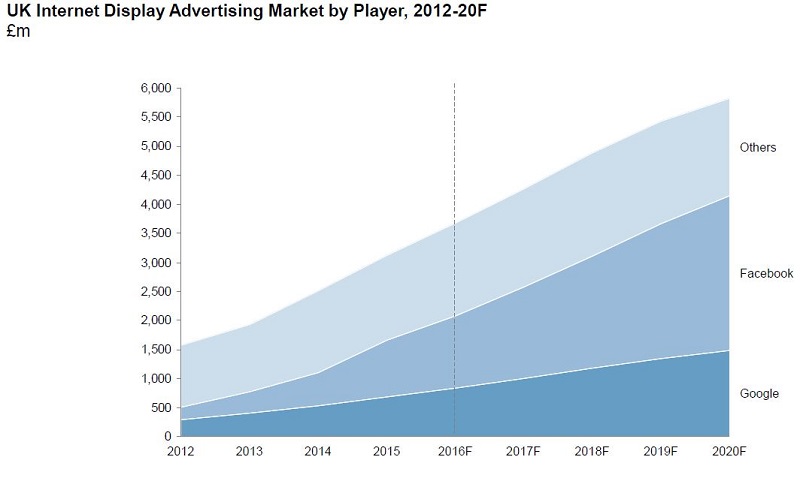

Google and Facebook will take more than 70% of all money spent on display advertising online in the UK by 2020, according to new research.

The study, from OC&C Strategy Consultants, suggesting the firms will soon account for about three-quarters of the £18.4bn display ad market in the US, and 53% of the £4bn currently spent in the UK.

According to OC&C’s Marketing 20:20 report, the two companies currently account for just over half (53 per cent) of the £4bn online display advertising market in the UK, but will experience combined annual growth of on average 24 per cent year-on-year over the next four years.

Already attracting two thirds of the US’ lucrative £18.4bn online display ad market, OC&C Strategy Consultants’ report suggests it will take Facebook and Google just four years to achieve a similar share of the UK market.

Display ads (including video) are now the leading digital advertising format across the world and represent around 40 per cent ($216bn) of global advertising spend.

“Google and Facebook provide unique tools which allow marketers to reach and target customers in new and innovative ways,” said Fergus Jarvis, partner at OC&C Strategy Consultants. “As these tools become more precise, and their audience continues to grow, CMOs are increasingly seeing the benefit of highly measurable and targeted campaigns. As a result, Facebook and Google’s command of the online advertising market is not a matter of if, but when.”

OC&C Strategy Consultants’ projections reveal that, in the next 12 months in the UK, time spent looking at content on a mobile will surpass that watched on TV for the first time. In 2017, the average Brit will consume around 3.2 hours of content on their mobile each day, compared to 3.1 hours on TV.

Both Facebook and Google have positioned themselves to take advantage of the pivot to mobile, owning eight of the 10 most used mobile applications between them.

“Facebook and Google are increasingly at the centre of all content consumed on a mobile and can provide quite remarkable reach to advertisers as a result,” said Jarvis. “But as more and more advertising spend drifts towards Facebook and Google, it’s all the more important for marketers to understand the returns these platforms can generate. CMOs need to do two things: firstly, they need to understand how much better the ROI is for advertising through Facebook and Google compared with other channels; and secondly, they need to ensure that ad spend through these platforms forms part of a diversified media and marketing mix.

“For media companies, the picture is altogether more complex. With Facebook and Google not only able to drive traffic, but also able to identify that traffic and monetise it, publishers need to find ways of collaborating and innovating to keep up. In order to compete, media companies need to build out a better view of their customers and aim to provide better targeting to marketers directly than they can get through Facebook or Google.”

http://www.occstrategy.co.uk/