Luxury brands need to keep up with the trend of connecting online and offline environments to increase web and in-store traffic and promote sales, according to new research.

The research, from customer engagement specialists ContactLab, indicates that consumers buying luxury goods both online and in store spend around 50 per cent more per year than in-store only customers.

The majority of luxury brands are still lagging behind the curve in offering a service which manages both online and in-store activity.

Whilst still a relatively small channel, online is expected to drive around 40 per cent of luxury market growth over the 2016-20 period. The customer shopping experience has evolved and customers are expecting to interact with brands both online and in store.

The “Digital and Physical Integration: Luxury Retail’s Holy Grail” study which was produced by ContactLab in conjunction with Exane BNP Paribas, revealed how digital is one of the more profitable “growth pockets” available to luxury brands today. The modern consumer is digitally savvy and embraces the opportunity to spend more online. With the development of technology, top designers are able to take advantage of established technologies which are accessible from a range of service providers. Digital sales also promote higher margin and lower costs such as rent or personnel.

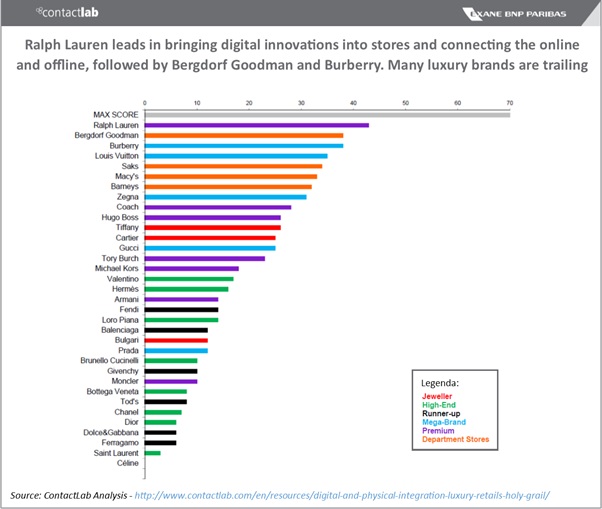

ContactLab’s team of experts carried out 61 store visits in New York city, developed 21 parameters to measure digital and physical retail integration amongst top designers, looking at three areas: 1) the basic: technology in-store; 2) the developed: how digital clients are received and services in-store; 3) the advanced: how digital is leveraged to make the most of traffic in-store. The study highlighted the drastic contrast between a handful of brands such as Ralph Lauren, Bergdorf Goodman and Burberry whom have succeeded in achieving a seamless, omni-channel experience and those who were trailing behind (figure 1).

One of the biggest threats to luxury brands is usage of space and footfall in store. The study examined how digital is being leveraged to make the most of traffic in-store and found that digitally engaged clients spent more in-store. Providing seamless integration between online and offline POS opens cross selling opportunities, either from online to the store (order online and pick-up or return/exchange instore) and vice-versa: when products are out of stock customers have the opportunity to order online in-store and receive their purchases at home, which increases conversion rates and ultimately sales.

Burberry is a good example of collaboration of online and offline operations with click & collect already representing 15 per cent of Burberry’s online sales. The study also examined which brand promoted their e-commerce activity through promotions in store, which had Bergdorf Goodman and Saks leading while 70 per cent of the panel appeared to be lagging in these measures.

Massimo Fubini, CEO of ContactLab comments: “It is surprising to see that not many luxury brands are optimising the relationships they can have with their customers. Luxury brands are faced with competition with online retailers and so need to up their game in order to take advantage of the online sphere.”

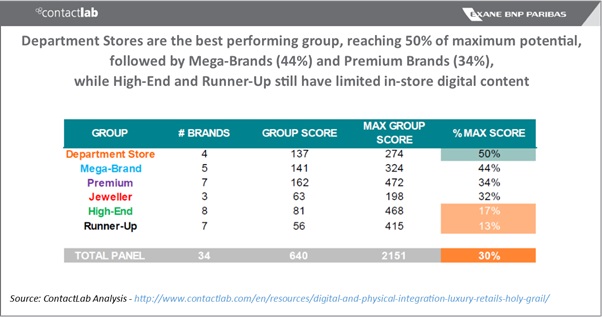

Brands are in the first steps in digital and physical integration and many luxury brands are facing the challenge of having to implement new technological devices to improve the customer shopping experience. Department stores are the best performing group, reaching half of the maximum potential; Ralph Lauren leads in bringing digital innovations into stores with interactive mirrors in their changing rooms connecting the online and offline worlds, followed by Bergdorf Goodman and Burberry. Yet, fourteen brands have not adopted any digital tools or exploited a few of the potential channels given by digital proficiency.

Massimo continues: “Modern consumers cannot be categorised as online or offline as they expect multi-channels as a paradigm to engage with a brand. Brands need to not run their online and in-store business activity as separate but need to bridge the gap and offer a seamless shopping experience.”

View the report here (registration required).