Sweden has the highest smart device penetration with 150% smart device penetration,while the UK surprisingly only ranking thirds, according to a new report looking into European app trends.

The study, from Yahoo-owned Flurry, tracked over 725,000 apps across 564 million devices in Europe.

The research uncovered marked differences in usage and preferences across the continent.

Key findings include:

• Everyone has one in Sweden! Sweden has the highest smart device penetration with 150% smart device penetration, or one and a half devices for every man, woman and child in the country! Surprisingly the UK ranked in only third place

• The UK and France love to chat! Both countries spent almost twice as much of their time in messaging and social apps as they do in games, at approximately 40% of total app time

• Size matters in the UK! 59% of the smart devices have a medium size screen – eg iPhones. A mere 1% opt for a smaller screen – such as more primitive Blackberry models

Sweden Leads in Smart Device Penetration; Italy Lags

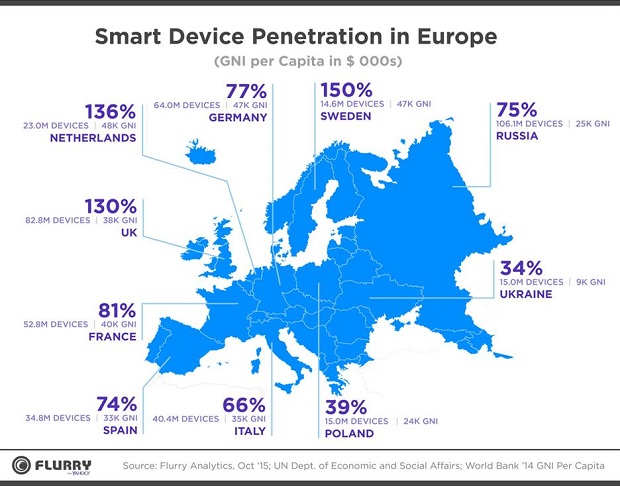

For this analysis, we focused on the top 10 European countries by total population: Russia, UK, Germany, France, Italy, Spain, Netherlands, Ukraine, Poland, and Sweden. We next compared the total population and Gross National Income (GNI) per capita of these countries, to the number of iOS and Android devices Flurry Analytics tracked in each of these countries throughout October 2015. GNI is a measure of a country’s wealth, as calculated by the World Bank in constant US dollars.

Unsurprisingly, smart device penetration is highest in the north. Sweden has the highest smart device penetration with 150% smart device penetration, or 1.5 devices for every man, woman and child in the kingdom! This is followed by The Netherlands at 136% and the UK at 130%. France clocks in at 81% penetration, followed by Germany at 77%, and Spain at 74%. Given the ratio of minors to adults in these nations, the data implies that almost every adult has a smart device.

Italy is the exception, with the lowest smart device penetration of any country in Western Europe at 66%. Russians on the other hand, are willing to spend more of their income on smart devices, bumping their penetration up to 75%, despite a low GNI.

Spain Joins the Phablet Revolution; Small Phones Near Extinction

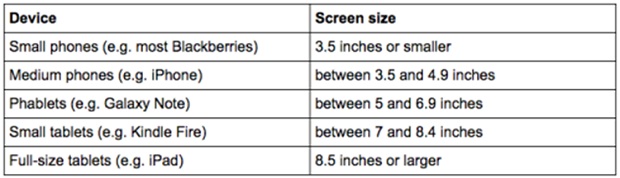

So, what devices are actually in-use? To better understand their composition, we looked at the distribution of form factor types based on a sample of 100k Android and iOS devices in each country. As a reminder, we classify devices as follows:

As we reported previously, there has been a global revolution in phablet adoption and we see that Europe is not far behind the global trend. Spain is clearly leading the charge in Europe with 37% phablet share. Other countries are continuing to grow adoption with each having over 20% of their devices belonging to that optimum size: small enough for users to carry in their pockets and large enough to engage in reading and entertainment.

Consistent with the global trend, small phones have been nearly wiped off the map in Europe. Small tablets, like the iPad Mini, haven’t really caught on anywhere but the UK. It’s clear that like in the rest of the world, European consumers are becoming increasingly smitten with larger screen sizes.

Session Growth Still in Double-Digits for Western Europe

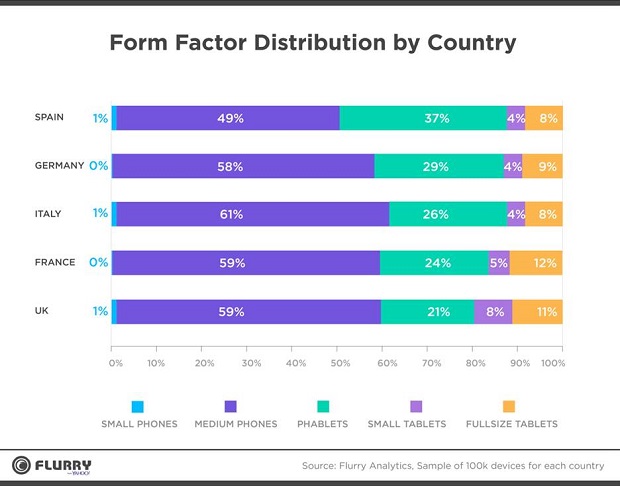

And how are Europeans engaging with increasingly larger devices? Looking at the number of sessions generated by each country, year-over-year, is a good indicator of mobile activity growth. Based on the apps that Flurry tracks, the global average growth in sessions from October 2014 to October 2015 was 64%. The US, for comparison, posted 52% growth, while emerging economies like Brazil and India posted gains of 189% and 107%, respectively.

In Europe, the growth of France and Spain is on par with global average at 63% and 61%, respectively. The UK and Germany’s year-over-year growth lags the global average and that of the US at 36% and 28%, respectively, which is not uncommon in more mature markets.

Italy again is the outlier at 31% growth, which is not surprising given the relatively lower penetration rate of smart devices in that country. It’s interesting to note that the app session growth in Vatican City is higher than the Italian average at 36%.

A Continent Divided: Gamers vs. Chatters

To understand what is driving all that activity in Europe, we examined which app categories users spent the most time in.

The British and French spend almost twice as much of their time in messaging and social apps, versus in games, at approximately 40% of total app time. Italy, on the other hand, spends the lowest percentage of their time in Messaging and Social, perhaps because only 66% of the population can be messaged via smartphone.

Germans, Italians and the Spanish spend nearly one-third of their app time in gaming apps. Despite their love for gaming, users in Italy also spend a significant share of their app time in Utilities & Productivity apps (18%) which is twice the share that users in France dedicate to the category (9%).

Music, Media & Entertainment apps seem to hold the same interest in users irrespective of the borders, around 10% of their app time.

Europe Picks Up Bigger Phones; Apps Continue to Entertain

Although Western Europe was amongst the group of early adopters in the app revolution, this growth shows no sign of slowing down, as market usage continues to climb into the double digits. Some countries have even surpassed more than one device for every man, woman, and child.

Similar to the US, Europeans don’t use their phones in their 9-to-5s; dedicating just 12% percent of their time to productivity apps. While the US has seen a major decline in mobile gaming, this category still represents nearly one-third of app time in major European markets.

And how are Europeans enjoying their games? On Phablets, which have definitely arrived on the continent. It’s safe to say there will be many new iPhone 6s Plus devices under Christmas trees in Europe this year.

Source: http://www.flurry.com/