The data, from Advertising Association/WARC Expenditure Report data found that total ad market growth was recorded at 3.5% year-on-year, with £5.4bn spent during Q3 – the 17th consecutive quarter of market expansion.

The report found that total spend on mobile (including display, search, and other formats such as SMS/MMS) was higher than TV spend for the first time. Yet TV remains the leading display channel.

“The latest data indicate that total mobile ad investment during the quarter was higher than that for TV for the first time – though the two channels serve different roles for advertisers,” said WARC’s Data Editor, James McDonald.

“While TV remains the largest display medium by some distance, mobile investment is being driven by advertisers looking to reach consumers via search results and social feeds.”

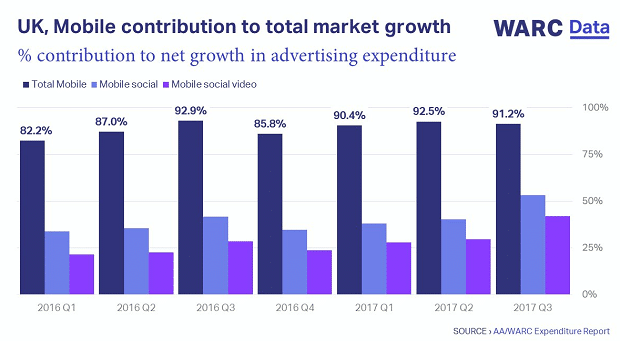

New data show that the vast majority of mobile display spend is being directed towards advertising on social media, which rose 44.7% year-on-year. This, coupled with rising spend on paid search, is driving sector growth, as early estimates for the full-year 2017 put total mobile adspend above £5bn.

The latest verified data resulted in an upgrade to 2017 full-year estimates, with total ad market growth now believed to have been +3.4%, 0.3 percentage points higher than the last AA/WARC projections in October 2017. Advertising expenditure is expected to grow by a further 2.8% this year.

Though total TV saw a slight decline (-0.8%) year-on-year during the third quarter, within this, video on demand spend posted healthy growth of 13.3%. TV spend across traditional and digital formats is thought to have returned to growth in the final quarter of last year, culminating in a preliminary estimate of -2.0% for 2017 as a whole, the first annual dip since 2009. However, total TV spending is expected to turn positive this year (+1.5%).

Among the other media channels covered by the report, national newsbrands’ digital revenues rose strongly in Q3, up 21.5% year-on-year. While this was not enough to offset print losses during the quarter, the total market contraction of 5.1% was the best performance in three years, suggesting a slight easing of the intense business pressures newsbrands are facing.

Elsewhere, direct mail recorded its strongest quarter in six and a half years, as spend rose 5.9% to reverse a prolonged downturn. Radio (+5.1% year-on-year) also had a strong quarter, though annual dips were seen in out of home (-0.8%), cinema (-8.4%) and magazine (-11.9%) spend.

Stephen Woodford, CEO of the Advertising Association, noted the continued role of advertising in delivering growth to UK business. “UK advertising spend enjoyed a record high in the third quarter of 2017, with figures up again year-on-year. It is encouraging to see further predicted growth of 2.8% for 2018”, he said. “UK advertising is vital for the economy, generating £6 for every £1 spent”.

Going forward, Woodford emphasised the continued importance of accurate advertising data in the current context. “As we work through Brexit, we need to help Government make the best decisions to support our industry and, by extension, the wider UK economy as we target growth across the nations and regions and in an increasingly global marketplace.”

Analysis

Andrew Morsy, UK MD of ad platform Sizmek, said: “Warc’s latest figures show mobile accounting for a large part of the increased ad spend in the UK and, for the first time, this has outgrown TV expenditure. This is encouraging for both advertisers and brands, who are continuing to see mobile as not just a profitable investment, but as a safe and secure way to deliver their message.

“Now there is massive opportunity for mobile advertising. Given the oceans of data available for advertisers, including consumer location, ads can be more creative, relevant and meaningful. We’ll continue to see a push into mobile advertising particularly when it comes to video this year, with shorter creative and a snappier approach to the way people like to consume content.

“With the right combination of media placement and creative, I’ve no doubt that mobile will continue to push the boundaries of smart and relevant advertising, giving consumers content they actually want to see and engage with.”

Josh Krichefski, CEO, MediaComCEO said that although mobile ad spend continues to rise, advertisers will find that a lack of personalised and relevant content will render the engagement entirely useless.

“Audiences across all demographics now want to view what they want, when they want and mobile is rapidly becoming the platform that allows them to do just that,” Krichefsk said. “In the UK alone, well over three quarters (85%) of 16-75 year olds own a smartphone. That is clearly a huge opportunity for brands to connect to a powerful audience – brands who use data well and execute smart campaigns based on that are able to engage an audience with tailored content that builds a personal relationship and ultimately leads to them buying from, or at least being more aware of, that company or product.

“Yet, harnessing mobile for the sake of mobile is not, and never will be, the right approach; for any ad campaign to succeed it must be made with thought, care and the right target audience in mind. The key lies in remembering that consumers love mobile content because it’s easy to access and view. Mobile ads can take advantage of that, but they cannot allow it to be a reason to spam consumers – the audience will expect and demand an unforgettable experience, but if they see an ad ‘blocking’ the content they want to view, all that ad spend will be completely wasted.”