The tech firm said it had seen “increased engagement” in the first quarter of the year but, like Google 24 hours earlier, admitted advertising revenues had taken a hit as the COVID-19 uncertainty began.

Facebook reported almost three billion monthly users, on average, across its family of apps including Facebook, WhatsApp, Instagram and Messenger at the end of the three months to March.

That represented a 10% increase on the same quarter last year.

There were 1.73 billion users active on Facebook daily over the same period – a rise of 11%.

Total revenue rose to $17.7bn from $15.1bn – with net profits doubling to $4.9bn – despite a slide in advertising sales over the final weeks of the period as marketing budgets were slashed amid uncertainty over the economic landscape.

But the company cautioned its business “has been impacted by the COVID-19 pandemic and, like all companies, we are facing a period of unprecedented uncertainty in our business outlook.”

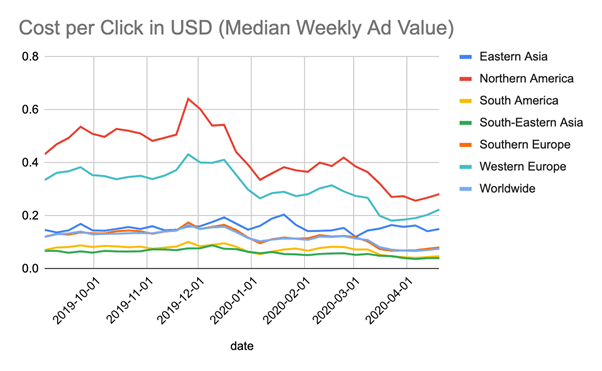

“Outlook is really uncertain,” Facebook Chief Financial Officer David Wehner told CNBC in an interview. “We have a really cautious outlook on how things are going to develop.” He noted a “broad-based pullback” in advertising among small and large businesses on the platform, which led to a decline in ad prices the last three weeks of the first quarter.

Uncertainty over a wobbly economy prompted Facebook to not provide revenue guidance for the second quarter or full-year 2020. Instead, it offered what it calls a “snapshot” on revenue performance in the second quarter.

“We have seen signs of stability reflected in the first three weeks of April, where advertising revenue has been approximately flat compared to the same period a year ago, down from the 17% year-over-year growth in the first quarter of 2020,” the company said in a statement. “The April trends reflect weakness across all of our user geographies as most of our major countries have had some sort of shelter-in-place guidelines in effect.”

Shares, which gained 7% in normal trading ahead of the results release, added another 9% in extended deals.

The company pointed to the creation of its in-app COVID-19 information centre as evidence it was attempting to keep people informed and safe during the outbreak following sharp criticism that the sector has not done enough to boost safety tools and tackle harmful content more widely.

Analysis

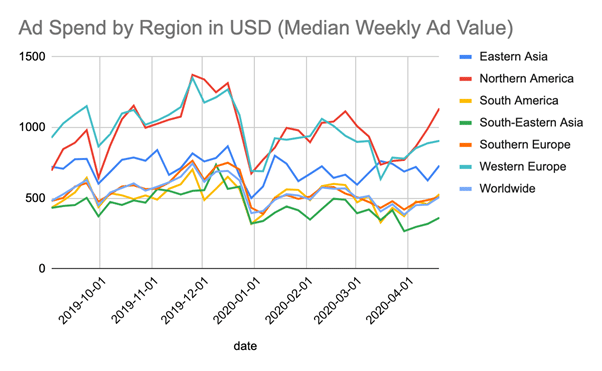

Socialbakers’ data shows ad spend beginning to pick up in the US and Europe – suggesting that marketers are taking advantage of low CPC, and hinting that platforms may see a return to normality after the initial shock of COVID-19.

Chart source: Socialbakers

Following Facebook’s strong Q1 earnings results overnight, Yuval Ben-Itzhak, CEO of social media marketing firm Socialbakers, said: “Despite the challenging economic situation, it’s exciting to see Facebook reporting a surge in user numbers, engagement, and even an increase in revenue. We have seen that during the COVID-19 crisis people are spending more time on Facebook and its family of applications, proving that they really are the key platforms for marketers looking to reach and engage with their communities – and also showing just how important social media has become in our lives.

“Social media data shows that ad spend in key regions like North America and Western Europe has started to pick up as savvy marketers look to stay close to their customers as these regions get to grips with the pandemic, which is a good sign that ad revenue will continue to grow for Facebook in Q2 and onward.”