Customers of Citi in the UK and Paysafe are the first to benefit from Decision Intelligence, the first use of artificial intelligence implemented on a global scale directly on the Mastercard network.

Decision Intelligence is a comprehensive fraud decisioning service. The solution uses artificial intelligence technology to help financial institutions increase the accuracy of real-time approvals of genuine transactions and reduce false declines.

Citi and Paysafe have already begun to use the technology in the UK, with additional markets and issuers to go live in the coming months.

Elif Kayhan, Head of Fraud Analytics for UK Consumer and IPB at Citi commented: “Mastercard Decision Intelligence has provided us with a solution that will increase the efficiency of fraud alerts and increase our fraud detection rate, helping us to ensure we are providing our clients the highest security against cyber-crime. We believe that this product will increase our fraud detection capabilities significantly and we look forward to working closely with Mastercard on this new venture.”

Johan Gerber, Executive Vice President, Security and Decision Products, Mastercard said: “Trust is a currency in itself. Our cardholders want peace of mind and convenience when using their Mastercard. Decision Intelligence enables issuers to approve more of the genuine transactions traditionally declined, while declining more fraudulent transactions that may previously have been approved.”

Current decision-scoring products are focused primarily on risk assessment, working within predefined rules. Decision Intelligence is a radical new approach that goes much further. It takes a broader view in assessing, scoring and learning from each transaction. That score then enables the card issuer to apply the intelligence to the next transaction.

The unique technology behind Decision Intelligence examines how a specific account is used over time to detect normal and abnormal shopping spending behaviours. In doing so, it leverages account information such as customer value segmentation, risk profiling, location, retailer, device data, time of day, and type of purchase made to ensure a better picture is available to issuers so they can make more informed decisions.

Andrea Dunlop, CEO Acquiring and Card Solutions at Paysafe added: “Paysafe is very pleased to team up with Mastercard to utilise Decision Intelligence. This will reduce false declines on transactions and consequently create a positive impact on the usability of the card, while still adding an extra layer of security to address ever-changing fraud trends.”

This technology is a core feature of the Mastercard Enhanced World Elite platform, and is available to Mastercard issuers globally as an optional feature.

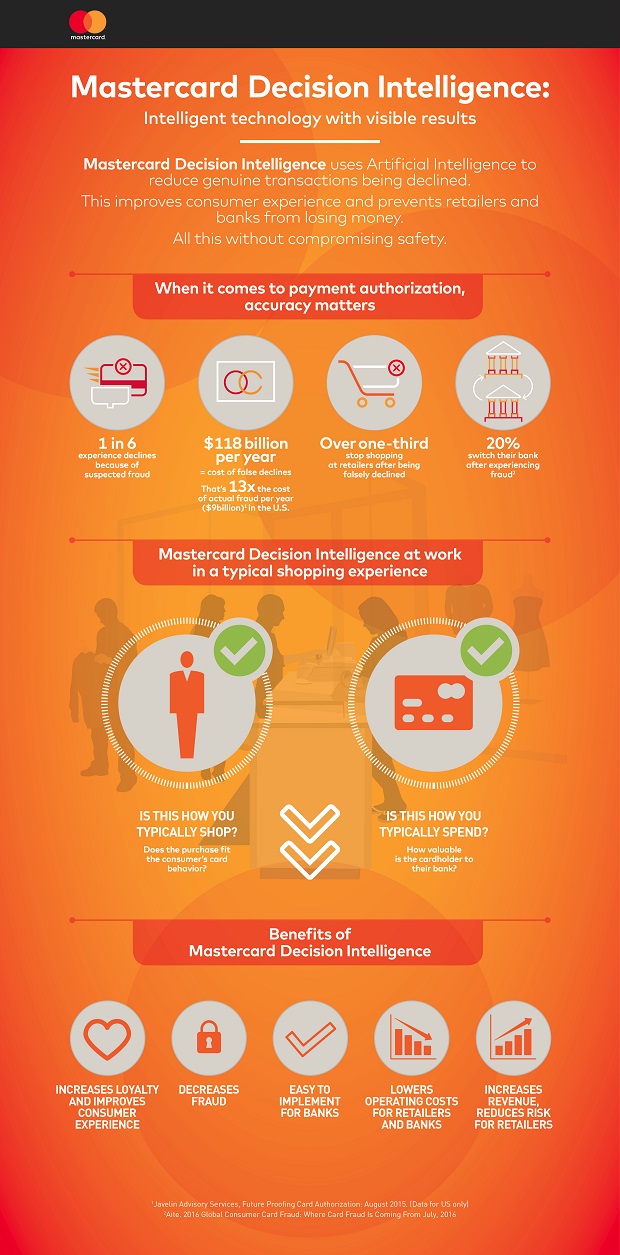

View this infographic explaining how Decision Intelligence works below:

www.mastercard.com