Findings from a new multi-country study of over 4,000 smartphone users across the UK, US, France and The Netherlands reveal how messenger apps are used and viewed by consumers today.

The study, from MetrixLab, looked at the chat app usage across key international markets.

Key findings:

• Facebook Messenger is the No.1 installed app among smartphone users, but WhatsApp has the most daily users

• Personal data security concerns are a big issue, even for top brands like WhatsApp. Snapchat is perceived as the least secure by consumers

• Generation Y are most likely to pay for an ad-free version of their favourite messaging app

“Messaging apps such as WhatsApp and Facebook Messenger, Skype and iMessage, have become extremely popular with consumers. Our survey uncovers everything from their impact on calling and texting to security concerns, attitudes to advertising and propensity to recommend” says Michelle de Montigny, Global SVP Consultancy at MetrixLab.

Messenger apps: Ten trends you need to know

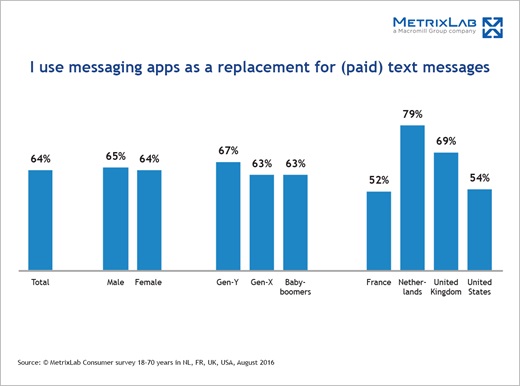

1. Messaging apps are replacing paid for texts and calls

63% of Baby Boomers use them as a replacement for paid text messages. This rises to more than two in three (67%) for Generation Y. Messaging apps are replacing paid-for phone calls too – 67% of Generation X and 66% of Generation Y agree that they use messaging apps as a replacement for calling.

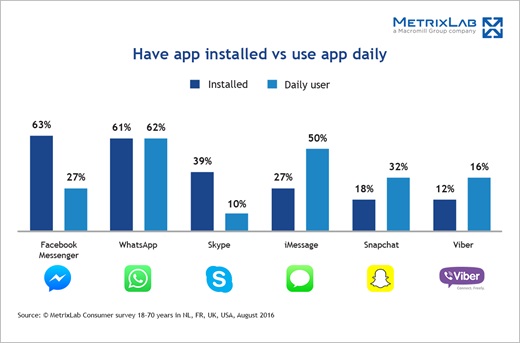

2. The top five apps

Facebook Messenger is the most installed app at 63%, closely followed by WhatsApp at 61%. At 39%, Skype is in third place, iMessage in fourth at 27% and Snapchat next at 18%. A plethora of other smaller brands have so far failed to make much impact.

3. Install rates aren’t the same as daily usage rates

Usage rates for Facebook Messenger and WhatsApp vary significantly. It is interesting to compare installation rates with daily use rates. While both have very similar installation rates (63% and 61% respectively), just 27% of those with Facebook Messenger use it daily compared to 62% of WhatsApp users.

4. It’s early days

Eight in ten consumers have heard of WhatsApp, but less than half (47%) feel that they know the brand “really well”. At 42%, it’s the same story for Facebook Messenger. Younger consumers are more likely to have developed a greater level of familiarity – 58% of Generation Y say they know WhatsApp “really well” while 54% say the same of Facebook Messenger.

5. Skype is the only brand to achieve universal appeal

Around one third of consumers would consider using Skype (Generation Y 32%, Baby Boomers 29%, Generation X 27%).

6. WhatsApp has the greatest level of awareness amongst consumers and is the most preferred app

It’s also the most preferred choice if consumers need to send a message immediately, favored by 42% of consumers who have heard of the brand. Facebook Messenger ranks second at 21%, followed by iMessage at 11%.

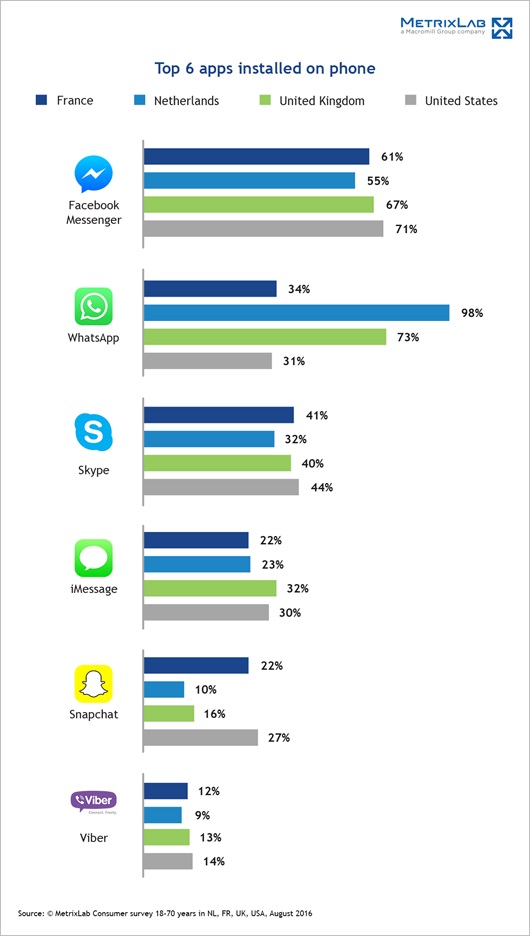

7. With an installation rate of 98%, almost all consumers in the Netherlands have WhatsApp on their smartphones

8. The top three recommended apps by those with apps installed are WhatsApp (91%), and two lesser-known apps: MobileQQ (90%) and KakaoTalk (87%).

9. Users are worried about the security of their personal data

There is real unease around the security of all apps – including big name brands. When we asked respondents familiar with WhatsApp, less than half (48%) said that they thought their personal data was secure with the brand, while 37% agreed for Facebook Messenger. With just 26% agreeing that their data is secure with the app, Snapchat is currently perceived by consumers as the least secure app.

10. Ad avoidance is worth a premium to some consumers

Some people would be prepared to pay for an ad-free version if their favorite messaging app used in-app advertising. Generation Y are most likely to pay for an ad-free version – almost one third (30%) would do so compared to 20% of Generation X and 13% of Baby Boomers.

“Our international study throws new light on how smartphone users of all ages are communicating via messaging apps today. And while Facebook Messenger takes the top spot for installed apps, WhatsApp wins the most daily users. We’ve also seen that personal data security is still a worrying issue for consumers, highlighting the need for brands to instill more confidence in customers who use these apps or risk being overtaken by the next messaging trends” concludes de Montigny.

Source: www.metrixlab.com