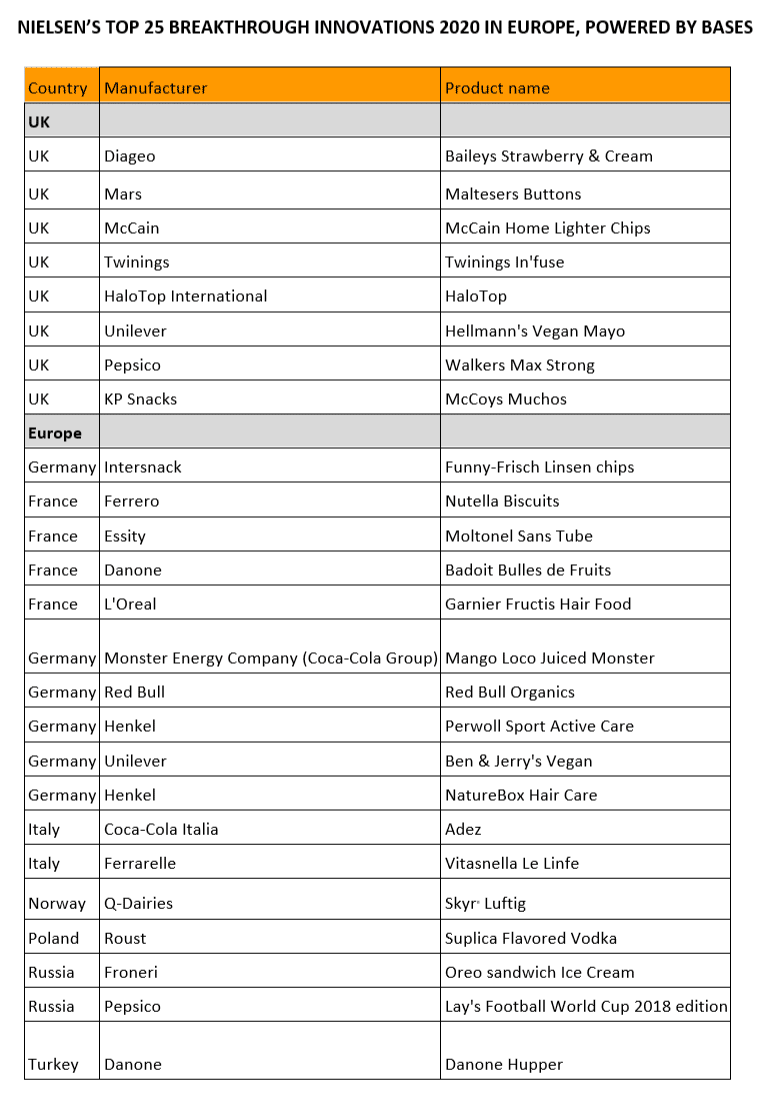

The report from Nielsen – ‘The Top 25 Breakthrough Innovations’ looks at recent product innovations across various FMCG categories in Europe.

Nielsen data reveals that Brits are more adventurous in sampling brand new products than the rest of Europe – with 73% interested in buying new products regardless of COVID-19 (versus Europe’s average of 67%). In the UK, 4195 new products launched in total in the first half of 2020.

Nielsen’s BASES is a model which analyses products with strong sales and measures how they reflect strong, distinct qualities such as mass potential, longevity, brand incrementality, category distinction or appeal toward a specific consumer target. It then compiles winners across Europe for the Top 25 Breakthrough Innovations list.

Mindful living couples with indulgence

In this years’ list, eight of the winning product innovators were for products within the UK market, and the results reveal two main trends: mindful living and indulgence are clearly a source of inspiration for manufacturers. This is in line with customer preference – Nielsen found that when surveyed, 49% of UK consumers said they have reduced their meat consumption while 46% usually check if products are ecologically friendly. This is reflected in product innovators such as Unilever, which owns Hellmann’s, creator of a new vegan mayonnaise. Consumer mindfulness extends from sustainability into health, with 57% of UK shoppers believing that having healthy food and drink options is very important when grocery shopping.

There were also successful products in the UK market that focussed more on indulgence as people looked for treats during a difficult period. This included tea brand Twinings with its cold water tea bags Twinings In’fuse, Diageo, which owns Bailey’s and introduced a new Strawberry & Cream liqueur, Mars for its chocolate Maltesers Buttons, Pepsico for Walkers’ Max Strong crisps and KP Snacks for McCoys’ Munchos – quesadilla shaped tortilla chips. Consumers want to feel treated; but are conscious of the health and environmental impact of products.

Celine Grena, Nielsen Bases Europe Leader, said: “The global lockdown has had a huge impact on consumers. Deprived of travelling and out-of-home entertainment, they are seeking adventure in other ways and this includes trying new and innovative products. What’s interesting is that 44% of this year’s winners across Europe have a premium pricing, proving that consumers are still looking to fulfil that indulgence and treat themselves. However, the pandemic has come with its challenges and it’s crucial that brands must consider being more flexible and ready to comply with changing consumer’s patterns moving forwards.”

Grena concludes: “The heart of good innovation always comes down to fulfilling a consumer need. Over 50% of this year’s Breakthrough Innovations winners have at least one of the “healthier lifestyle” claims compared to only 26% of last year’s winners. This is in line with the growing trend around healthier lifestyles and being mindful about products and sustainability. We can expect to see this to continue to rise in popularity.”

Report methodology

This year’s Breakthrough Innovation process reviewed over 50,000 product launches, all introduced to the European market in the past two years. The brands that made the 2020 list reflect a wide range of products and approaches that succeeded in making meaningful connections with consumers, an impressive feat within an increasingly crowded marketplace. Beyond BASES requirements for products that reflect strong, distinct qualities such as mass potential, longevity, brand incrementality, category distinction or appeal toward a specific consumer target, this year’s list brings the continued evolution of the success criteria, which includes all six of Nielsen BASES’ activation profiles.