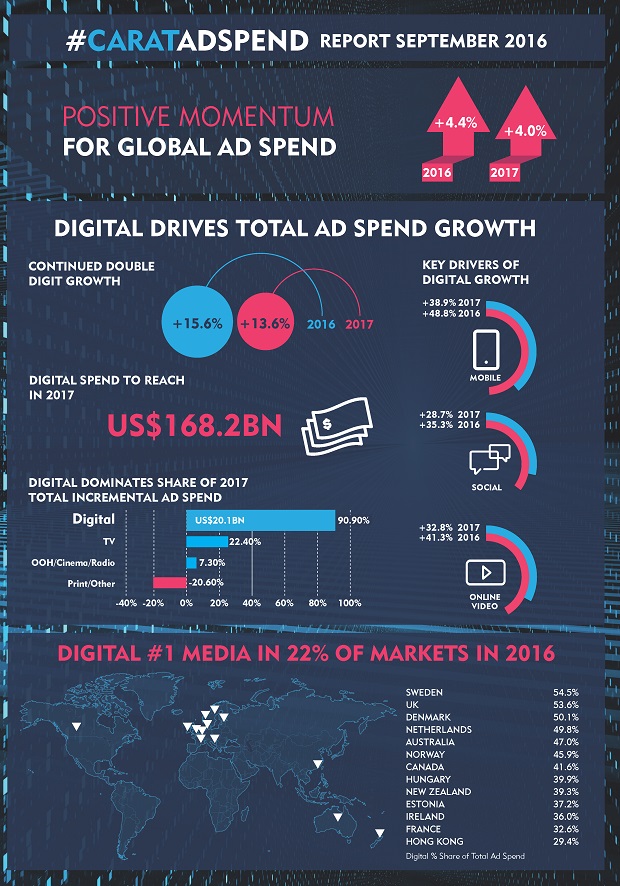

There is a positive outlook for the global advertising market in 2016, set to continue in 2017 powered by the ongoing growth of Digital, according to new research.

The study, from Carat, is based on data received from 59 markets across the Americas, Asia Pacific and EMEA.

Global forecasts show that advertising spend will reach US$548.2 billion in 2016, accounting for a +4.4% year-on-year growth.

The healthy outlook is fuelled by a buoyant 2016, marked by high-interest media events including the UEFA EURO championship, the Rio 2016 Olympics and Paralympics, as well as the upcoming US presidential elections.

Key insights from Carat’s latest report include:

• Healthy growth in global advertising spend predicted in 2016 of +4.4%, supported by major media events, including US presidential elections, the Rio 2016 Olympics and Paralympics, and the UEFA EURO 2016 football championship. Total advertising spend is expected to hit US$548.2 billion this year.

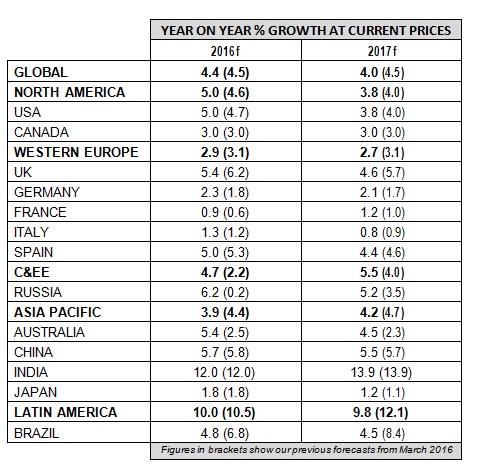

• In North America, the forecast for the US advertising market has been revised up to +5.0% from +4.7% previously predicted in the March 2016 report, due to increased investments in the lead- up to the US presidential elections, which are forecast to generate approximately US$7.5 billion of incremental spend.

• Western Europe is forecast to deliver a more moderate growth of +2.9% in 2016 and +2.7% in 2017. Despite slightly revised down forecasts (+3.1% predicted for both years in the March 2016 report), prospects for the advertising market remain positive, expected to reach US$94.4 billion this year.

• Forecasts in the C&EE region show the return to positive growth in 2016, revealing a V-shaped recovery to achieve a healthy +4.7% increase in 2016 and a further +5.5% in 2017. The encouraging outlook in the region, which exceeds previous forecasts from March 2016 (+2.2% and +4% respectively), is mainly driven by stabilisation in the Russian advertising market.

• In Asia Pacific, the buoyant Indian advertising market continues to lead growth prospects of

+12.0% in 2016 and +13.9% in 2017. Conversely, more moderate growth remains in China where advertising spend is expected to increase by +5.7% in 2016 and +5.5% in 2017, as the market adjusts to a ‘new normal’ economic landscape.

• Growth forecasts in Latin America have been affected by the economic challenges Brazil continues to face with ongoing political uncertainty. Advertising spend is however receiving a boost from the Rio 2016 Olympics and Paralympics with a strong growth forecast for TV this year.

• Digital media spend continues to grow at double-digit prediction levels of +15.6% in 2016 and +13.6% in 2017, powering growth in worldwide advertising spend despite negative headwinds in some markets.

• The continued growth of Digital, the leading media type in 13 out of 59 markets in 2016, is fuelled by Mobile, Online Video and Social Media, which are increasingly attracting more advertising investment. Mobile continues to show the highest spend growth across all media in 2016, with a year-on-year estimated increase of +48.8% in 2016, outpacing predictions of +37.9% in the March 2016 report.

Will Swayne, Global President, Carat, commented: “Digital continues to significantly outpace the growth of all other media and is now the number one media in 13 markets. Digital, and the data created, is redefining brands and agencies’ understanding of people’s behaviour and the ability to go to market with greater insight, addressability and agility.”

The key findings are shown in the infographic below:

In 2016, Carat reports a positive outlook for most regions with particularly robust growth in North America (+5.0%) and strong recovery in Russia (+6.2%), countering lower expectations in some markets.

The US continues to show positive market confidence with forecasts revised up to +5.0% as the US presidential elections alone are expected to generate US$7.5 billion of incremental spend. Despite a slight moderation following the EU referendum, the UK continues to be the largest advertising market in Western Europe, with positive growth of +5.4% expected in 2016, exceeding the average rate of +2.9% in the region. Advertising forecasts are also set to remain strong in Latin America and Asia Pacific, with +10% and +3.9% growth respectively in 2016, in spite of Brazil’s lower expectations and China’s adjustments to its ‘new normal’ economic landscape.

Despite a slight decline due to volatility in some markets, the positive momentum of the global advertising spend is expected to continue into 2017 reaching US$570.4 billion, a +4.0% year-on-year growth, led by the ongoing upsurge of Digital media.

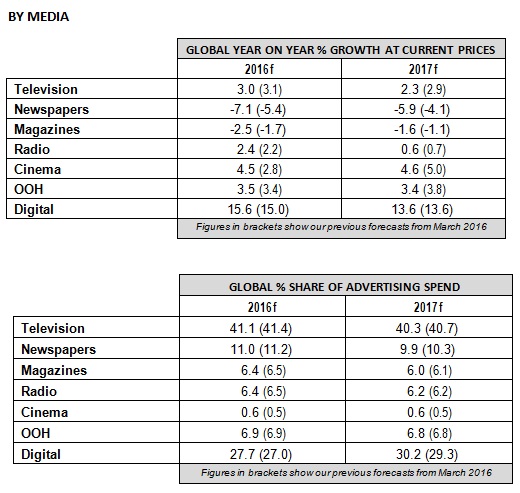

As the leading media type in 13 of the markets analysed, Digital continues to grow at double-digit prediction levels of +15.6% in 2016, accelerating further at +13.6% in 2017. Driven by the high demand of Mobile, Online Video and Social Media, Digital media spend is expected to reach 27.7% share of total global media spend in 2016, increasing to a predicted 30.2% in 2017.

Whilst TV continues to hold the highest share of total media spend of 41.1% in 2016 – boosted by high-interest media events – it is expected to grow at a more moderate rate of +2.3% in 2017 with a lower predicted share of spend at 40.3%.

In line with expectations, Print advertising spend is forecast to continue to decline by -5.5% in 2016 and by -4.3% next year. Excluding Print, Carat’s forecasts reconfirm year-on-year growth for all other media in 2016, highlighting year-on-year positive growth in Cinema (+4.5%), Radio (+2.4%) and OOH (+3.5%), with predictions slightly revised down for 2017.

Commenting on the Carat advertising expenditure forecasts, Jerry Buhlmann, CEO of Dentsu Aegis Network, said: “Carat’s latest forecasts show continued confidence and positive momentum for global advertising spending. Expanding over three times faster than the global rate, Digital reaffirms itself as the unrivalled driver of growth. As the digital economy brings complexity, speed of change and disruption, it is only through Digital that brands can build engagement and remain relevant to their audiences on a fully addressable and real-time basis.”

“In a world where connectivity and convergence are now the norm, Mobile, Social and Online Video lead the rapid growth of Digital investments. With more flexible, targeted and data-led media solutions, Mobile, Social and Video are driving the demand for richer and more powerful consumer engagements, in the right place, at the right time.”

Sanjay Nazerali, Global Chief Strategy Officer, Carat, said: “The occurrence of spend spikes around big ticket events is a trend that is likely to continue. However, as the market around these events becomes more and more saturated, it is key for advertisers to consider the growth of data and digital and the opportunities they provide to leverage event associations, maximise stand-out and drive engagement.”

REGIONAL BREAKDOWN

NORTH AMERICA

Advertising spend in North America continues to show positive momentum in 2016 with a strong +5.0% growth forecast (revised up from +4.6% predicted in March 2016), ahead of the global growth prediction of +4.4%. North America is expected to generate US$213.3 billion, 38.9% of total global advertising expenditure in 2016.

The positive outlook in the region is primarily driven by steady growth in the US, the largest advertising market, where spend is estimated to reach US$204.8 billion in 2016, increasing by +5.0% (revised up from +4.7% forecast in March 2016). Growth in the US is fuelled by the upcoming US presidential elections, accounting for approximately US$7.5 billion of additional spend, as well as the Rio 2016 Olympics and Paralympics, which contributed to a strong first half of the year in the market with an incremental US$1.3 billion spend.

In 2017, despite the lack of major media events, the US advertising market will maintain its positive momentum with a steady but more moderate +3.8% year-on-year growth (marginally revised down from our March forecast of +4.0%). Other highlights on the US advertising market include:

• TV, predominantly local, will make up approximately 70% of the US$7.5 billion incremental spend from the US presidential elections this year.

• TV will continue to command the largest share of advertising spend, accounting for 38% of all investments in 2016 and 37.3% in 2017. TV is forecast to grow by +4.0% in 2016 and +2.0% in 2017.

• Digital spend growth of +16.7% in 2016 continues its upward trajectory with Video (+50%), Mobile (+49%) and Social Media (+45%) leading the way. Digital spend is forecast to hit US$56.8 billion in 2016, 27.8% share of total US ad expenditure, predicted to increase to 30.5% in 2017. Digital growth is expected to continue its double-digit level of +14.0% in 2017.

• Print share of spend continues to erode, driven by Newspapers declining by -9.0% in 2016 and 2017.

The Canadian advertising market is set to maintain steady +3.0% growth in 2016 and 2017. Recovering from a challenging Q1 2016, advertisers’ confidence has improved following adjustments to the currency fluctuation and more stability in the economy. Overall, advertising spend in Canada is expected to reach US$8.5 billion in 2016. Other key highlights on the market include:

• Online Video is estimated to be the largest winner in 2016 with high growth of +28%, driven by the introduction of better audience measurement and higher demand. Online Video is forecast to accelerate further in 2017, with +14.7% growth.

• Mobile has started to gain traction in 2016 with double-digit growth forecast of +27.4%, set to continue at similar speed in 2017, with +23.2% increase. Retail and Automotive are the main sectors generating demand.

• In 2017, the Canadian advertising market is expected to continue its steady growth of +3.0% and generate US$8.8 billion, fuelled by strong investments in Digital, expected to increase by +9.6%.

WESTERN EUROPE

Advertising spend in Western Europe is forecast to deliver moderate growth of +2.9% in 2016. Markets showing the highest growth predictions this year include the UK (+5.4%), Ireland (+7.5%), Sweden (+6.4%), Spain (+5.0%), as well as recovering Greece (+4.2%). Markets with lower or declining growth in 2016 include France (+0.9%), Netherlands (+1.3%), Finland (-0.6%), Switzerland (-1.0%) and Norway (-3.7%).

Advertising expenditure in Western Europe is expected to reach US$94.4 billion in 2016, representing 17.2% share of global ad spend and increasing by +2.7% in 2017, slightly revised down from the +3.1% predicted in March 2016 report.

While figures have been slightly revised down after the EU referendum, growth forecasts in the UK, the number one ranking advertising market in Western Europe and the fourth globally, continue to highlight solid growth of +5.4% in 2016 and +4.6% in 2017. Growth in the UK is primarily driven by the continued rise of Digital, accounting for 53.6% share of spend in 2016 and set to maintain pace in 2017, with +11.5% increase. Other insights on the UK advertising market include:

• Online Video, growing at +44.9% in 2016 and +36.4% in 2017, is one of the most significant drivers in Digital and overall growth in the market, as brands consistently focus on content distributed and curated through online channels.

• Social Media spend is expected to grow by +32.7% in 2016 and +21.9% in 2017. In particular, Facebook continues to grow faster than almost every other media supplier and is set to become the third largest media platform in 2017 behind Google and ITV.

• Paid Search continues to generate growth, predicted at +10.6% in 2016 and +8.4% in 2017, particularly through Mobile, providing a wealth of more targeted and relevant data.

• TV advertising spend in the UK is forecast to grow by +3.6% in 2016 as the UEFA EURO 2016 football championship generated growth and higher viewership in the first half of the year. Whilst this appears to moderate in the second half of the year, TV has overall delivered positive performance in 2016.

• Retail is forecast to increase spending by +5.0% this year. Other sectors showing significant growth in 2016 include Cosmetics & Personal Care (+9.0%) and Entertainment & Leisure (+7.0%).

Advertising spend forecasts in Germany continue to highlight steady growth with a small but solid upward trend of +2.3% in 2016 (revised up from +1.8% in March 2016). Neither the refugee crisis nor the EU referendum seem to have shaken consumer confidence in the German economy, which is expected to gain more momentum in the second half of the year with all economic indicators remaining solid. In 2017, growth is forecast to continue in Germany at a moderate +2.1% pace. Other highlights on the advertising market in Germany include:

• Smartphones will win against desktop as Mobile spend is forecast to increase by +50.5% in 2016 and +45.6% in 2017.

• As consumer data continues to open up more data-driven real-time marketing opportunities, Programmatic (Display and Video) is predicted to grow at high rates of +45.4% in 2016, and +42.4% in 2017.

• TV consumption will become more non-linear. The big channels are now more involved in digital content and VoD. YouTube and live streams on Facebook or other platforms will gain ground but lack of standardised audience measurement will still be an obstacle in favour of standard TV advertising.

• Overall, the UEFA EURO 2016 football championship has not had a major impact on spend in Germany, as public TV channels allow limited advertising time in the market.

The advertising market in France continues to stabilise in 2016 alongside improved economic data, with marginal +0.9% growth forecast, revised up from +0.6% in March 2016. Advertising spend is driven by TV and Digital, with strong performance across Programmatic, Social and Mobile. As the host country and finalist of the UEFA EURO 2016 football championship, TV also delivered positive growth in 2016 hitting TV spot price records for the broadcasting channels.

With the presidential elections taking place next year, the upward trend is estimated to continue in France in 2017 with a further +1.2% growth rate. Other findings on France include:

• Digital media is forecast to grow by +5.6% in 2016 and +5.0% in 2017 to reach US$4.1 billion, representing 33.9% share of spend next year.

• Paid Search has the highest share of total Digital investment at 53.6% in 2016 with a growth forecast of +3.0% to continue at +1.9% in 2017. Mobile (Search + Display) represents 33.4% of Digital investments in 2016 with high growth forecasts of +38.6% in 2016 and +24.0% in 2017. Programmatic continues its expansion and should overtake direct buying by the end of 2016, with a 53.8% share of the Digital market.

• TV was overtaken by Digital in 2015 and is now the number two ranking media type in France in terms of share of the market spend, with 30.6% in 2016 and 30.5% in 2017.

The Italian advertising market has been positive in H1 2016, as international sporting events have generated growth. However, projections for the rest of the year are more conservative, with +1.3% overall growth, as the economic recovery slows down and consumer and business confidence continues to fluctuate. In 2017, due to the absence of main media events and an uncertain economic situation, growth forecast has been moderated to +0.8%. Other findings on the Italian advertising landscape include:

• TV continues to be the dominant media type, accounting for the highest media share of 52% in 2016 and 51.7% in 2017. The advertising revenues are supported by the high-interest sporting events in 2016, the strengthening of Digital Terrestrial TV, as well as the increase of sponsorships (branded content, product placements and more).

• Thanks to the increase in investments in Mobile, Video and Social, Digital is forecast to account for 23.8% of media share in 2016, increasing to 25.1% in 2017.

The advertising spend in Spain in 2016 is expected to grow at a rate of +5.0%. After deep decline until 2014, this growth forecast sees a continuation of the positive ad market recovery. However, 2016 predictions have been revised slightly down from +5.3% in March 2016 as political uncertainty and Spain’s political deadlock continues to affect the general economy. The same trend is set to continue in 2017, when spend is expected to grow at a more moderate pace of +4.4%. Further insights by media type include:

• Digital is the main driver of growth in Spain with +11.8% upsurge forecast in 2016 and +10.2% in 2017. Accounting for 27.2% of the advertising market in 2016 and 28.7% in 2017, Digital is the second largest media type for share of spend behind TV.

• In 2016, TV maintains the highest market share (41%) and is forecast to increase by +4.3%.

However, as Digital continues to deliver higher growth, TV share of spend is forecast to decrease marginally to 40.7% in 2017 with slower +3.8% year-on-year growth.

• Online Video is the highest growth Digital sub-category, predicted to increase by +25.8% in 2016 and +20.1% in 2017. This media type is increasingly popular in Spain to complement TV campaigns and reach younger target audiences.

C&EE

Following a -3.0% decline in advertising spend in 2015, the C&EE region shows a V-shaped recovery, expected to achieve a healthy growth rate of +4.7% in 2016 and a further +5.5% in 2017. The encouraging outlook, which exceeds previous forecasts from March 2016, is driven by a return to growth in major market Russia which is forecast to grow by +6.2% in 2016 and +5.2% in 2017. Other markets performing well in the C&EE region in 2016 include the Czech Republic (+9.0%), Lithuania (+8.1%) and Romania (+6.0%). In contrast, forecasts in Turkey – the third highest spending market in the region behind Russia and Poland – have been revised down to flat in 2016, due to political and economic uncertainty following the coup attempt in July 2016. With a three-month state of emergency declared in Turkey, it is estimated that this will have an impact on advertising investments in the market.

Despite the ongoing decline of the economy, the advertising market in Russia has gradually adapted to the new reality, showing positive growth in the first half of 2016. Starting from a very low base in 2015, the market has experienced a significant increase of +18% in Q1 2016, continuing albeit at a more moderate pace of +8% in Q2 2016. Overall, the Russian advertising market is predicted to reach a healthy +6.2% in 2016, and continue at a more moderate pace of +5.2% in 2017, revised upwards from +0.2% and +3.5% respectively in Carat’s March 2016 report.

Other key findings on Russia cover:

• TV’s share of spend in Russia accounts for 44.6% in 2016 and 44.2% in 2017. TV, Russia’s leading media type, increased by +18% in Q1 2016 and overall by +6.4% for the full year. The trend is forecast to continue in 2017 with +4.2% solid growth.

• Digital, the second most popular media type in the market, is expected to reach 34.7% share of total spend in 2016, and 36.5% in 2017. Digital media spend is forecast to grow by +16.6% in 2016, driven by Paid Search (+19.4 %) and Online Video (+12.6%). The growth of Digital media spend is predicted to continue at double-digit level of +10.8% in 2017.

• The top 3 spending categories in 2016 for gross growth forecast include Pharmaceutical (+7.0%), Retail (+5.0%) and Food (+6.0%).

MIDDLE EAST AND NORTH AFRICA

Growth in the Middle East and North Africa region is forecast to increase by +1.2% in 2016 and +2.0% in 2017, with growth by market in low single digits or declining due to ongoing economic and political challenges.

Major market Egypt is forecast to increase by +2.4% in 2016 and +3.0% in 2017. Whilst the country continues to struggle with an unstable government, consumer sentiment appears to be stable. Elsewhere in the region, Morocco and Qatar are growing at relatively higher growth rates of +2.3% and +3.8% respectively in 2016 and +5.0% and +3.2% in 2017, with Lebanon showing a more modest pace of +1.8% in 2016 and +1.9% in 2017.

UAE, the second largest advertising market in the region, is forecast to show a limited +0.1% increase in 2016 and +0.4% in 2017, as the market shows signs of softening with the removal of oil subsidies. In Saudi Arabia, forecasts are declining to -1.4% in 2016 and -1.2% in 2017, as consumer confidence has taken a hit due to the unrest in neighbouring countries and the oil price crisis. Declining spend is also predicted in Kuwait (-1.3% in 2016 and -1.1% in 2017), Oman (-4.8% for both years) and Bahrain (-4.3% for both years).

ASIA PACIFIC

Advertising spend forecasts in Asia Pacific show continued growth of +3.9% in 2016 and +4.2% in 2017, marginally revised down from the March 2016 report (+4.4% and +4.7% respectively). Overall, the

outlook of the region paints a very mixed picture with variations at a local level. Double-digit growth rates in India (+12.0%), Vietnam (+10.6%), the Philippines (+9.9%) and a solid performance in Australia (+5.4%), are countering declining spend in Hong Kong (-11.8%), Taiwan (-7.6%) and Thailand (-5.2%), due to lacklustre economic growth and weak demand. Spend forecasts in the region also reflect a more conservative growth in China, as the market adjusts to a ‘new normal’ economic landscape. This trend is expected to continue in 2017, with the Asia Pacific region growing at a healthy, yet moderate growth forecast of +4.2%.

The Australian advertising market in 2016 is expected to generate significant growth of +5.4%, building on the strength of Digital, which continues to generate strong double-digit year-on-year increase. Other key drivers of growth include a 12-week lead-up campaign to the Federal elections held in July 2016, as well as the Rio 2016 Olympics and Paralympics, collectively accounting for an estimated US$110 million spend this year. Despite the absence of major media events in 2017, the positive outlook for Australia is predicted to continue next year at a healthy pace of +4.5%, also facilitated by the return of the Liberal Coalition to power which is expected to bring positive business conditions. Other highlights on the market include:

• TV, overtaken by Digital since 2014, continues to decline year-on-year, making up only 24.9% share of the total spend in 2016, compared to Digital’s dominating share of 47.0%. The incremental decline of TV is also driven by audience fragmentation to VoD (Video on Demand), SVoD (Subscription Video on Demand) and other Digital entertainment pastimes.

• TV is expected to decline by -5% in 2016 and by a further -4% in 2017. Bucking this trend, Pay-TV is likely to sustain a slight positive growth in the next three years at around +2% compound annual growth rate.

• Total Digital spend in Australia is forecast to reach 50.5% of share in 2017, following year-on-year strong growth of +16.5% in 2016 and +12.4% in 2017. Paid Search continues to command the highest share of Digital (45.1% in 2016) although Digital Display (including Video and Social) is gaining ground with year-on-year growth forecast of +20.0% in 2016 and +18.0% in 2017.

• Newspapers continue to decline at -7.0% in 2016 and -6.5% in 2017 with a similar trend expected to continue in the future.

China, the world’s second largest advertising market, is expected to reach US$81.8 billion spend this year. Following many years of double-digit economic expansion, China is now experiencing a more moderate growth, reflected in a steady +5.7% ad spend forecast for 2016. As the market has now entered a ‘new normal’ era, its advertising spend is predicted to increase at a similar rate of +5.5% in 2017. Other insights on the Chinese advertising landscape include:

• TV still commands the majority share of total spend in China, a predicted 53.4% share in 2016 and 51.2% in 2017. However, with fierce competition from Digital and moderate year-on-year growth (+1.7% in 2016 and +1.3% in 2017), TV’s share of total spend in China shows a negative trend falling by between 1 and 2% points a year since 2010.

• Digital is the second largest media type in China with 25% share of total spend predicted in 2016 and high performing double-digit growth of +25.9% in 2016 and +21.4% in 2017.

• Mobile is driving total Digital spend growth with a forecast increase of +47.1% in 2016 and +34.6% in 2017. With more than 656 million smartphone users in China in 2016, Mobile is forecast to reach over a third (34%) of total Digital spend in 2017.

• Online Video is expected to increase by a rapid +42.3% in 2016 and +34.5% in 2017 as the use of professional generated content grows exponentially in the market.

• OOH, the third largest media type in China, is predicted to increase at a solid +4.1% in 2016 and +3.8% in 2017, with China’s metro development and airports as key growth drivers.

• In contrast, Print continues to show consecutive year-on-year declines with Newspapers expected to slump by -14.9% in 2016 and -16.2% in 2017, and Magazines by -12.2% in 2016 and -13.1% in 2017.

Forecasts continue to be extremely bright in India, the highest spending and fastest growing advertising market globally. Spend is expected to accelerate by +12.0% in 2016, a buoyant year with multiple media events taking place in the market, including the T20 Cricket World Cup, the Indian Premier League (IPL) as well as the state elections.

Retaining its position as one of the fastest growing world economies with real GDP growth of +7.5% in 2016, the positive advertising outlook for the Indian market is expected to continue in 2017, growing further by +13.9%. Additional media-related statistics include:

• India is one of the few large markets where all traditional media platforms still show positive growth. Holding the highest share of spend of 38.5% in 2016 and 38.0% in 2017, TV is forecast to grow by +12.3% in 2016 and +12.5% in 2017 driven by investment from FMCG brands and eCommerce companies.

• Newspapers still represent the second largest media type with 35.7% share of total spend in 2016, and this is expected to continue to grow by +10.5% this year and +10.8% in 2017.

• As in other markets, Digital is the fastest growing media type in India (+31.5% in 2016 and +39.6% in 2017), but its share of spend (8.9% expected in 2016 and 10.9% in 2017), still remains relatively low compared to the resilient traditional media.

• India is gradually transitioning from a “mobile first” to a “mobile only” country. Mobile spend is forecast to grow by +27.2% in 2016 and +35.1% in 2017.

Advertising spend forecasts in Japan highlight continued gradual growth in 2016 to reach US$56.2 billion, a +1.8% increase in line with Carat’s predictions in March 2016. Large media events – including the Rio 2016 Olympics and Paralympics and the FIFA World Cup Russia qualifying round in September

– are predicted to boost advertising expenditures in the market. However, this is balanced by a greater economic downturn, as well as the postponement of the consumption tax increase to October 2019, which was expected to generate a last-minute surge in demand in the second half of 2016.

In 2017, Japan’s advertising spend is forecast to continue to grow at +1.2% as marketing activities will start in the lead-up to the Tokyo 2020 Olympic and Paralympic Games. Following the government’s decision to enact a large economic stimulus package of ¥28.1 trillion to help the economy emerge, it is forecast that the overall business confidence and the consumption by individuals could improve the outlook for Japan and its advertising market. More findings on media forecasts in Japan include:

• With a 31.4% share of total spend in 2016, TV continues to be the number one media type in Japan. Following a decline in TV advertising spend of -1.2% in 2015 (including both Terrestrial TV and Satellite Media-Related spending), TV spend sees a mild recovery in 2016 at a growth rate of +2.0% and +1.8% in 2017, to reach US$18 billion.

• Digital is the second largest media type in Japan. With high growth forecasts of +9.0% in 2016 and +8.0% in 2017, Digital is the key driver of the advertising spend increase in Japan and is predicted to reach US$12.2 billion spend in 2017.

• With the postponement of the increase in consumption tax, the recovery in Newspaper advertising expenditures in Japan is expected to be pushed back. Newspapers are forecast to see a small decline of -1.3% in 2016, slowing further to -0.6% in 2017. However, Newspapers continue to command the third largest share of advertising expenditures in Japan.

LATIN AMERICA

Advertising spend in Latin America is forecast to increase by +10% in 2016 and reach US$26.9 billion, driven by high price inflation in Argentina which has pushed its advertising market growth of +40.9% in 2016 and +31.9% in 2017. Advertising spend forecasts for the region have been revised slightly down from +10.5% predictions in March 2016 as Brazil continues to face economic challenges and ongoing political instability.

Despite the incremental spend from the Rio 2016 Olympics and Paralympics supporting growth in the market, Brazil’s forecast for 2016 has been revised down from +6.8% prediction in March 2016 to +4.8%, hampered by the continuing economic and political uncertainty. Carat’s latest advertising growth forecasts predict a moderate increase by +4.5% in 2017 amid tentative signs of an improving economy.

• TV continues to command the majority share of spend in Brazil, a strong 66% in 2016 and in 2017, with spend forecast to grow by +5.0% in 2016 and 2017. Digital is the second leading media type in Brazil with 18.4% share of spend in 2016, however still significantly behind TV.

• Due to the economic turmoil, advertisers are migrating budgets from open TV to more affordable options such as Pay TV or Digital. From January to May 2016, Pay TV investment has increased by +14%.

Elsewhere in Latin America, Mexico’s growth exceeds predictions made in the March 2016 report with +3.6% forecast for 2016 and +4.3% for 2017, to reach US$4.5 billion advertising spend next year. In Colombia advertising expenditures are forecast to decline marginally this year by -1% before stabilising in 2017 with a small positive increase of +0.4%. Total advertising spend in the market is forecast to account for US$1.7 billion in 2017.

BY MEDIA

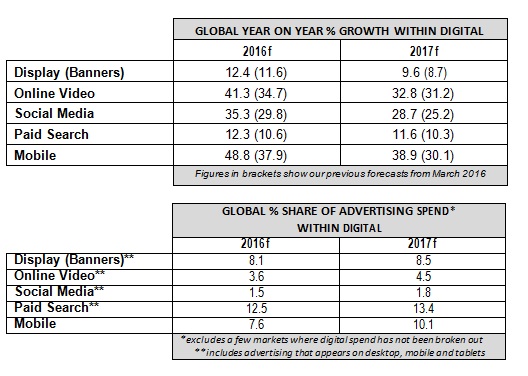

Carat’s latest forecast highlights the continued rise of Digital, the established star performer of global growth. Digital spend is predicted to grow by +15.6% in 2016 and rise further by +13.6% in 2017, reaching US$168.2 billion next year. In 2016 Digital will be the number one ranking media type in 13 out of the 59 markets analysed (Australia, Canada, Denmark, Estonia, France, Hong Kong, Hungary, Ireland, Netherlands, New Zealand, Norway, Sweden and UK). The Czech Republic and Germany are predicted to join this list in 2017, followed by Taiwan and Lithuania in 2018.

Globally, Digital media spend is forecast to reach 27.7% share of total media spend in 2016 increasing to 30.2% in 2017, showing an average increase of 2.5% points each year during the past five years. Digital media currently commands the highest share of spend in Sweden (54.5%) followed by the UK (53.6%) and Denmark (50.1%). In 2017 Digital media spend in Australia and the Netherlands is also predicted to tip over the 50% mark for the first time.

The strength of Digital reflects its greater role in influencing the consumer journey and purchase decision making, with an increasing percentage of consumers researching online and using some form of Digital media to help inform purchase decisions. The high growth of Digital spend is driven by Mobile, Online Video, Social Media and Programmatic.

Mobile ad spend is forecast to increase globally at a rapid rate of +48.8% in 2016 and +38.9% in 2017, exceeding Carat’s prediction (37.9% in 2016 and 30.1% in 2017) in the March 2016 report. With the improving sophistication of Mobile advertising and the access to insightful audience data, brands are increasingly investing in this media type to reach and engage effectively with modern, mobile-first consumers. In addition, the richer, more native advertising formats are delivering more impactful and creative ways to engage with target audiences.

Mobile’s growth continues to benefit the leading social and video channels, such as Facebook, Instagram, Google+, YouTube and Twitter, which capture the lion’s share of Mobile advertising spend.

Social media spending is forecast to increase globally at a high double-digit rate of +35.3% in 2016 and +28.7% in 2017. Social platforms are consistently improving their ability to gather data and provide marketers with actionable insights to reach and engage with their target audiences. Since the launch of Facebook Live for all users, the popularity of live content has steadily increased with consumers watching live video three times longer than pre-recorded content.

The upsurge of Social Media and Mobile is also contributing to the growth of Online Video advertising spend, forecast to increase globally by a strong +41.3% in 2016 and +32.8% in 2017 as brands consistently create and invest in video content to be distributed and curated online. Online Video is increasingly becoming more mobile, with over 117 million people in the US alone watching video on their mobile devices in 2016. This is expected to continue to grow by 6% in 2017, reaching nearly 124 million users. YouTube continues to be a scalable platform for premium video inventory making it easier to embed advertising messages within top performing content.

Programmatic spend is forecast to increase at a rapid rate of +32% in 2016 and further +25% in 2017. Programmatic initially had advertisers focused on cost efficiencies and a more effective performance. While that is still the case, the growth can be attributed to the ability to deliver better business outcomes with access to all types of scalable inventory including premium video and social. Following the negative press that open exchange inventory has been receiving, the industry is now deploying brand safety best practices and adopting a private marketplace strategy that is transacted programmatically. These private marketplaces are not only providing guard rails around brand safety, but also improving viewability metrics and assurances around inventory.

Boosted by the considerable rise of programmatically booked inventory, Display (Banners) spend, including desktop and Mobile, is forecast to increase by +12.4% in 2016 and +9.6% in 2017.

Television continues to command the highest share of total media spend globally with 41.1% in 2016 and a predicted 40.3% in 2017. Compared to the multiple media types available within Digital, TV is forecast to remain the single largest investment point for advertisers. However since its peak in 2010 at 44.0% share of total spend, TV has been on a slow declining trend with share decreasing by on average 0.5% points annually in the past five years. TV advertising spend is forecast to grow by +3.0% in 2016, supported by high-interest media events including the UEFA EURO 2016 football championship, Rio 2016 Olympics and Paralympics and the US presidential elections. TV advertising

spend is expected to grow at a more moderate pace of +2.3% in 2017, slightly revised down from Carat’s predictions in March 2016.

Paid Search is forecast to grow by +12.3% in 2016 and by +11.6% in 2017. Reaching a 12.5% share of total spend in 2016, Paid Search is forecast to overtake Newspapers for the first time this year. Paid Search remains an essential component of holistic marketing strategies, providing marketers with powerful audience data. With the growth of Mobile, Paid Search is becoming far more personal and relevant, leveraging insights on location, time of the day and other contextual information.

Globally Newspapers continue to be the third largest media type, behind total Digital and TV, with

11.0% share of total advertising spend in 2016 but continue to decline by over one percentage point each year since 2008, to drop to a predicted 9.9% share of spend in 2017. Magazines are experiencing a similar declining trend albeit at a slower rate with a 6.4% share in 2016, falling to 6.0% in 2017. As Digital continues to grow, traditional Print publishers, especially Magazines, are increasingly aiming to broaden their total audience reach across multiple platforms including Digital channels.

Cost effectiveness and flexibility contribute to maintain demand for Radio, predicted to account for 6.4% total share of spend in 2016 and 6.2% in 2017, but with slow growth rate of +2.4% in 2016 and 0.6% next year.

OOH is growing relatively strongly at +3.5% in 2016 and +3.4% in 2017, with stable share of spend of 6.9% in 2016 and 6.8% in 2017. Advances in technology, such as the digital transformation of public space and data usage, will continue to shape this media type creating new exciting opportunities for advertisers for more personalisation and relevance.

With increased commercial flexibility making it easier for advertisers to adapt spend to the big screen, Cinema is forecast to continue to grow globally by +4.5% in 2016 and +4.6% in 2017.

Methodology: Carat’s advertising expenditure forecasts are compiled from data which is collated from around the Carat network and based on Carat’s local market expertise. We use a bottom-up approach, with forecasts provided for 59 markets covering the Americas, EMEA, Asia Pacific and Rest of World by medium – Television, Newspapers, Magazines, Radio, Cinema, Out-of-Home and Digital Media. The advertising spend figures are provided net of negotiated discounts and with agency commission deducted, in current prices and in local currency. For global and regional figures we convert the figures centrally into USD with the average exchange rate. The forecasts are produced bi-annually with actual figures for the previous year and latest forecasts for the current and following year.