The study, released by WPP and Kantar Millward Brown, indicates that the total brand value of the Top 100 grew by 21% ($748 billion), despite economic and political uncertainty in many regions of the world, to reach $4.4 trillion – close to the GDP of Japan.

Key findings:

- Total brand value increases by a record 21% ($748 billion), to reach $4.4 trillion

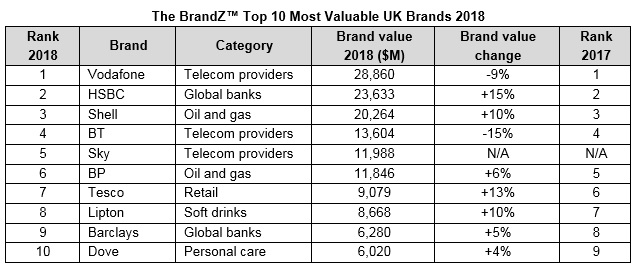

- Top 10 most valuable UK brands grow 7% to $140.24 billion; Vodafone remains at no.1

- Smart partnerships with tech companies help to drive innovation

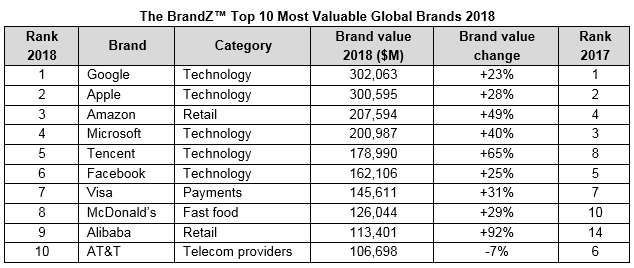

Eight of the Top 10 brands are technology or tech-related, with Google and Apple retaining the number 1 and 2 spots, growing +23% to $302.1 billion and +28% to $300.6 billion respectively. Amazon moved up to no.3 ahead of Microsoft, growing +49% to $207.6 billion. Tencent rose to no.5 ahead of Facebook (no.6), growing +65% to $179 billion. Tech-related brands now account for over half (+56%) of the Top 100’s overall value.

The total value of the BrandZ Top 10 most valuable UK brands has increased +7% to $140.24 billion. Vodafone remains the UK’s most valuable brand and is at no.37 in the BrandZ Global Top 100. Three other UK brands are also in the global ranking: HSBC (no.50), Shell (no.63) and BT (no.94).

The UK brands that have increased their value have successfully innovated through smart partnerships with tech companies, and the use of intelligence-led marketing technologies such as AI, AR, machine learning and predictive analytics, to connect with consumers and deliver a great brand experience.

Shell (+10%) partnered with IBM to allow retail customers to check out in five seconds without scanning purchases one by one, and launched the world’s first in-car payment system. Burberry (+5%), which now sits just outside the UK Top 10 at no.11, used Facebook Messenger chatbots to improve customer service, and introduced AI into its chat platforms and app. Asos (no.14 in the UK) used Instagram Stories to great effect, and launched a mobile app that applies AI to learn from each transaction, then adapt and improve the shopping journey.

Overall, UK brands are still suffering from a perceived lack of innovation among consumers, largely due to being in categories that are considered to be less innovative. The average score for innovation across all UK brands is 102, compared with 110 for the BrandZ Global Top 100, which includes many hard-hitting technology and retail brands.

Sky is the most innovative brand in the BrandZ UK Top 10, with a score of 112, which has helped to drive a value increase of 11% in just six months. Tesco (+13%) is the most-loved brand in the UK Top 10, having changed its fortunes through a clear strategy of connecting more effectively with consumers and shifting from a focus on price to one of creating a better customer experience.

The ongoing success of Dove (+4%) demonstrates the power of consistency and a long-term commitment to purpose and investing in the brand. It has followed the consumer trend towards more natural beauty, and rolled out innovations such as Baby Dove and its DermaSeries line for women with skin conditions such as eczema, while all the time staying true to its 13-year-old ‘Real Beauty’ message.

Jane Bloomfield, Kantar Millward Brown’s Head of UK Marketing, says: “The UK’s value growth is more modest than that of the global ranking, but the strongest brands have risen to the top by retaining a sharp focus on listening to and engaging consumers and getting the experience right. They’re focused on meeting consumer needs in a relevant and meaningful way. This increasingly involves using technology to make it easier to find out about, order and pay for the things we want, get them in our hands more quickly, gain more from using them, and ultimately tell other people about the value we perceive them to have.”

Martin Guerrieria, Global BrandZ Research Director at Kantar Millward Brown, says: “With continuing perceptions that there’s an ‘innovation gap’ in the UK, partnerships are proving pivotal for brands that may struggle to innovate organically. A smart collaboration can be a way to quickly gain capability and credibility, and create a perception of innovation, as well as bringing increased speed, agility and reach. But the collaboration has to feel right, and be completely relevant to the purpose and the brand.”

Key trends highlighted in this year’s BrandZ Global Top 100 study include:

- Newcomers include US telecoms giant Spectrum (no. 27), Uber (no.81), Instagram (no.91), and the first Indonesian brand in the ranking bank BCA at no.99.

- This was the first year non-US brands grew fastest. Disruptive Chinese brands made a huge impact, with 14 appearing in the Top 100. They saw year-on-year value growth of +47%, more than double that of the US brands (+23%).

- Trailblazing Chinese brands also dominate the fastest risers this year: JD.com (no.59) +94%, Alibaba (no.9) +92% and Moutai (no.34) +89%.

- Retail was the fastest rising category, growing +35% in value over the last 12 months, driven by ecommerce brands.

- Brands support value creation more strongly than ever. If we compare the growth of all the brands in the ranking with S&P500 and MSCI World Index, our portfolio outperforms by 70% and 122% respectively.

As the largest and definitive brand equity platform in the world, BrandZ reflects the brands that are integrated into today’s consumer lifestyles. It is the only brand valuation study to combine interviews with over three million consumers globally with analysis of the financial and business performance of each company (using data from Bloomberg and Kantar Worldpanel).

The BrandZ Top 100 Most Valuable Global Brands report and rankings, and a great deal more brand insight for key regions of the world and 14 market sectors, are available online here.

Source: Brandz