Profits were also up – $720m (£565m) for the latest quarter, which is nearly triple the level of a year earlier.

The streaming service, known for shows such as The Crown, Tiger King and Money Heist gained 10.1 million customers in the second quarter.

This beat expectations and meant it has added 26 million so far this year, compared with 28 million for the whole of 2019.

However, it forecast that growth in subscribers would slow markedly to 2.5 million in the current July-September period, disappointing investors and sending shares 10% lower in after-hours trading.

In a letter to shareholders, Netflix said: “As we expected, growth is slowing as consumers get through the initial shock of COVID and social restrictions.”

The company had added a record 15.8 million customers in the first quarter.

In its latest update, Netlfix said “restrictions on what we do socially” had helped drive a “pull-forward” in subscription resulting in “huge growth in the first half of this year”.

“As a result, we expect less growth for the second half of 2020 compared to the prior year,” the company told investors.

The 26 million additions figure for January to June was more than double that of a year before while the 10.1 million reported for the second quarter was nearly four times better than in 2019.

That took its number of global paying customers to just under 193 million.

Resuming production amid growing competition

Netflix said it was slowly resuming production in many parts of the world, including Korea, Germany, Spain and the UK after it was shut down by the pandemic.

However, there was “more uncertainty” over filming in the US due to “current infection trends”.

The latest surge in customer numbers came even as Netflix is facing increasing competition from newly launched services such as Disney+.

Industry analysis

Dave Castell, GM Inventory and Partnerships for EMEA, The Trade Desk, said: “While today’s results demonstrate that Netflix has continued to benefit from the acceleration of streaming during the pandemic, the easing of lockdown may equal the end of its growth streak. Our research found that one in three UK consumers plans to cancel their streaming subscription once lockdown lifts – a trend that will likely be reflected in next quarter’s earnings.

“With the opening up of hospitality and travel against a backdrop of ongoing economic uncertainty, UK consumers will be keeping a close eye on their spending. While paying for a streaming subscription will have been a top priority during the depths of lockdown, many consumers will now be looking to cut back to fund other activities. This shift is one our research identified back in April, with one third of consumers only willing to spend £10 per month on streaming – up from one quarter nine months earlier.

“This change is also accompanied by a growing acceptance of ads in exchange for free TV content. Many consumers will be feeling full from binging on Netflix during lockdown – and we’ll start to see a shift in appetite for a broader range of services including ad-supported options like Pluto TV and Rakuten.”

Mark Inskip, CEO UK and Ireland, Kantar, Media Division, said: “Today’s results show that despite fierce competition from Amazon, Disney+, Apple TV and the multitude of other smaller streaming platforms available, Netflix remains the platform to beat. Lockdowns all over the world have meant more people than ever are embracing streaming and Netflix has clearly benefited in no small part, from that trend.

“Our DIMENSION report found that almost three quarters of consumers now access a paid subscription service, with 54% using Netflix including 73% of 18 to 34-year olds. However, an uncertain economic outlook for the rest of the year means many consumers will be reconsidering their priorities. With lockdown easing and people starting to ease back into old habits retention will become the name of the game for these streaming platforms. Services like Netflix will need exceptionally strong USPs to stay ahead of free, ad-funded challengers.”

Eric Haggstrom, eMarketer forecasting anayist, said:”With movie theaters closed and major sports seasons postponed, streaming video has been a notable bright spot in the media industry. Netflix continues to lead the industry, both in the US and internationally. Whether or not Netflix can continue to grow subscribers as lockdowns are relaxed is a major question. Netflix is much better positioned than many of its competitors. Its 2020 content release schedule won’t be significantly impacted, it isn’t reliant on sports, live events or advertising. It also doesn’t have to play a delicate balancing act between selling content to legacy partners or putting content on a new streaming service. Netflix will weather this crisis better than almost everyone else in the media industry.”

Key stats from eMarketer:

NETFLIX USERS (WORLDWIDE)

Worldwide, Netflix is on track to have 453.5 million* individual users in 2020, up 9.1% over last year.

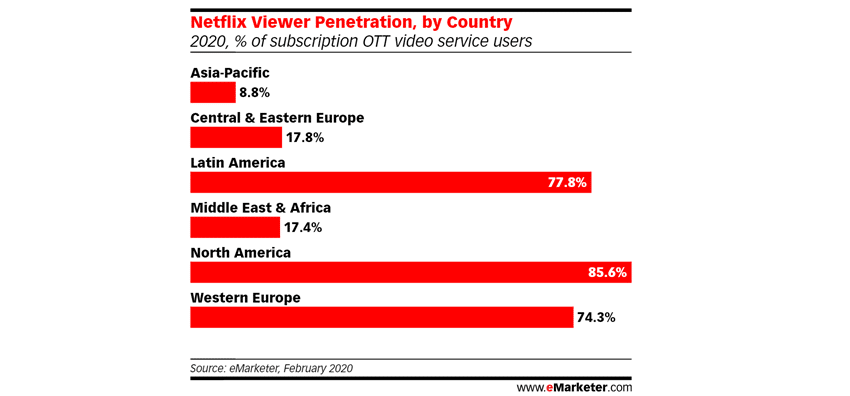

This year, Netflix will capture 33.0% of subscription OTT viewers globally.

*eMarketer estimates roughly 2.5 viewers for every 1 paid Netflix subscription

NETFLIX USERS (US)

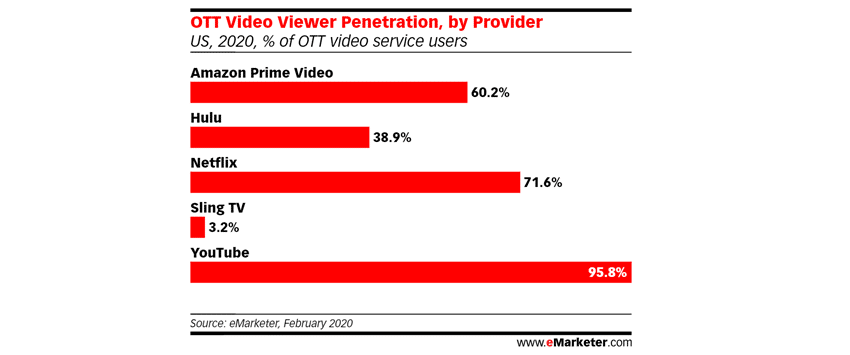

In the US, Netflix will have 158.9 million users in 2020, up 2.9% over last year. Netflix captures 71.6% of US OTT video users.

While North America represents 36.6% of all Netflix viewership, its share is shrinking, as Netflix expands internationally.

Note: There is overlap, as some viewers use more than one service.

US TIME SPENT

– In the US in 2020, adult Netflix viewers spent an average of 63.0 minutes per day watching the streaming service, up 13.5% over 2019.