Mobile ad spend is forecast to top $100bn worldwide in 2016, accounting for more than half of the digital market, according to new research.

The study, from eMarketer, also indicates that US and China will account for nearly 62% of global mobile ad spending next year.

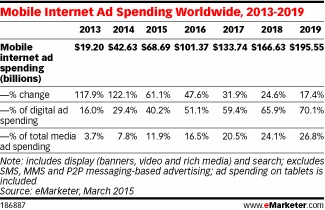

The $101.37 billion to be spent on ads served to mobile phones and tablets worldwide next year represents a nearly 430% increase from 2013.

Between 2016 and 2019, the last year in our forecast period, mobile ad spending will nearly double, hitting $195.55 billion to account for 70.1% of digital ad spend as well as over one-quarter of total media ad spending globally.

Next year, eMarketer estimates, there will be more than 2 billion smartphone users worldwide, over one-quarter of whom will live in China alone.

Especially there and in other emerging and developing markets, many consumers are accessing the internet mobile-first and mobile-only, so leading advertisers allocate their digital expenditure to mobile accordingly.

The number of tablet users worldwide, while growing more slowly than the smartphone audience, is still expected to eclipse 1 billion in 2015. The proliferation of these mobile devices across the world is driving the shift in advertising from the desktop to reach these untethered, always-on consumers.

In the short term, the leading global markets, particularly the US and China, will drive mobile ad spending growth. In 2016, US advertisers will spend $40.24 billion to reach consumers on tablets and mobile phones, more than doubling the total from 2014, while those in China will invest $22.14 billion—nearly triple the amount they spent in 2014. Both of these countries will see mobile become a majority of digital ad spending next year.

The UK, Japan, and Germany will fill out the rest of the top five, though they won’t see mobile become the majority ad channel until 2017.

The next year, Brazil will become the ninth-largest mobile ad market globally, eMarketer predicts, and Indonesia will make the biggest run to the No. 12 spot, from No. 21 this year.

Despite India’s huge base of mobile phone users, eMarketer says, its market growth will remain relatively slow, remaining under $1 billion by 2018.