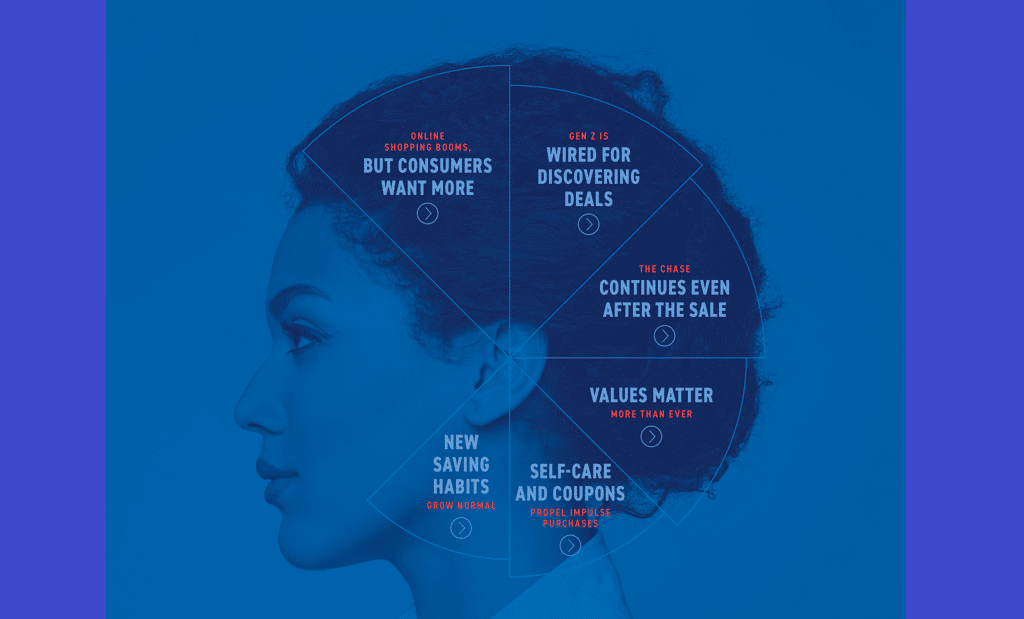

Valassis, a Vericast business and the leader in marketing technology and consumer engagement, shares additional proprietary research stemming from its annual Consumer Intel Report, illuminating the impact of promotional messages on consumer behavior, enticing consumers to change behavior, as well as shoppers’ perception of “value.”

Key findings include:

- 55% of consumers said they have a more positive impression of stores or brands that offer coupons and discounts.

- Consumers believe that coupons or discounts make them feel like a smarter shopper (69%) and can lead them to choose a brand they would not typically buy (53%).

- 45% of respondents are leveraging coupons or discounts to expand their budgets and their ability to buy “fun things or experiences.”

While marketers historically used promotions to influence consumer purchases, Valassis research reveals that consumers respond to marketing messages beyond savings. Looking for new products and experiences, 56% of consumers find it “exciting” to discover a coupon or discount for a new product or brand they have not previously tried. Forty-five percent of respondents are leveraging coupons or discounts to expand their budgets and their ability to buy “fun things or experiences.”

Marketing messages that include coupons, discounts and social media promotions can also lead to incremental sales. Valassis found that consumers can be highly influenced through incentives such as:

- 60% of consumers to try a new product

- 59% to buy something not on their list

- 54% to make an impulse purchase

- 46% to change their planned purchase

Making another connection between an offer and brand beyond its financial value, 55% of consumers said they have a more positive impression of stores or brands that offer coupons and discounts. Furthermore, consumers believe that coupons or discounts make them feel like a smarter shopper (69%) and can lead them to choose a brand they would not typically buy (53%), placing even greater value on coupons outside of typical savings.

Valuing time, millennials and parents are more likely to agree that if forced to choose, saving time is more important than saving money. This is true for 68% of parents and 65% of millennials. With this, 71% of parents and 69% of millennials say they need better solutions to save even more time shopping – something for retailers to consider to attract these desired groups of shoppers.

The report examines responses from more than 2,000 U.S. consumers in two separate surveys, noting how their shopping patterns and purchasing decisions have changed within specific categories including food, household goods and health & beauty care products amid the COVID-19 pandemic. The research provides a view into the evolving role value has in our distracted age. The research also offers recommendations on how brands and retailers can stay relevant and top of mind with consumers by gaining insight into what is important to them.

“The modern shopper leads a multi-faceted life. Deals and discounts appeal to their desire for not just saving on their daily needs, but also to try new things and connect to the world around them, a fact that should make providing deals and discounts even more compelling to marketers,” said Michelle Engle, chief marketing officer at Valassis. “But our findings also uncovered that value comes in several forms and consumers want choices that enable them to find what they deem to be valuable. Data and insights, like those from our Consumer Intel Report, help brands identify what is important to their consumers, connect with them and plan for a new yet uncertain normal.”

Additional findings reveal:

- Mobile takes on a more significant role.

- The use of smartphones and mobile devices to save on shopping trips increased during the pandemic to 44% vs. 34% in 2019.

- 87% of online grocery shoppers are now placing an average of 44% of their grocery orders via mobile.

- 73% of millennials and 67% of Gen Z will switch brands based on a discount notification received via mobile while in the store (compared to 49% of all consumers).

- Consumers use more resources to plan their in-store grocery trips.

- The average number of planning touchpoints increased by 15% to 3.9 in 2020 compared to 3.4 in 2019.

To review the full 2020 Consumer Intel Report, download “Chasing Value: The Mind of the Modern Shopper,” or view the report infographic. Additionally, listen to a recorded panel discussion examining “The Mind of the Modern Consumer Packaged Goods (CPG) Shopper” hosted by Matthew Tilley, senior director of marketing, Valassis. The panel includes Meggie Giancola, head of CPG sales and strategy, Valassis; Charlie Brown, vice president, marketing, NCH; and Mike Loyson, N.A. director of value delivery, Procter & Gamble.