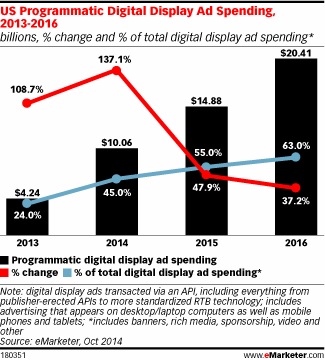

US programmatic digital display advertising is projected to top $10 billion this year, more than double last year’s $4.24 billion, with similar growth predicted next year, according to new research.

The study, from eMarketer, forecasts that programmatic display ads will double again to reach more than $20 billion in 2016.

That trajectory puts programmatic on track to take 63% of the total US digital display spend within two years, more than two-thirds of which will take place on mobile devices.

The estimates are based on analysis of dozens of data sources as well as interviews with more than 50 executives at ad agencies, brands, publishers, media companies and advertising technology firms.

2014 has seen the most dramatic growth and expansion in programmatic advertising to date, and eMarketer expects significant increases ahead thanks to the build-out of private marketplaces and programmatic direct deals, as well as continued maturation in both mobile and video advertising.

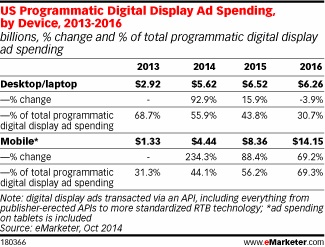

As with other digital advertising, much of the growth is coming via the mobile channel. This year, mobile will account for 44.1% of all US programmatic display ad spending, or $4.44 billion. The report projectsthat mobile will surpass desktop as early as next year, taking 56.2% of all programmatic ad expenditure. This trend is consistent with the digital display ad market overall, which has shifted to mobile rapidly.

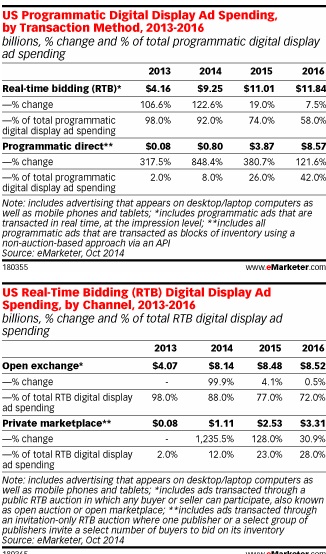

The forecast also breaks down RTB spending into two distinct channels: open exchanges and private marketplaces. In 2014, open exchanges will account for almost 90% of US RTB digital display ad spending, totalling $8.14 billion.

By 2016, the report forecasts spending on private marketplaces to reach $3.31 billion as open exchange investments remain essentially flat—though political ad dollars will play a role in maintaining the health of the latter in 2016.