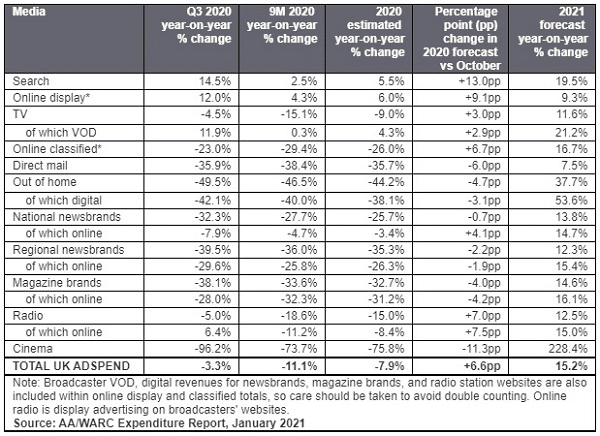

The UK’s Advertising Association/WARC Expenditure Report paints an optimistic picture for 2021, forecasting growth of 15.2% (0.8% up from its October musings), more than making up for a 7.9% decline in 2020.

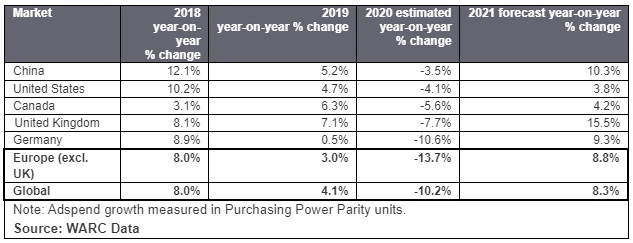

It expects UK adspend to be £23.17bn in 2020 (£25.37bn in 2019) reaching £26.69bn this year. This is ahead of other big ad markets: The US is expected to grow 3.8%, Germany 9.3%, Europe (excluding UK) 8.8%, and China 10.3%. Digital leads the growth.

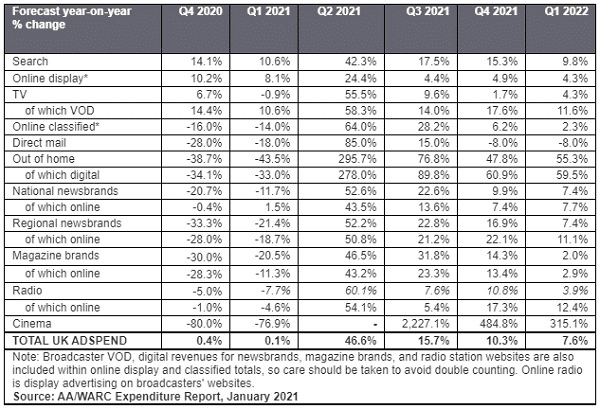

UK media sectors expected to recover strongly are cinema (mostly closed in 2020) at 228.4%; digital out of home at 53.6%, traditional out of home at 37.7%, and video on demand at 21.2%.

AA CEO Stephen Woodford said: “The latest figures from the AA/WARC Expenditure Report come as welcome news at the beginning of the year. Not only does the data show the overall decline expected in 2020 may be less than feared, but the recovery in 2021 will be stronger than we would have dared hope even a few months ago.

“With the vaccine rollout accelerating and a Brexit trade deal in place, the 2021 business outlook is brightening, reflected by these new forecasts showing a stronger and quicker recovery in adspend, with a stronger rebound than in other large economies. With every £1 of advertising spend generating £6 of GDP, this is good news for jobs and growth in the wider economy.”

James McDonald, Head of Data Content, WARC commented: “The latest market data show that the largest online properties were shielded from the worst of the industry downturn last year. Indeed, with consumption and commerce migrating online during the pandemic, the results show that ad money followed to these platforms’ benefit.

“Paid search – which accounts for over a third of all advertising spend in the UK – was the format that gained most from a surging e-commerce sector. Ancillary research by WARC shows that online sales recorded a six-year leap in penetration in 2020, as e-commerce’s share of all UK retail value rose by 8.4 percentage points to 27.6%. This rate was ahead of China (24.9%) and double that of the US (13.4%) last year.

“The outlook for the year ahead is bullish, reflecting greater certainty around Brexit and the potential for the vaccination programme to unlock economic growth. We now believe that the ad market can overcorrect in these circumstances to top its 2019 peak, though large parts of the industry remain in a fragile state.”

Industry comment

Chris Hogg, Managing Director EMEA, Lotame, said: “These latest figures demonstrate that marketers understand the value of online in driving their businesses, even in the most tricky of environments. They also mirror what we have seen in our business, where despite the early 2020 decline in spending due to the pandemic, we saw strong growth in our data enrichment in H2. This has been a good time for brands to build a panoramic view of the changing customer, optimise data enrichment strategies, and keep customers and prospects engaged with relevant messaging. Those that have done so will be in the strongest position to take advantage of the forecasted recovery.”

Andy Ashley, International Marketing Director, Digital Element, said: “With bad news still the norm, it is fantastic to read a report forecasting a positive way forward for the industry. These latest findings prove that the UK advertising market is resilient and, with recovery on the horizon, it is great to be able to prepare for a brighter time ahead.

“However, the flexibility the industry learnt in 2020 must remain. While consumer behaviours will start to return to ‘normal’ in some areas, its important brands and advertisers stay nimble to accommodate the lasting impact of the pandemic. With this in mind, it is not enough to simply use insight-driven decision making. The absolute priority should be to ensure the data used to gain these insights is as up to date and accurate as possible. Those who continue to adapt will be those seeing success as the recovery draws nearer.”

Filippo Gramigna, Strategic Advisor, Audiencerate, said: “It’s encouraging to read the phrase ‘a strong year ahead’ in the latest AA/Warc Expenditure Report. While advertising budgets haven’t stabilised just yet, engaging and understanding consumers should still be the number one priority for brands, if they wish to end 2021 in a strong market position.

“To achieve this, especially in the current climate, marketers need powerful, flexible advertising strategies to enable them to respond to rapidly changing consumer needs and also technology evolutions. Therefore, data solutions, such as predictive audience modelling, identity resolution and analytics, should be on every marketers must-have list. Using sophisticated modelling capabilities like these will enable brands to identify which traits are most common in their target audiences, which respond best to upselling, and which are at risk of churning. From this granular data, brands will be able to boost both effectiveness and efficiency in their advertising campaigns through a stronger understanding of their audiences.”

Ali MacCallum, CEO UK, Kinetic Worldwide, said: “It’s really welcome news to start the year that not only was last year’s decline gentler than feared, but that recovery is set to be stronger than we had imagined. The current lockdown has – inevitably – set us back, but we’re confident that brands and agencies now have robust enough plans in place to move quickly when the worst is over, the vaccine comes into play and we can return to our normal lives.

“The technological advancement and digital innovations in the past year puts OOH in a hugely strong position for brands when it comes to flexibility and rapid responses to mass audiences. With millions of people not being able to work from home, OOH is still reaching targeted audiences with optimised messaging. This agility will be a key aspect of the sector’s recovery this year as more and more brands will want to reconnect with their audience once lockdown restrictions have been lifted.”

Anne Stagg, UK CEO, Merkle, said: “As we’ve now come to expect, the latest insight into the health of the sector is a real mixed bag. Search and online display continue to grow, as consumers rely even more on platforms where they can find brands in lockdown. There’s a cautious optimism following last week’s IPA Bellwether report on budgets too. Clearly, the months ahead may not be smooth sailing, but tentatively, we can expect 2021 will be stronger than we could have imagined mere months ago as brands are better prepared and willing to adapt to the change required to make a difference. No single year has brought about more change to consumer behaviour than the last, and with the shift in consumer engagement channels and media, and the notable lack of physical interactions – brands must be hyper-focused on delivering value to customers in an increasingly nimble way, meeting them with relevant content in a meaningful way wherever and however they decide to engage.”