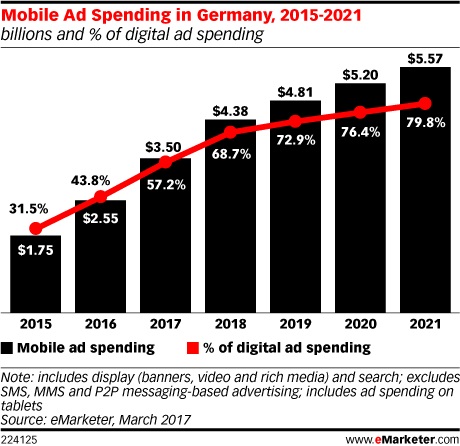

Mobile ad spending in Germany will reach €3.2 billion ($3.5 billion) this year, representing more than half (57.2%) of all digital ad spending for the first time, according to new research.

Total media ad spending in Germany – which includes digital and traditional – will reach €18.4 billion ($20.4 billion) in 2017, a yearly growth of 1.4%. Digital will account for 30.0% of the market or €5.53 billion ($6.12 billion), making it the country’s largest media type by ad investment.

According to eMarketer’s latest ad spend forecasts for Germany, TV will continue to hold its own, growing by 2.5% this year. In 2017, just over a quarter (25.3%) of all media spend in Germany will go to TV, representing $5.16 billion (€4.67 billion).

Germany has a highly educated population that also skews older, and print newspapers have fared much better here against digital competition than in many other European markets. But this year will represent a milestone: Newspapers will actually fall behind TV in terms of ad spend, taking a 24.0% share or €4.4 billion ($4.9 billion). TV remains the first-choice platform for many traditional industries; automotive brands still typically prioritize TV spots, for example.

Mobile’s majority share of digital isn’t the only notably change in ad spending patterns in Germany. The country has a highly educated but also slightly older population, both factors that have helped newspapers fare much better against digital competition than in many other European markets. Nonetheless, 2017 represents a milestone for newspapers. This year eMarketer predicts newspapers’ share of ad spending will slip to 24.0% as investment declines to €4.47 billion ($4.95 billion). As a result, TV will surpass newspapers for share of total media ad spending for the first time. TV ad dollars will grow 2.5% to €4.65 billion ($5.14 billion), representing just over a quarter (25.3%) of paid media ad spend.

“Germany’s ad marketplace is remarkably well balanced, offering brands a wide spectrum of options to reach various target audiences,” said Karin von Abrams, principal analyst with eMarketer. “Of course advertiser outlays will continue to shift towards digital platforms and mobile devices in particular. But the entire industry is also benefitting from the country’s very encouraging economic growth. Even the political and social uncertainties arising from factors such as the US presidential election and the UK’s Brexit vote haven’t dented the underlying stability and strength of Germany’s finances. This is very reassuring not just for Germany but for the larger European industry picture.”

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.

www.eMarketer.com