The survey data released by Ubimo, a Quotient brand specializing in OOH technology, also found that 60.4% of consumers who notice OOH are likely to purchase a product on their shopping trip after seeing an OOH ad.

Ubimo spoke to more than 1,000 consumers nationwide to uncover how consumer shopping behavior has changed due to the pandemic. The survey also explores how consumers are taking fewer/more purposeful shopping trips, whether they go to the same stores on each trip, and how they perceive different advertising channels (social media, OOH, etc.) along the way.

Some other key data points featured in the report include:

- 90.4% of consumers are still opting for at least one in-person shopping trip per week during the pandemic and 82% always or usually go to the same stores every time.

- 63% of consumers believe the brand messaging within an ad is important during the pandemic.

- While 50.2% of consumers said they have the most positive impression of brands when they see them on social media, nearly a quarter of consumers feel the same way about OOH.

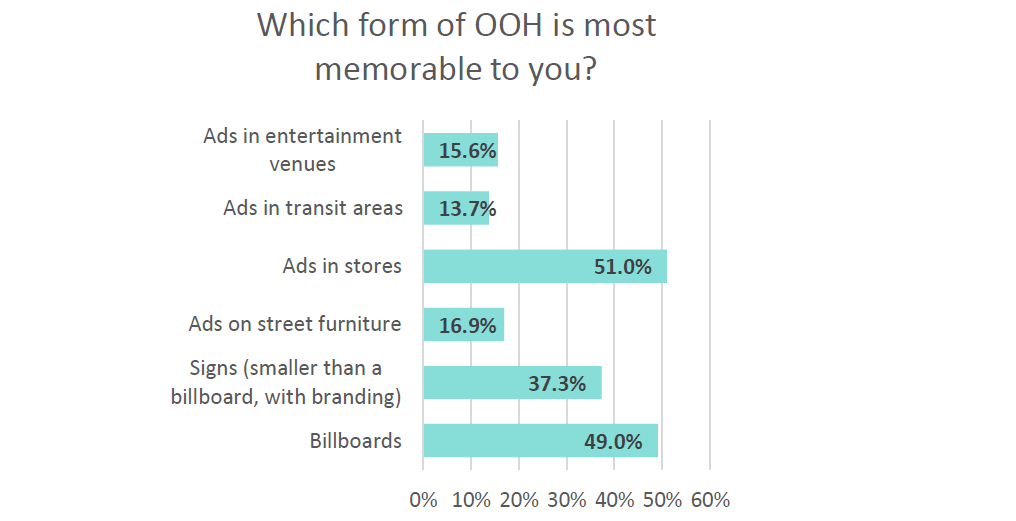

- Ads in stores (groceries, pharmacies, etc.) and billboards are rated as the most memorable forms of OOH advertisement for each gender and generation.

Ecommerce is rising, but a majority of consumers are still opting for in-person shopping trips Before the pandemic, 2.3% of consumers did all their shopping online.

Although there has been a massive ecommerce boom driven by quarantine and shelter-in-place orders, only 9.6% of consumers say they now conduct all their weekly shopping online.

In other words, 90.4% of consumers still make a shopping trip at least once a week, meaning there still is great potential for brands looking to reach consumers outside the home. More than one third (36.5%) of respondents stated they venture out twice or more often each week, and 53.9% leaving once.

While some behaviors remain similar, other consumer shopping patterns have changed in drastic ways

Perhaps most surprisingly, Gen Z respondents illustrated the smallest change in behavior, with less than half indicating they shifted their shopping from in-store to online. By far the most popular shift among those surveyed was making the change to a single shopping trip during the week.

Analysis across all generational groups and by gender indicated increases in the number of people taking one shopping trip each week compared to before the pandemic, with this cadence more than doubling among women, Gen Xers and Baby Boomers.

Fewer, more purposeful shopping trips means more careful planning with the rise of the strategic shopper

With 77% of consumers opting for one or two weekly shopping trips during the pandemic, many have become more strategic with their lists and planning ahead. These purposeful trips embody the art of shopping on a mission – knowing exactly where you need to go and what you need to buy every time you leave the home.

According to survey respondents, when consumers leave their homes during the pandemic, 92.9% have a specific plan in mind about what stores they need to visit and what they need to buy.

Additionally, of those who specified planning ahead now, only 63.2% did so before the pandemic.

Over two-thirds of consumers say this is to reduce time spent outside the home and protect themselves and their households from catching/spreading the virus. This is particularly true for Gen Z and millennials.

Interestingly, females were less inclined to plan their shopping trips ahead of time before the pandemic (57.2%) compared to their male counterparts (70.8%). During the pandemic, females are slightly more strategic (95%) compared to males (90.5%).

When it comes to which stores they visit, 82% of consumers always (16.9%) or usually (65.1%) go to the same stores every time. Older generations are more likely to regularly visit the same stores compared to their younger cohorts. This presents an opportunity for brands to maximize customer loyalty through membership programs and other initiatives.

Consumers are tuned into OOH and notice this channel more during the pandemic Awareness of OOH has a positive impact on in-store product purchases In general, 65.6% of consumers notice OOH advertising on their shopping trips. Of those who notice OOH, 81.7% notice it more (26.3%) or about the same (55.4%) during the pandemic.

Generation gap

Younger generations are particularly more aware at this time, with 30.9% of Gen Z and 28.8% of Millennials noticing OOH more since the onset of the pandemic. Also crucial information for brands, the survey results show that 63% of consumers believe the brand messaging within an ad is important during the pandemic.

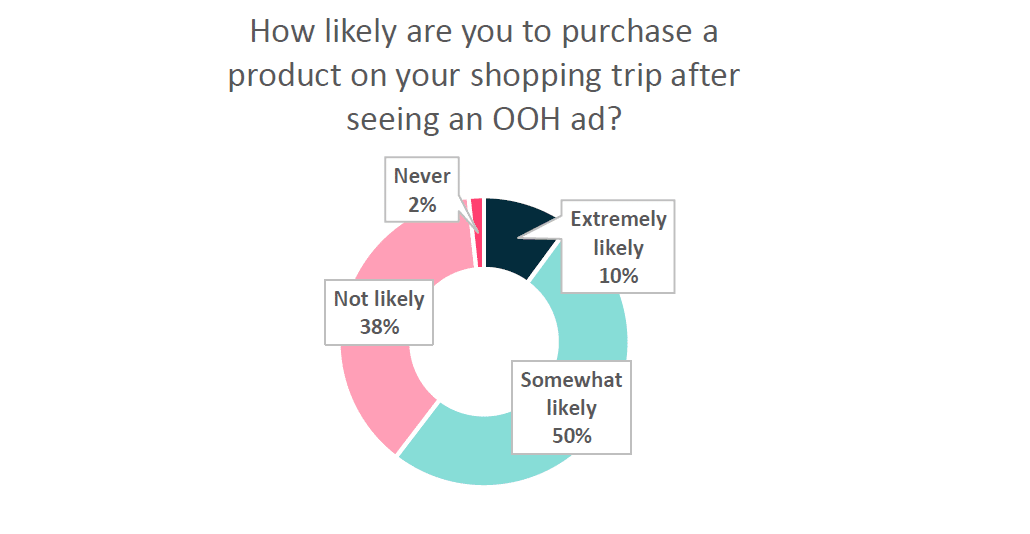

Generationally, Gen Z, millennials and Gen X believe messaging is important whereas Baby Boomers are not as phased. Additionally, 16.4% more females than males believe brand messaging to be important. Results show that of those consumers who notice OOH, 60.4% are likely to purchase a product on their shopping trip after seeing an OOH ad (extremely likely – 10.1%; somewhat likely – 50.3%).

Millennials are the most likely to be persuaded to make a purchase after seeing an OOH ad – 66.4% responded they are either extremely likely or somewhat likely, closely followed by Gen Z (60%) and Gen X (60.7%). Why does this matter? Although 50.2% of consumers said they have the most positive impression of brands when they see them on social media, nearly a quarter of consumers feel the same way about OOH – especially males (28.5%) over females (19.2%). With ads in stores (groceries, pharmacies, etc.) and billboards rated as the most memorable forms of OOH advertisement for each gender and generation, this channel proves to be a powerful vehicle when it comes to in-store purchases.

Methodology

Ubimo conducted a survey of over 1,000 respondents across various age groups in the United States via Survey Monkey in August 2020 to assess changing consumer shopping behavior during the pandemic.