Driven by advertisers’ need to tap into people’s rising use of mobile to watch content, digital advertising grew at its fastest rate for nine years – by 17.3pc to £10.3 billion in 2016, according to new research from the Internet Advertising Bureau UK / PwC Digital Adspend.

Driven by advertisers’ need to tap into people’s rising use of mobile to watch content, digital advertising grew at its fastest rate for nine years – by 17.3pc to £10.3 billion in 2016, according to new research from the Internet Advertising Bureau UK / PwC Digital Adspend.

The last time annual growth was higher was 2007 (38%), the report found.

Key findings:

• 17.3pc rise is highest annual growth rate for 9 years

• Mobile driving almost entire growth, up 51pc

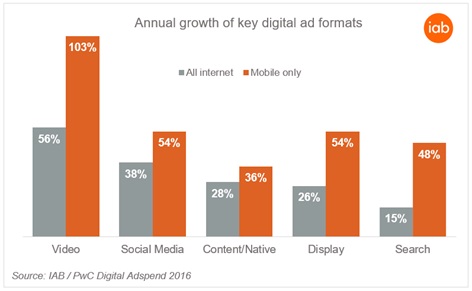

• Mobile video the fastest growing ad format, up 103pc

As almost half (48pc) of UK internet time is now spent on smartphones², mobile ad spend rose 50.8pc to £3.87bn. Mobile now accounts for 38% of all digital ad spend, up from 4% just five years ago. However, it accounts for 63pc of video spend, 76pc of Content & Native (including social media news feeds) and 79pc of social media spend.

Mobile video is fastest-growing ad format

Spend on mobile video ads more than doubled (up 103pc) to £693 million – making it the fastest growing ad format. It accounts for 29pc of the total growth in digital ad spend.

The rise in mobile video ad budgets reflects online YouGov data³ showing that in the last six months, 54pc of British smartphone users watched video clips on their phone, with two-in-five of these saying they do more of this than a year ago. A significant number have also watched TV programmes (17pc) and films (11pc) on their smartphones. This behaviour is much more prevalent among 18-24 year olds, with 75pc watching short clips, 44pc watching TV and 33pc watching films on mobiles. Six-in-10 people who watched short clips, TV or Film on their phone did so whilst ‘out and about.’

The rise in people consuming mobile and video content has accelerated digital’s growth rate to its highest level for nearly a decade,” said the IAB UK’s Chief Marketing Officer, James Chandler. “Reaching the £10 billion threshold has been made possible by brands breaking the mould, trying innovative formats and making the most of video to reach and amaze people. It’s impossible to ignore the issues the industry is facing at the moment, but digital never stands still and these figures are testament to the long term strength and power of digital.”

Video – across mobile and PCs – is growing at 56pc, driven by outstream/social in-feed’s huge 234pc rise to £465 million. Outstream accounts for 43pc of all video spend but 56pc of mobile video. Pre- and post-roll video ad spend grew 12pc to £603 million (55pc share of all video).

Sebastien Bardin, Sony Mobile’s European senior digital marketing manager, added: “Online video is becoming a bigger priority, providing an impactful and cost-effective incremental reach. In particular, outstream video is great for engaging with our target audience in premium, trusted and viewable environments without disrupting their media consumption or being too intrusive.”

Nearly three-quarters of display is traded programmatically

Display ad spend rose 26pc year-on-year to £3.77bn in 2016 – 72pc of which was traded programmatically (£2.71bn) – with significant growth coming from direct deals and private marketplaces.

“The biggest change in how display ads are sold is the rise of programmatic direct, which now accounts for nearly half of sales,” says Dan Bunyan, Senior Manager at PwC. “Right now, considerations such as brand safety mean the advertiser is rightly demanding more certainty in the placement of their ads and the industry is evolving quickly to find new solutions to address brands’ needs in this dynamic environment.”

Ad spend on social media sites grew 38pc to £1.73bn, accounting for nearly half (46pc) of display. Social media spend on mobile alone grew 54pc. Content & Native ad spend – which includes ‘advertorials’ and ads in social media news feeds – increased 28pc to £1.17bn (31pc of display).

Search and classifieds

Driven by mobile, which grew 48pc, paid-for search overall grew 15pc to £4.99bn – a 48pc share of digital ad spend. Classifieds, including recruitment, property and automotive listings, grew 8pc to £1.48bn (14pc share).