Spend on Facebook mobile app ads rose a massive 235% last year, but click through rate (CTR) fell as competition increased, according to a new global study.

The research, from Kenshoo, indicates that advertisers who use Facebook mobile app adverts to promote and drive downloads of mobile apps from Google Play and the Apple app stores, increased their spend on this ad unit over 2014, with monthly spend rising 235% in December compared with January.

The Mobile App Ad Trends research unveiled at Kenshoo’s App Marketing Summit. Impressions for these ads went up by 65% during the year while installs of mobile apps from the ads increased by 182% according to the data.

At the same time, Kenshoo’s study shows that the click-through rate (CTR) on Facebook mobile app ads fell by 27% over the year, indicating the greater competition for clicks in this sector as more companies advertise their ecommerce (including retail), gaming and consumer apps.

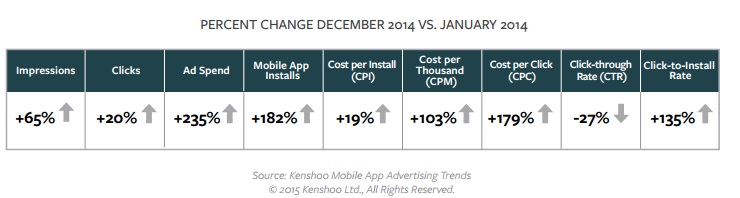

Key metrics from the Kenshoo study of Facebook mobile app advertising performance during the course of 2014 are shown in the table below.

Key metrics for Facebook mobile app install ads (percent change Dec 2014 v Jan 2014)

Important findings from the Kenshoo study are:

• Marketers need to spend more than double the amount on mobile app ads to trigger an app installation on Apple iOS devices as they do on Android devices. In other words the cost per install (CPI) of Facebook mobile app ads on Apple devices is more than double that for Android devices. This could indicate either greater competition, perceived value, or just a price premium on Apple devices.

• Across app types, gaming apps carried higher CPI costs for Facebook mobile app ads than ecommerce or general consumer apps.

• The cost-per-click (CPC) for Facebook mobile app install ads rose over the twelve month period, with December showing a 179% increase over January. The CPC on iOS devices was 163% higher than on Android devices

• While the overall CTR for Facebook mobile app ads decreased over the year, ads on Android devices deliver a higher CTR than those on iOS devices – in other words ads on Android devices are more likely to drive engagement.

• Facebook mobile app ads for consumer and eCommerce apps had relatively higher CTRs (and hence engagement) than ads for gaming apps, possibly because of the greater competition in the gaming sector.

• The rate at which clicks on Facebook mobile app ads convert to mobile app installs increased by 135% over the year according to the data, which shows that when people do click on an ad, they are much more likely to install the app on their phone. This indicates an improvement in targeting and/or ad creative and messaging on the publisher side and the advertiser side.

The Kenshoo Mobile App Trends report reflects an aggregation of advertisers using Adquant by Kenshoo that are Mobile-only and have defined a Mobile App Installation as a conversion. The resulting data set comprises over $19 million (USD) in advertiser spend, and over 10 million app installs, targeted across more than 100 countries worldwide.

Visit kenshoo.com/mobile-app-trends to download the full report.