The trade body found that 89% of large multinational companies have deferred marketing campaigns this month, up from 81% in March.

Over half (52%) of marketers at these companies said they’ll now hold back ad spend for six months or more, compared to just 19% who considered taking similar medium-term action last month.

The findings are based on responses from 38 companies in 17 different categories with a total global ad spend of $46 billion.

The number of companies now running some kind of crisis response campaign has more than doubled since March – 32% then compared to 68% now. But, the WFA says, this rising activity will not compensate for the deep cuts to other campaigns.

The WFA forecasts that global ad budgets will be down 36% in the first half of the year, and 31% for the full year.

While 62% of respondents said they believed it was essential for brands to avoid “going dark” during the crisis, they are still making big cuts to overall ad spending. TV is expected to be down globally by 33% over the first half of the year, but print (down 37%), out of home (down 49%), and events (down 56%) are suffering even more dramatically.

Spending falls on digital are far less dramatic, with online video down just 7% and online display down 14%. Radio (down 25%), Point of Sale (-23%) and Influencer (-22%) are expected to see deep cuts over the year.

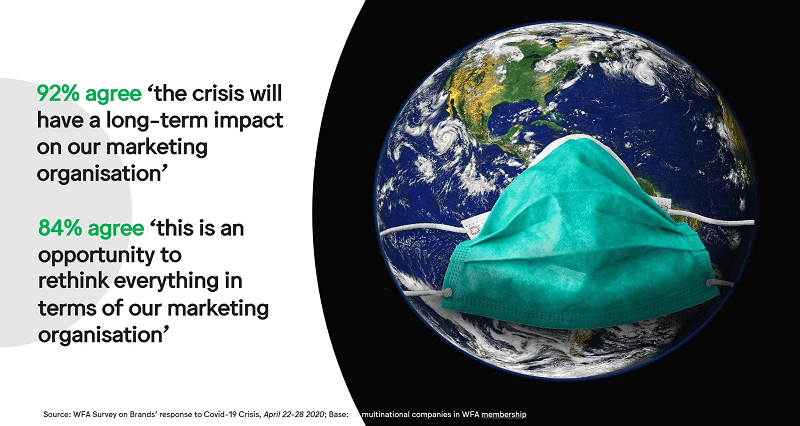

Ninety-two per cent of respondents said the crisis will have a long-term impact on the way they operate, and 84% agreed it was an opportunity to “rethink everything in terms of our marketing organization”; the same percentage said the crisis has already accelerated digital transformation.

Almost two-thirds (63%) said they were now concentrating on strategies for the immediate post-crisis period, and for the longer term; but in the meantime, 73% agree they will have to find ways to support agencies during the crisis.

The data gives some insight as to what lies ahead for the remainder of the year as the industry grapples with the possibility of an ad recession. In the first three months of the year, the UK alone saw the slowest uptick to ad budgets since the 2008/2009 financial crash.

In line with advice to keep spending in a time of crisis, some 62% of respondents agreed it was critical for brands not “to go dark” during this period. However, there were still dramatic cuts to spend overall in April.

The squeeze is being felt hard by TV, traditionally the biggest media. US broadcasters such as ESPN, CBS, Turner and NBC – which rely on live sports to boost their ratings and advertising hauls – are also expected to take a hit.

Globally, the WFA says TV investment will be down 33% across the first half of the year. Print (down 37%), out of home (down 49%) and events (down 56%) are suffering the most, though.

Digital is boosting its share of ad spend by virtue of the fact that spend falls in this area are less dramatic, with online video down 7% and online display down 14%. Other channels such as radio (-25%), point of sale (-23%) and influencer marketing (-22%) are expected to experience significant cuts.

While 68% have some kind of crisis response campaign now running (up from 32% in March), this activity will not compensate for the cuts to other campaigns.

Global ad budgets are now expected to be down 36% in the first half of the year (up from 23% in Wave I) and 31% for the full year.

Industry comment

Paul Wright, Managing Director, AppsFlyer, UK, FR, ME & Turkey, said: “This is a period of radical change and to navigate it, brands must think long-term. Freezing ad spend is not advisable unless absolutely necessary as there will be repercussions to brand perception after the pandemic. The World Federation of Advertisers research echoes this point, agreeing it is critical for brands not “to go dark”.

Our data shows that since March, global in-app revenue has actually continued to rise – growing 36%. Consumers are turning to mobile apps and online services at the moment and they have never had as much free time to engage with brands and their content.

Brands should be using this time to create a new relationship with consumers; one less focused on boosting immediate sales and more focused on building long term loyalty. By supporting customers during the crisis and engaging with them via mobile and apps that are providing entertainment, brands can gain positive mindshare for the future.”

Chase Buckle, Trends Manager, GlobalWebIndex said: “The findings from the World Federation of Advertisers are interesting, and perhaps unsurprising given the current global environment. However, now is not the time to freeze ad spend.

Our research shows that consumer attitudes to brand campaigns are positive at this time – 85% of consumers approve or are impartial to advertising carrying on as normal. Media consumption is at its highest peak, with 60% of consumers watching more news and 40% watching more broadcast TV. Thirst for entertainment in lockdown continues to soar, with 52% of people watching more shows via streaming services.

Brands should maintain investment in advertising and marketing during this time to continue momentum with their audiences. Switching off a brand now, with arguably the most engaged audience in history, is a short-sighted decision that could erode decades of hard-won brand equity.”

Source: WFA