketing spend was -41.7%.

The report is anticipating a “robust” recovery in economic conditions next year, as businesses return to operating at full capacity. IHS Markit is predicting a 4.9% expansion in GDP next year and adspend growth of 6%, with “above-average growth” in later years as conditions stabilise in 2024.

Sector trends: Events takes biggest hit while online marketing falls 35%

Main media advertising reported a steep decline in Q2. In fact, the reduction in budgets was the most severe since the survey’s inception, with a net balance of -51.1% of marketing executives seeing a decline in available spend. Underlying data within this main media category suggested the worst performing sub-category was out of home advertising (-61.2%).

The worst-performing sub-category was out-of-home (-61.2%), followed by audio (-50.0%), published brands (-49.2%), video (-39.3%) and other online (-35.1%).

Long recovery until 2024

IHS Markit now expects a -11.9% decline in UK with a matching 11.3% decline in adspend.

It anticipates a robust recovery in macroeconomic conditions during 2021 as businesses move closer to operating at full capacity, translating into a predicted +4.9% expansion in GDP and implied adspend growth of +6.0%.

The report expects the economy to achieve above-average growth (from a historically low base) during a further recovery phase, before stabilising near long-run rates in 2024 and 2025.

Two-thirds of those surveyed reported a “pessimistic” outlook for their company’s finances, compared with just 11.5% who expected an improvement, taking the net balance to -55.1%. It is a similar picture for industry-wide sentiment, with nearly three-quarters (72.4%) downbeat about financial prospects compared with 6.4% who were optimistic.

Growth next year “hinges on the decisions companies make now”

IPA Director General Paul Bainsfair said: “As we suspected, these Q2 Bellwether figures reveal the very grave impact of COVID-19 on UK companies’ marketing budgets, financial prospects and employment plans. Understandably companies in the most severely disrupted sectors have had few options but to preserve cash and operations to survive until trading conditions are more benign. We can only hope that the range of Government aid – from VAT cuts to the Eat Out scheme, in addition to the furlough scheme and more, can help to facilitate this.

“While the future trajectory of the economy is unpredictable, however, that of brands starved of marketing investment is much clearer. Our evidence from previous recessions and periods of buoyancy consistently shows that cutting marketing investment weakens brands in the near-term and limits growth and profitability in the long-term.

“There are positive forecasts for a return to adspend growth in 2021 but a significant part of this coming to fruition hinges on the decisions companies make now. Ultimately, companies must invest in marketing in a recession in order to profit in a recovery.”

Eliot Kerr, Economist at IHS Markit and author of the Bellwether Report, added: “Given the steady flow of awful economic data that we’ve seen since the start of the UK lockdown in March, a further reduction to marketing budgets in the second quarter was anticipated. However, the sheer scale of the latest decline, unprecedented since we first started producing this report over 20 years ago, shows the catastrophic impact that this crisis has had. Despite the weak headline figures and the corresponding hardship that many businesses will face for the rest of this year, we do expect a strong bounceback in 2021.”

Industry comment

Mark Inskip, CEO UK & Ireland, Kantar (Media Division), said: “The economic effects of the coronavirus pandemic are still being felt deeply here in the UK so, while disappointing, it’s hardly surprising that marketing budgets plummeted through Q2. But after digesting the initial economic shock, many forward-thinking businesses will have used the last few months to begin to regroup and plan more optimistic marketing strategies going forwards.

“In such turbulent times, it’s crucial that brands measure each step of their campaigns and stay up to date with what consumers are thinking and feeling. According to our recent DIMENSION study, 43% of UK consumers prefer to see ads that are relevant to their interests and needs, demonstrating the importance for brands to keep talking to audiences in the right ways and in the right places.

“Despite marketing budgets remaining tight now and for the duration of 2020, the IPA Bellwether forecasts that we will start to see an uplift again next year, making it even more important for brands to stay present and relevant. Those that use on-the-pulse insights to continue communicating in a sensitive but consistent way will reap the rewards when they find themselves at the forefront of minds as consumer spending ramps up again.”

Paul Hutchison, Chief Executive Officer, UK at Wavemaker, said: “Today’s report confirms the reality of what we have been experiencing since the middle of March. Of course, whilst the headline of the fastest decline since this report commenced 20 years ago is shocking, it is, however, hardly surprising.

“V shaped recovery, U shaped recovery, who knows. What we do know is that marketing is an investment and growth is there to be had. We may need to think differently about how and where to find growth and experience uncomfortable change to realise it but those brands who positively provoke and focus on both short term optimisation and longer term transformation will, bounce back strongest and fastest.”

Rayhan Perera, CEO and Founder, OneDash, said: “Current market conditions are a hub for new trends and business development, particularly as the pandemic continues to drive new consumer habits. Despite the IPA’s report that video budgets are down 39.3%, we would expect video to be one area that will remain resilient, particularly with separate reports forecasting UK spend on digital video to reach £3.72 billion in 2020, up 15% from last year.

“This surge in popularity offers brands a chance to tap into the potential of video as an advertising tool by experimenting with interactive, shoppable formats. Making use of these tools now will give advertisers the opportunity to test how effective they can be, as well as give consumers time to adapt to the new visual medium. With Facebook and YouTube already announcing their own products in this area, we can expect shoppable video to be one of the new trends to emerge from the pandemic, driven by brands’ need to find more innovative ways to engage consumers and close the conversion gap.”

Richard Wright, Head of Marketing, Scoro, said: “The largest recorded contraction in advertising budgets may not come as a surprise to many media agencies who experienced this first-hand, but the figures will hammer home the urgent need to cut costs when clients are doing the same. Online advertising is one of the strongest performers highlighted in the report, which also gives agencies a clue as to where their internal priorities should lie. The shift to all things digital is in full flow and agencies that fall behind in this regard will pay a greater price than before COVID-19 re-shaped the industry landscape.

“Agencies should aim to scale back on time inefficient practices, which could mean scrapping mandatory meetings or allowing staff to work remotely whatever the office situation might be. Flexibility should be the priority, starting with making smart investments in tech to aid remote-working collaboration, which will be a reality of life for most of us for the foreseeable future. By focusing on these factors, agencies will be in the strongest financial position to weather the losses of 2020 and make the most of a more promising 2021.”

Jenny Kirby, Managing Partner, GroupM, said: “With Q2 bearing the brunt of the COVID-19 lockdowns, advertising spend in the UK has been unsurprisingly stunted. However, a deeper dive into the figures shows some advertisers were actually looking to invest more over this time period. Audio spending is the best example of this, with almost one in five (18.5%) advertisers revising their annual budgets upwards in Q2 and a third (33%) maintaining their levels of investment. Similar figures for video and online advertising more generally shows that the overall picture could be skewed by more traditional forms of advertising, such as out of home, which was negatively impacted.

“A closer examination indicates that advertisers spotted an opportunity to meet marketing objectives through online channels by engaging with consumers while they were at home, and spending more time than over on their digital devices consuming news and entertainment content. The pressing need to prioritise return on investment and achieve core business outcomes meant advertisers were more selective with their spending.”

Lisa Menaldo, Co-Founder, The Advisory Collective, said: “The Bellwether Q2 report clearly underlines the serious impact that Covid-19 had on many companies across our industry, highlighting that few are immune from its effects.

“The rapid decline of ad budgets in Q2 meant that businesses were forced to realign and enforce drastic cost saving measures at an unprecedented rate to preserve both cash and employees. With the uncertainty of a second wave of the virus, compounded with the potential economic pressures of Brexit, it is understandable that many marketers remain cautious as we head in H2. But we are already starting to see green shoots of recovery and while significant budgets will not switch on overnight, brands understand that to drive business forward they need to invest in marketing.

“Media will need to work harder in the coming months, but it is setting the right directional path on the road to recovery as we prepare to head into a more positive 2021.”

Filippo Gramigna, Strategic Advisor, Audiencerate, said: “Marketers must now start to look beyond the pandemic and prepare for the anticipated robust recovery of macroeconomic conditions in 2021. If COVID-19 has proved anything, it’s that agility matters, especially when bundled with quality, and even more so when it comes to harnessing data for targeting.

“While technological advances have improved the efficiency of data on-boarding, synchronisation and activation, marketers still wait weeks before they can tap the granular user profiles needed to drive effective advertising — and months to see what impact their efforts create. When consumer behaviour and market conditions are more changeable than ever, this isn’t fast enough to keep revenue rolling. If marketers want to stay ahead of competitors and the ever-shifting climate, they need sharper and more tailored capabilities that will strengthen their data monetisation strategies, to deliver more impactful and competitive campaigns.”

Pierce Cook-Anderson, UK Country Manager, Smart AdServer, said: “Although media budgets are down across the board, we are seeing clear cases where spend is accelerating in a positive way – most noticeably in the video and OTT space, as well as in gaming. With TV time among adult viewers up 10 minutes per day in 2020, advertisers are taking better consideration of their target audiences, and shifting their ad dollars to digital video as a result. The boost in ad spend for this category should support the industry’s overall recovery and, as third-party cookies disappear, we can expect continued interest from advertisers in what digital video and connected TV can do for them.”

Alexander Igelsböck, CEO, Adverity,said: “When the pandemic first hit it was natural for advertising to be cut back as marketers needed time to reassess their priorities and to better understand new consumer behaviour. There is light at the end of the tunnel with ad spend recovery expected from 2021, but in the meantime as marketers and advertisers continue to exercise caution, it is clear that critical to short-term and future success is the adoption of data-driven insights and ensuring every penny works as hard as possible.

“Marketers may not always have direct control over the size of their marketing budgets, but they can have better understanding of their data and scrutinise the value of every pound spent. The adoption of a data-driven approach facilitates the opportunity for increased digital efficiencies and is also key to demonstrating the value of maintaining marketing efforts at a time where all spend is under review. For those that get it right, this will prove to be a pivotal year for marketers to gain a competitive advantage with 2021 in mind.”

Rachel Powney, VP of Marketing, Dugout, said: There’s no doubt it was a tough quarter for advertisers overall, with uncertainty about consumer behaviour brought about by lockdown. But those same circumstances drove us online in huge numbers, seeking new forms of communication and entertainment to replace face-to-face interaction and live events. This digital silver lining is clearly accounted for in the report, with video and online advertising making up the better performing channels.

“As ad spend recovers, the trend towards digital looks set to continue because certain changes in consumer behaviour will remain in place for the foreseeable future. For example, live sport has returned, but so far fans have not. So clubs and sporting organisations will have to be more creative to keep their larger digital fanbase engaged, and we are likely to see further growth in live streaming and esports as a result. This will in turn create new opportunities for brands to reach these audiences and maximise their marketing spend.”

Chris Hogg, Managing Director EMEA at Lotame, said: “With economic conditions predicted to make a robust recovery in 2021, this is a pivotal time for marketers to gain a competitive advantage and be in a strong position for the upturn. As both consumers and brands continue to adapt to the ‘new normal’, previous advertising strategies will need to be adjusted to reflect the new environment; this is an opportunity for the industry to create a better tomorrow.

“Consolidating online and offline consumer activity has always had its challenges, but the obstacles are growing fast with more stringent privacy regulations, third-party cookie blocking, and first-party cookie limitations. To capture the increasingly complex digital life of a consumer, advertisers should learn about and build a panoramic view of their audience to understand their ever-shifting interests and behaviours. Only then can they reinforce consumer connections and come out on top, post-pandemic.”

Barney Farmer, U.K. Sales & Marketing Director, Nielsen, said: “While it is clear the impact of the Covid-19 pandemic has reached an unprecedented scale, it is vital the UK industry does not stop advertising. Now more than ever we need to be focused on the future and make thoughtful decisions about how we handle the challenges of the pandemic to shape the industry of tomorrow.

“The sharp contraction of budgets was inevitable. However, the value of continued investment in advertising is significant, even in tough times such as these. It is proven that almost half of marketing efforts are realised a year after implementation – so even the smallest expenditure now, could be powerful when the recovery kicks in.

“The use of accurate, trustworthy and independent data analytics will be key to ensuring these pandemic-era budgets are used as effectively as possible and drive the most value, now and through the next year.”

Nick Morley, EMEA MD, Integral Ad Science (IAS), said: “It’s unsurprising to see a further downturn across all types of marketing, and with many businesses still operating at a reduced capacity, marketers should also expect a challenging second half of the year. Ahead of recovery expected in 2021, marketers need to make sure available budgets are spent wisely and efficiently – education around the technology and tools available will be key.

“Considering lockdown is beginning to ease, understanding the contextual environment of each ad, and the technology a marketer has deployed, is vital for a successful campaign. Also, an open dialogue between advertisers and publishers will not only enable publishers to communicate what their publishing environment entails, but brands, and their agencies, can define and communicate their brand’s suitability goals. It’ll be great to see more marketers taking this important step towards contextual control, to contribute to the industry recovery we are all working towards.”

Calum Smeaton, CEO, TVSquared, said: “The report paints a clear picture of the impact when brands “go dark”. Many pulled back on ad spend while they figured out how to revise business operations during a sensitive period, and refocus restricted budgets on where their consumers were actually spending their time. We’ve seen many direct-to-consumer (DTC) brands thrive thanks to audiences spending greater time with TV, especially where audiences across all platforms have increased, but it’s clear not everyone has been able to return to their pre-pandemic ad spend plans.

“For those marketers that are spending, they’re under increased pressure to prove a clear return on their investments. Marketers simply can’t afford for attribution to be the missing link right now. To prepare for the above-average growth and recovery forecast in 2021, every single campaign must be bought, sold and measured based on data-driven insights.”

Victoria Usher, Founder CEO, GingerMay, said: “The outbreak of COVID-19 was a double hit for many businesses. With four years of Brexit uncertainty out of the way, 2020 was the year that many felt would be their best yet – but the pandemic set the industry back once again.

“The results illustrated in the latest Bellwether report are not a surprise, and match the dire predictions made by economists and the Government. But while the situation is devastating for many, there are strong signs that the recovery is happening fast, with sectors such as ecommerce and gaming in particular doing extraordinarily well. If we continue on our current path, 2021 could turn out to be the successful 2020 we were all hoping for.”

Ian Lowe, VP Marketing, Crownpeak, said: “The report shows overwhelmingly that the majority of businesses are experiencing reductions across the board not just in terms of economic prospects, but also to their marketing budgets. With huge impacts to in-person engagement and live events we are now seeing further proof that we have entered a “digital-only” era where brands must deliver great digital experiences in order to survive. With uncertainty about the future economic environment and many questions surrounding a possible return to lockdown, declining consumer confidence in offline engagement, and recessionary pressure, it’s critical for organisations not only to deliver good digital experiences, but also to be adequately geared up to rapidly react to ongoing changes.

“To be successful businesses will need to focus their efforts on building a great digital experience infrastructure to deliver quality digital engagement with buyers, decision makers and key audiences by prioritising ease-of-use, clarity and authenticity. It will also be vital to invest in technologies that improve efficiency and reduce infrastructure and maintenance costs. This will allow organisations to eliminate friction, increase agility and ultimately to survive and grow during the upcoming quarters”.

Nickolas Rekeda, CMO at MGID, said: “Despite the crisis, pausing marketing activity is not an option for brands wanting to keep a strong market position – particularly as the economy begins to show signs of recovery. However, this doesn’t mean marketers should carry on with the same approaches they were using before the pandemic hit.

“Marketers should use this time to experiment with new formats and digital approaches; especially given the rise in online audiences. But to gain audience attention in the ’new normal’, brands cannot simply rely on assumptions. Brands must focus on making optimal use of their budgets by prioritising performance-based marketing efforts where effectiveness is easy to track, instead of long-term brand awareness campaigns.”

César Melo, Head of EMEA at VidMob, said: “The wider context reveals that the disruption caused by the pandemic created positive opportunities as well as challenges.

Alongside plunging media budgets, Q2 delivered strong spending growth in sectors that include CPG, eCommerce, and gaming. Moreover, forward-thinking global brands that understand the importance of technology in delivering enhanced efficiencies adopted platforms to streamline workflow and measurement tools to improve ROI. They also diverted dollars away from offline and broadcast media toward digital channels. On the whole, the impact of COVID-19 expedited digital transformation, and businesses already moving with this tide and dialing up technology investments will be the long-term winners.”

Andy Ashley, International Marketing Director, Digital Element, said: “It is no surprise the global pandemic has hit the advertising industry hard, but while this latest report makes for some difficult reading, marketers should not give up on driving positive results and future success.

“At these times of uncertainty, making the right decisions about internal processes and tools is arguably as important as the messaging being displayed to the public. Efficiency and accuracy are absolutely critical to ensure the budget advertisers do have available goes towards driving as much value as possible.

“As we see advertisers try to adopt the best strategies to maintain business over the next few months – and drive growth when recovery eventually begins – decision makers need to select versatile tools they can trust to address multiple challenges. For example, IP Intelligence data can be used to not only localise content and target effectively – especially important for increasing responsiveness and revenues in these times where we see huge shifts in consumer behaviour – but also address the challenges of fraud and rights management.”

Ivan Ivanov, COO, PubGalaxy, said: “The sombre picture across every category is not unexpected news for digital publishers. With constant changes in buyer behavior as the pandemic unfolds, the supply-side must work to keep ad revenue steady, with an agile blend of experimentation, smart operations, and reliable demand. Importantly, publishers need to embrace the chance for experimentation, moving with buyer needs, and making the most of their assets, such as utilising revenue from a variety of different campaign verticals.

Maintaining strong traffic should also always be a priority, and evaluating minor changes in UX and interface design could see increased audience engagement in the future. Digital publishers could also revise the programmatic setup to accommodate buyer requirements; a good place to start would be optimising to satisfy different pricing models. And while there is no cover-all method for surviving the current market turmoil, adaptation will be essential to survive this uncertain time. Focusing on small steps to adjust activity for the best possible results now will help achieve greater future success.”

Phil Acton, Country Manager, UK & Benelux, Adform, said: “The report makes sobering reading and shows the widespread impact of this pandemic on marketing budgets. As businesses naturally face increased cost pressures, they will seek to streamline and find more efficient ways of working. Advertisers need support from their partners to bounce back quickly and it is those with access to integrated software solutions that will really make an impact, as marketers work to move their companies out of the downturn as fast as possible.

“With the consumer behaviour shift outlined in the report, marketers need efficient, accountable and performance-driven solutions that enable them to accelerate their transition towards digital, continue to reach consumers at scale and better manage costs. This will largely come via digital platforms and particularly programmatic advertising, as unfortunately traditional media channels such as OOH and Cinema no longer provide the mass audiences marketers need. Instead, mobile, video, audio, and gaming are emerging as the leading routes to communicate with consumers.”